Getty

There was history underfoot at Vermont’s Marlboro College. Tucked away in the Green Mountains, the nonprofit institution founded at the end of World War II held its first graduation in 1948. Robert Frost read a poem at the ceremony and Life Magazine printed a picture of its lone alum: a former rifleman named Hugh Mulligan who spent the years after the war hobnobbing in Paris with the likes of Picasso and studied Shakespeare in operatic form.

Mulligan died in 2008. And now Marlboro is gone too, shuttered after this year’s spring semester following years of fiscal turmoil. The bucolic 533-acre campus was sold for $1.725 million in cash and debt, plus operating expenses—a sum reportedly “far below the property’s assessed value.”

It’s hardly alone. At least a dozen independent, regional colleges are on the brink of collapse—mostly in the northeast—and all buckling from the one-two punch of dwindling enrollment and mounting debt. The 2019 Forbes review of U.S. colleges’ financial soundness, headlined “Dawn Of The Dead,” painted a stark reality for America’s educators: Huge swaths of the country’s independent small colleges now face a “merge or perish” reality. The pandemic has only made that problem worse, though its effects are not yet visible. More closures will come soon.

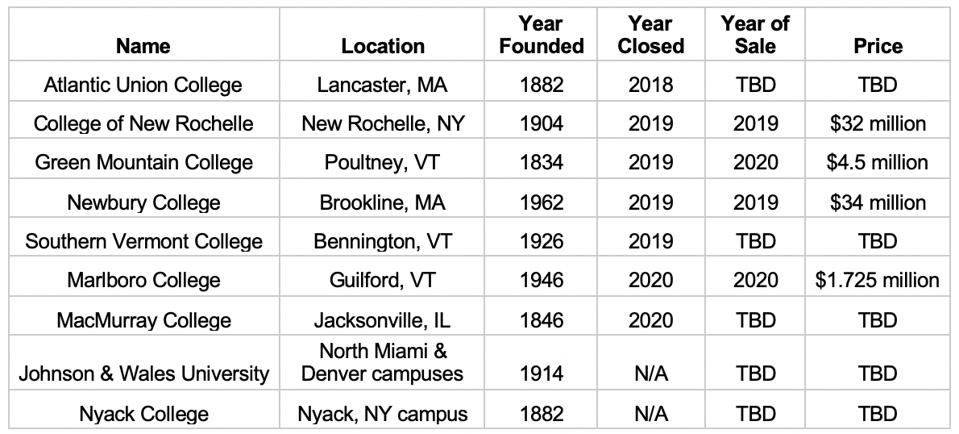

A sample of U.S. campuses that have hit, or likely will hit, the market:

Forbes

The number of those at the bottom of the scale—given a “D” grade by Forbes—jumped 61% to 177 since the first list in 2013, and many of them have been forced to heavily discount admission prices. (The average tuition sticker price is up more than 10% at private four-year colleges since 2013.) For some, the only way out becomes the unthinkable: unloading their most valuable asset in order to pay off creditors.

It rarely goes smoothly. In Vermont, Marlboro alums started a petition in a failed effort to stop the sale, joined by some locals who called it “a lousy deal.” Similar resistance had more success in New Jersey, where a pair of lawsuits helped scuttle the sale of Westminster Choir College to Kaiwen Education, a Chinese firm, two years ago. A fresh fight is brewing in New York, where the proposed sale of the Rockland County campus of Nyack College, a Christian school, to a yeshiva has caused such an uproar that a vote calling for the dissolution of the town is set for December.

“We’re going to see this trend continue and it’s going to accelerate,” says Nina Farrell, the higher education specialist at CBRE, of campus sales. The most vulnerable schools, she says, are ones “that have been operating at a really thin profit, or more likely at a deficit, for some time.”