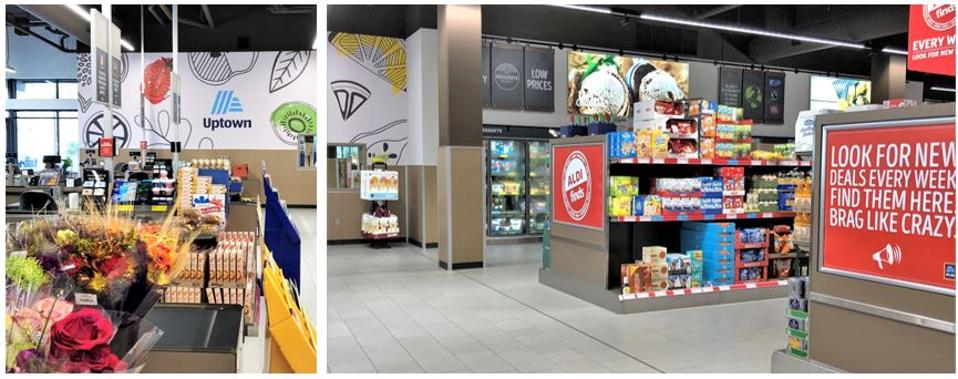

Aldi’s new Uptown Minneapolis location demonstrates their ability to leverage high traffic areas … [+]

I’m an admitted Aldi convert. I used to turn my nose up when my wife shopped the store, largely due to my ignorance and elitism; no more. Since visiting their newest additions to the Minneapolis market, I’m a believer.

Aldi has arguably become the poster child for the “limited assortment” grocery stores, which are growing at eleven times the rate of traditional supermarkets. The category that includes Trader Joe’s in addition to Aldi and Lidl, are projected to grow 5.6% annually through 2023, according to Inmar Analytics Inc., while sales at traditional supermarkets are projected to increase 0.5% annually.

Aldi, now the third largest grocery retailer in the US behind Walmart and Kroger, have managed to double their store count over the past decade to about 1900 stores in 36 states. Kroger by comparison has 2800 stores in 35 states, distributed over 28 chains. You can imagine the relative complexity in managing that many chains, compared to Aldi.

AIdi is broadening its offering to include more fresh produce, meats and poultry.

An Efficient Machine

Don’t think (as I did) that they are only about being the “cheapest”, it’s way more complex than that. They have an ingenious formula that combines to make them the most efficient grocer in the business. Their limited assortment is designed for efficiency. You won’t find five different variations of a given product, usually just one, and it’s probably private labeled as is the case for 90% of the store’s brands. This enables Aldi to pare its SKU count down to about 1,400 items products compared to 40,000 at a traditional supermarket and 100,000 at Walmart supercenters. Their stores are on average 15,000 square feet, one seventh that of an average Walmart.

But the Aldi magic goes beyond just a highly edited offering. Because their assortment always changes, and product turns occur at lightning speed, they manage to build in a bit of a “Costco-like” treasure hunt. One need only follow a loyal Aldi shopper scour the store. It’s not a quick pick-up of this or that; their customers make their way up and down every aisle, making sure that they take advantage of every bit of savings they came for.

Because the Aldi formula is all about efficiency, every nanosecond of operation and penny of … [+]

Managing Motion

Because the Aldi formula is all about efficiency, every nanosecond of operation and penny of overhead that can be paired out, is. Their checkout process is a study in fluid motion, beginning with the lightening fast product scanning. This is propelled via placement of bar-codes on every surface of their package goods. The “pack your own product” also cuts down on checkout time, as they have taught their customers to pay and get out of the way. They have provided ample room and counter space beyond the checkouts for packing, with the customer’s own bags. This cuts down on labor as well as being kind to the environment.

Their stores limited hours help keep employee costs in line. Most Aldi’s will only have three to five employees on hand at a given time, and around 15-20 on the payroll. But like Costco, Aldi has learned that spending liberally to gain and keep talent is a great investment. Their store managers make between 25% and 75% more than managers at other retailers.

Aldi’s newest prototype features all of the deals of the past in a fresh new envelope.

Location Flexibility.

Another component of their speedy accent has to do with their footprint. The stores very manageable size gives them the ability to seek out prime real estate, that a larger grocery retailer couldn’t consider. The newly opened store pictured in this article is located on the street level of a new apartment building in the dense and trendy south Minneapolis, Uptown neighborhood, with a high walkability factor. The store shares an elevator lobby with the apartment building as well. And speaking of sharing, I’m certain that “Minnesota Niceness” will motivate exiting customers to share their grocery cart with other Minneapolitans, saving the next shopper the $.25 cart rental.