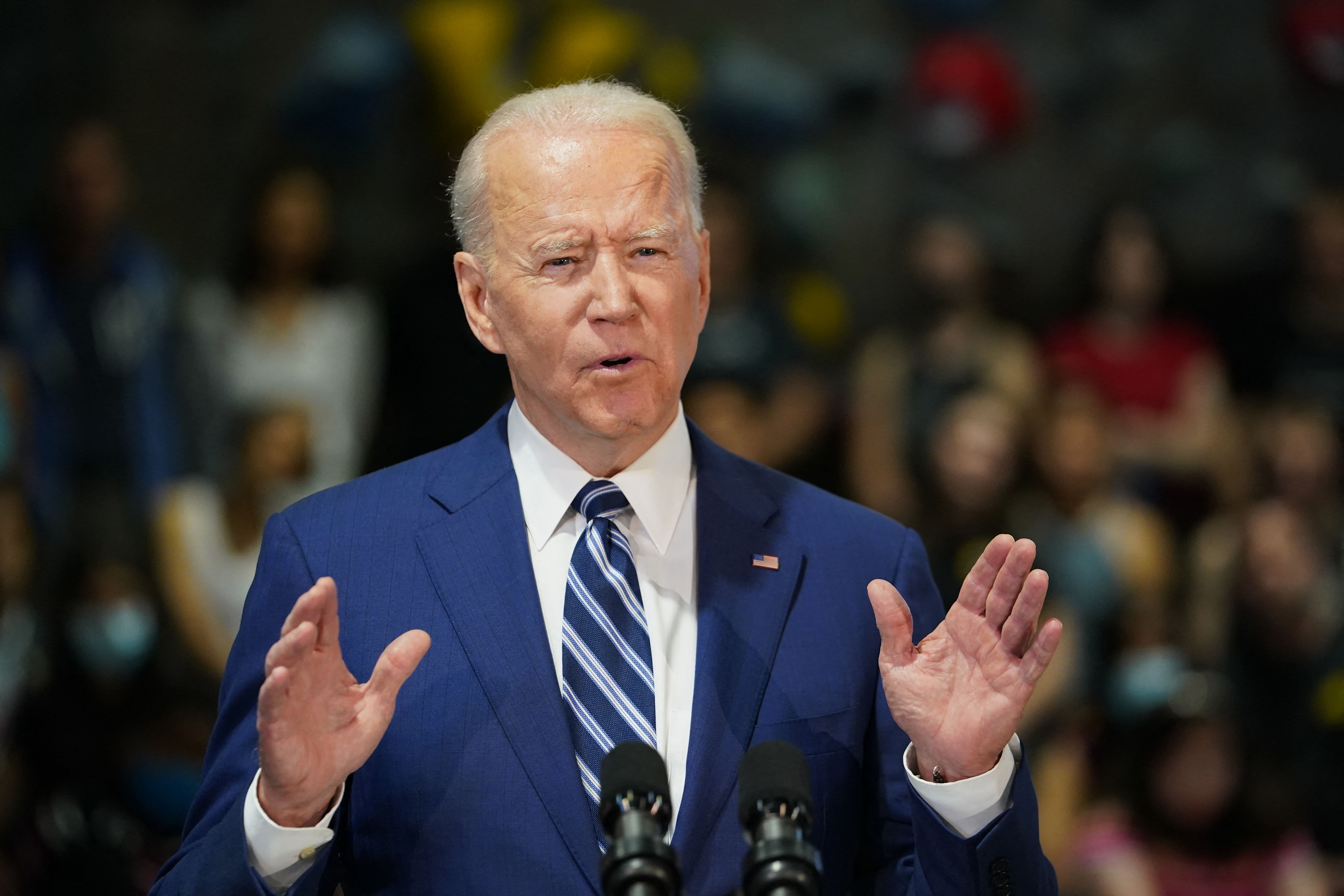

President Joe Biden released his proposed 2022 fiscal year budget on Friday, which calls for an increase of the top capital gains tax rate to 39.6%. Top earners may pay up to 43.4% on long-term capital gains, including the 3.8% Obamacare surcharge.

The proposed capital gains rate hike may be retroactive to the “date of announcement,” the Treasury outlined. However, it doesn’t specify whether the effective date was Friday’s budget reveal or when Biden unveiled the American Families Plan in April.

“We’re concerned, and our clients are concerned,” said certified financial planner Ian Weinberg, CEO of Family Wealth and Pension Management in Woodbury, New York. “We’re having active conversations about it.”

More from Personal Finance:

How Biden’s real estate tax plan may hit smaller property investors

Biden’s plan for inherited real estate may impact more than just the wealthy

How Biden’s capital gains proposal may hit some middle-class home sellers

Financial advisors have navigated retroactive tax changes in the past, but there has often been more wiggle room for tax planning, he said.

While the proposed increase may make selling investments more costly for the wealthy, there are still ways to reduce future tax bills, said Weinberg.

For example, some clients with significant gains may wait to sell investments, and philanthropic investors may gift appreciated property to reduce the tax bite.

We’re concerned and our clients are concerned. We’re having active conversations about it.Ian WeinbergFamily Wealth and Pension Management

Investors and their employers may also focus on putting more money into retirement plans, he said. Employees may try to reduce their gross income, and companies may get a tax deduction.

“Everybody should be thinking about that, from the employer down to the employee,” he said.

Business planning

The retroactive tax hike may acutely impact businesses in transition, said Weinberg. These company owners will need advanced tax planning ahead of their business sale or acquisition.

“That poses more serious thought, because those are multimillion dollar sales,” he said.

Business sales may easily bump an owner into the top tax bracket, exposing them to the 43.4% capital gains rate, not including state or local levies.

Those considering a business sale should meet with their tax advisor as early as possible, said Eric Pierre, an Austin, Texas-based certified public accountant and owner at Pierre Accounting.

Ideally, the tax-planning process begins six to nine months before the business sale.

“Too many people wait until the last minute,” he warned.

Stay vigilant

While many advisors prefer a proactive approach, it’s tough to predict whether the retroactive capital gains tax increase will survive negotiations in Congress.

“I call it a 50/50 shot because it could be a sticking point for the administration,” Weinberg said.

Still, advisors are staying vigilant and taking the appropriate tax-planning steps when necessary.

“We believe probably by September we should have a clearer picture,” said Pierre. “We’re going to do year-end planning early this year once we know what they will or will not allow.”