Supreme Court Will Review Entire Affordable Care Act Immediately After The Election

getty

Ending the Affordable Care Act (ACA) will be a case of Robin Hood in reverse – taking from the most vulnerable families to give the wealthiest Americans a massive financial windfall. This could soon become reality if the Supreme Court sides with the Trump administration and Republican state attorneys general and invalidates the entire ACA. With the case coming before the Court just a week after the presidential election, Trump and Senate Republicans are rushing to seat Judge Amy Coney Barrett, who has been critical of the law in the past. The financial stakes for American families of this rushed Supreme Court appointment are very high.

The ACA became law in 2010. It improved health insurance and health care access for tens of millions of people over the following years. The law regulated insurance companies, so that they could no longer discriminate against people based on gender or health conditions. Thanks to the law, pre-existing conditions were no longer a legitimate reason to exclude people from health insurance coverage or to charge them exorbitant premiums. These steps improved the quality of health insurance available to many people. The ACA also lowered the cost of health insurance. For instance, it expanded Medicaid and offered lower-income families subsidies to buy health insurance. It also contributed to smaller health insurance premiums by requiring more healthy people to buy health insurance. These benefits help explain the ACA’s growing popularity. Many families would quickly lose access to adequate and affordable health insurance if the Trump administration and its allies get their way before the Supreme Court.

The consequences of a complete ACA repeal would be far reaching, as my co-authors and I recently detailed. For instance, estimates suggest that more than 20 million people will lose health insurance coverage if the Supreme Court strikes down the law. Millions more, especially those with pre-existing conditions, will pay higher premiums as many cost saving regulations, such as the prohibition of discrimination on the basis of past health events, will end. Fewer healthy people will buy health insurance, again raising premiums. States and hospitals would lose financial support from the federal government for health care for lower-income Americans, leaving them with no choice but to cut health care for those hardest hit by the pandemic. More hospitals, for example, could close. Families would feel the fallout from an ACA repeal on a wide scale in the midst of a recession and global health crisis.

Federal Reserve data collected before the pandemic reveals how the lack of health insurance already correlated with financial security, even before the need for more health care grew. Those without health insurance were much more likely to not being able to come up with $400 in an emergency, to not being able to pay all of their bills and to end up with substantial medical debt after an unexpected major medical expense. For instance, after a major medical expenses, 59.8% of those without health insurance ended up with medical debt in 2019, compared to 38.2% of those with health insurance. The share of financially insecure households without health insurance was especially high among Black households, rural households and households with incomes below $40,000 in 2019. These households are also now suffering more from the pandemic and the recession than is the case for White, urban and higher-income households. The lack of health insurance has often gone along with substantial financial insecurity, particularly for those households most impacted by the current dual health and economic crises caused by the novel coronavirus.

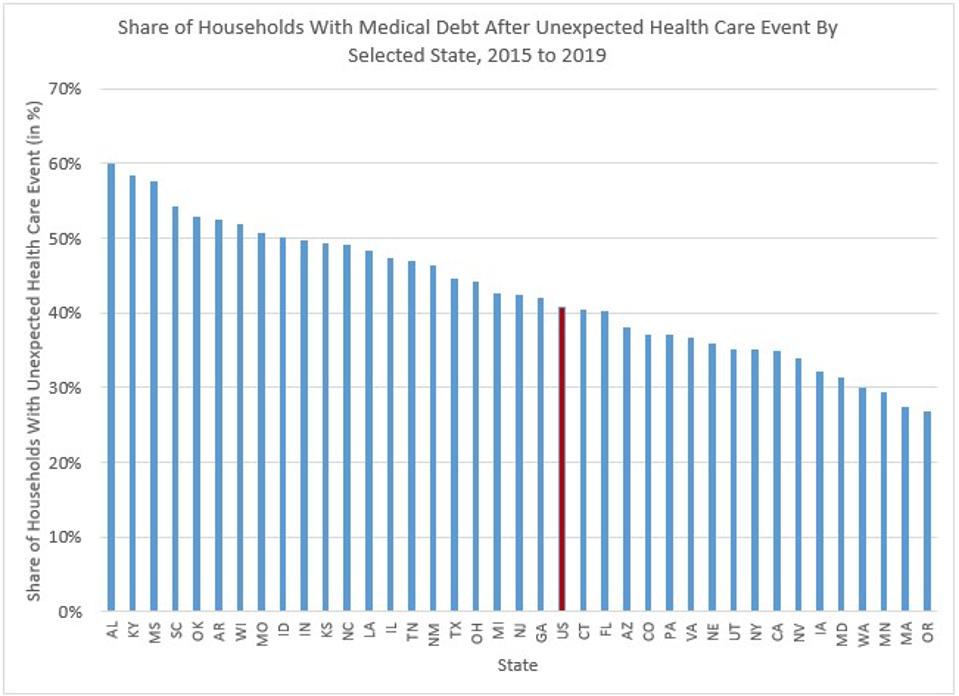

Still, many people with health insurance continue to struggle. They often lack emergency savings because they work in low-paid, unstable jobs with few benefits and thus have neither the income nor the savings to pay for their necessary health care. For example, more than one-third of households with health insurance, 38.2% to be exact, ended up with medical debt after an unexpected medical expense. The share of households with medical debt was especially high in Alabama, Kentucky, Mississippi, South Carolina, Oklahoma, Arkansas, Wisconsin, Missouri and Idaho, where it exceeded 50% (see figure below). With an ACA repeal, many more families could end up with medical debt and face severe financial hardship.

Large Shares of Households End Up With Medical Debt to Cover Major Medical Expenses.

Calculations Based on Federal Reserve. Survey of Household Economics and Decisionmaking

But some people would be big winners from an ACA repeal. The richest American households will get a tax cut in all likelihood if the Supreme Court undoes the law. The ACA imposed higher taxes on high-income earners to pay for the expansion of Medicaid and the health insurance subsidies for lower-income households. Striking down the law could also end these tax increases, giving the richest Americans yet another tax cut. Importantly, high-income earners saw their incomes and wealth rise faster than those of lower-income households before the pandemic and they are also on track to recover faster from the deep recession. The biggest winners from ACA repeal will be people who least need another financial windfall on top of the tax cuts they received from President Trump’s 2017 tax law.

Undoing the landmark health care law passed under President Obama has long been a policy goal for the Trump administration. It may get its wish as the Supreme Court decides on whether to void the entire law. Such a decision would put the physical and financial health of millions of Americans at risk in the middle of a pandemic and massive recession. At the same time, ACA repeal would give high-income households more unnecessary and wasteful tax cuts, further increasing their fortunes. Taking from those who struggle to give to those who are comfortable is cynical economic policy, especially, but not only, in a pandemic.