Years ago, when entertainer Jimmy Durante ended an appearance — whether live or on television — he would always sign off with his trademark catchphrase, “Good night, Mrs. Calabash, wherever you are.” It was a tribute to his first wife who died in 1943, which he would continue until his retirement nearly 30 years later.

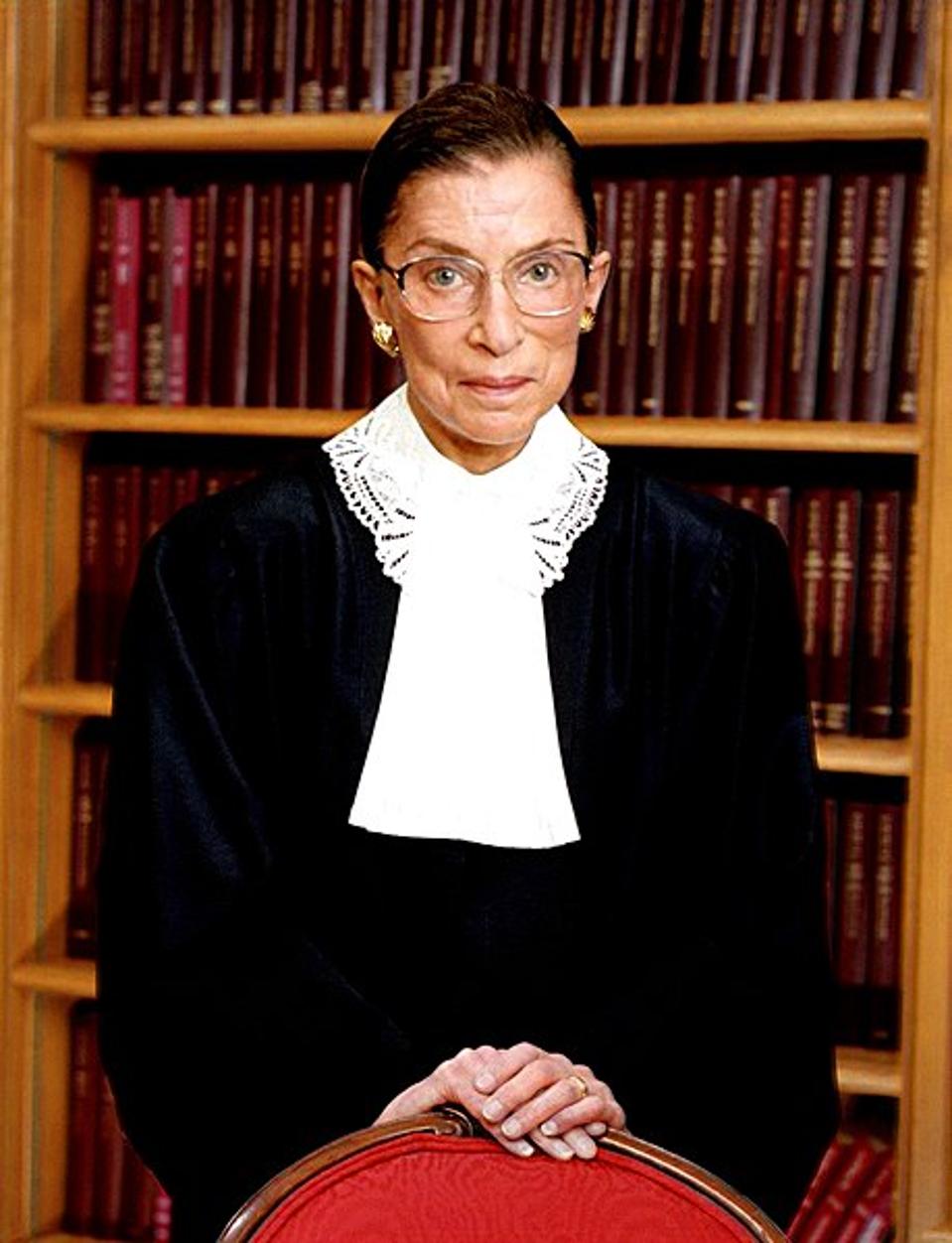

US Supreme Court

The nation now pays its respects to the late Ruth Bader Ginburg. While people might differ in opinion regarding her position on many cases before the US Supreme Court, every taxpayer must thank her for one particular case.

Turning back the clock over 2000 years to the Roman Republic, there were disputes as to which province taxed what when a citizen had ownership interests in more than one province. From the decisions that resolved those disputes, there became a body of tax principles upon which all of Western Civilization relies today. In the US, we would call this multi-state taxation.

Almost a decade ago, a multi-state trust taxation dispute was about to be born. It would become the case that advanced tax planners for families had always hoped for. The case made it way up through the state’s appellate court and supreme court and ultimately arrived in the US Supreme Court. Oral arguments were in May 2019.

It would have been easy to type cast each of the justices by the political dogma of the president who nominated them. And, the typical rhetoric would posit that a Democrat-appointed justice would be of the “tax and spend” mindset. But, that was not to be the case in this case.

When listening to oral arguments, one heard Madame Justice Ginsburg right out of the gate. While not referring to ancient Rome specifically, she nonetheless affirmed long-held principles of multi-jurisdictional taxation and undermined the fundamental position of the state tax authority in the case.

For about 2 or 3 minutes, it was her and no one else but her. And, at the end of that brief time, the handwriting was on the wall: the case would be decided in favor of the taxpayer. (Perhaps more of a surprise was that Madame Justice Sotomayor grabbed the baton and ran with it from there.)

For many, what Madame Justice Ginsburg did will go unnoticed. But, for this tax planner, mirroring Jimmy Durante, I will always think back to this case and say, “Thank you, Madame Justice Ginsburg, wherever you are.”