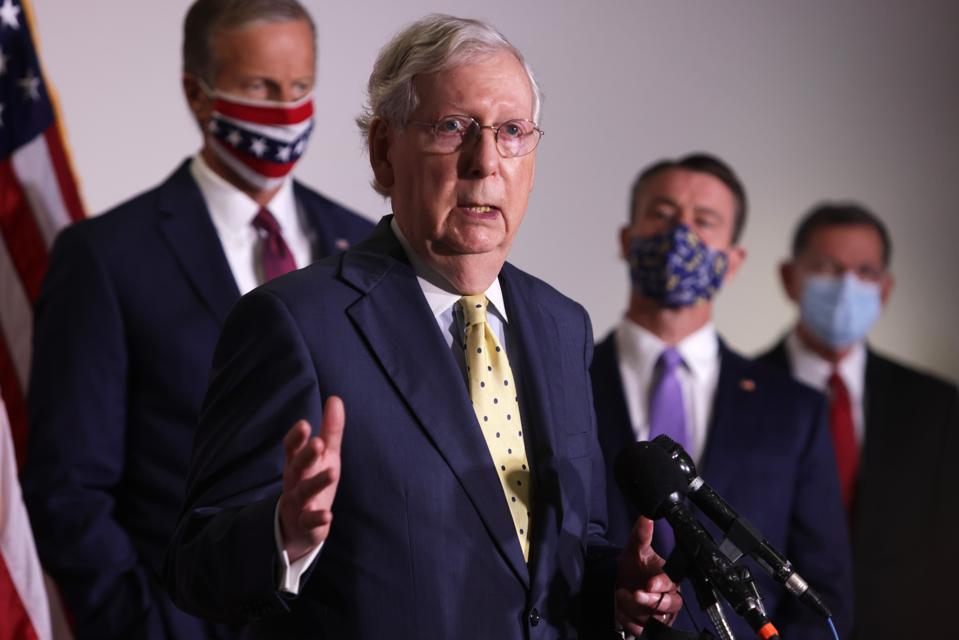

WASHINGTON, DC – SEPTEMBER 09: U.S. Senate Majority Leader Mitch McConnell (R-KY) speaks to members … [+]

Getty Images

It looks like Senate Majority Leader Mitch McConnell (R-KY) may bring a vote on the Senate “skinny” bill – the latest coronavirus relief bill. Why is it skinny? It has a slimmer price tag – and fewer benefits – than before.

Some Quick History

In May, House Speaker Nancy Pelosi (D-CA) announced a $3 trillion COVID-19 economic relief proposal known as the Health and Economic Recovery Omnibus Emergency Solutions Act, or HEROES Act. The Senate countered in July with a series of proposals referred to as the Health, Economic Assistance, Liability Protection, and Schools Act, or HEALS Act, which weighed in at about $1 trillion.

The idea was that they should meet in the middle. That’s how we arrived at the “Delivering Immediate Relief to America’s Families, Schools and Small Businesses Act” introduced by the Senate which is estimated to cost (checks notes) $500 billion.

The bill largely reflects a draft proposal that the GOP introduced in August.

Tax & Small Business Highlights

Protection against litigation. Near the top of the Act, the Senate established, as a priority, barring certain lawsuits due to COVID, writing that, “CARES Act funds cannot be diverted from these important purposes to line the pockets of the trial bar.” And hammering home their intent, the Senate bill claims that “[t]hese lawsuits also risk diverting taxpayer money provided under the CARES Act and other coronavirus legislation from its intended purposes to the pockets of opportunistic trial lawyers.” Several pages later, we get to the meat of the provision which states that Congress “must act to set rules governing liability in coronavirus-related lawsuits.” The rationale for the protections and the definitions which would offer liability protections for employers, schools and health care providers go on for about 70 pages.

Extension of Unemployment Benefits. The bill would extend the program that ended on July 31, 2020, to December 27, 2020. However, instead of $600 per week, the amount is reduced to $300.

Paycheck Protection Program Continuation. The bill would allow for another round of PPP loans totaling about $258 billion. As before, the proposal would expand the definition of allowable expenses to include those used to pay for any software, cloud computing, human resources, payroll, billing and accounting; costs related to “property damage and vandalism or looting due to public disturbances” that occurred during 2020 not covered by insurance; supplier costs; and worker protection related to social distancing, sanitation or other safety requirements. The Senate proposal also clarifies that lenders may rely on loan certification or documentation submitted by borrowers and would extend the covered period and allow the borrower to elect a covered period between eight weeks after origination and December 31, 2020.

PPP Second Draw Loans. The Senate proposal would allow the hardest-hit small business owners to receive a second PPP loan – and still qualify for forgiveness.

PPP Loan Caps. The Senate proposal officially reduces the maximum amount borrowers may receive under the first round of PPP funding from $10 million to $2 million but allows borrowers eligible for a bigger loan as a result of “any interim final rule that allows for covered loan increases” to ask for an increase even if the initial covered loan amount has been fully disbursed, or if the lender has already submitted a report.

PPP Targets. The Senate proposal creates specific PPP loan calculations for certain farmers and ranchers, allowing lenders to recalculate previously approved loans, and would expand eligibility to include 501(c)(6) organizations – with some restrictions, generally related to size and lobbying.

Postal Service Assistance. The Senate proposal would also forgive a $10 billion loan to the United States Postal Service (USPS) under certain circumstances. The USPS does not rely on tax dollars and the money authorized under the CARES Act was a loan.

Emergency Education Freedom Grants. The proposal would allow emergency appropriations funding for scholarship-granting organizations in each state. Any funds received as a scholarship would not be considered income to the recipient for tax purposes or for purposes of determining the eligibility for benefits or assistance under any federal program or under any state or local program funded with federal dollars.

529 Account Funding. The proposal would allow 529 account distributions through 2028 for expenses “in connection with enrollment or attendance at, or for students enrolled at or attending, an elementary or secondary public, private, or religious school.” Expenses would be expanded to include tuition for tutoring or educational classes outside of the home, including at a tutoring facility (subject to some restrictions); fees for standardized norm-referenced achievement tests, advanced placement (AP) exams, or any exams related to college or university admission; fees for dual enrollment in an institution of higher education; and educational therapies for students with disabilities. It would also include home school expenses – you may recall that provision failed to make it into the TCJA at the last minute. But with more home schoolers now, who knows?

Back to Work Child Care Grants. The proposal offers assistance to help child care providers stay open.

Charitable Giving Deduction. Remember the above-the-line $300 deduction authorized under the CARES Act? The Senate bill would double it – and make clear that you get two times the deduction for joint returns (that wasn’t quite clear before).

More, more, more. Yes, my eyes were watering at this point, too, but there are pages and pages to go, including provisions for “Critical Minerals” (funding the coal industry) and appropriations (largely for schools and medical expenses). Those are less tax-focused so I won’t summarize them here – you can read them on your own if you have interest (the link to the bill is at the bottom of the piece).

What’s Not In The Bill

Stimulus Checks. The Senate proposal does not include funding for a second round of stimulus checks at any dollar amount.

State & Local Funding. There’s also no additional funding for state and local governments (something the Democrats wanted).

Does It Have A Chance?

The bill is expected to pass the Senate with GOP leaders claiming they have the votes.

But it won’t get far in the House: Senate Minority Leader Chuck Schumer (D-NY) and Speaker Pelosi have already declared, “Senate Republicans appear dead-set on another bill which doesn’t come close to addressing the problems and is headed nowhere.”

Where Can I Read It For Myself?

You can read the entire not-so-skinny bill here (downloads as a PDF).