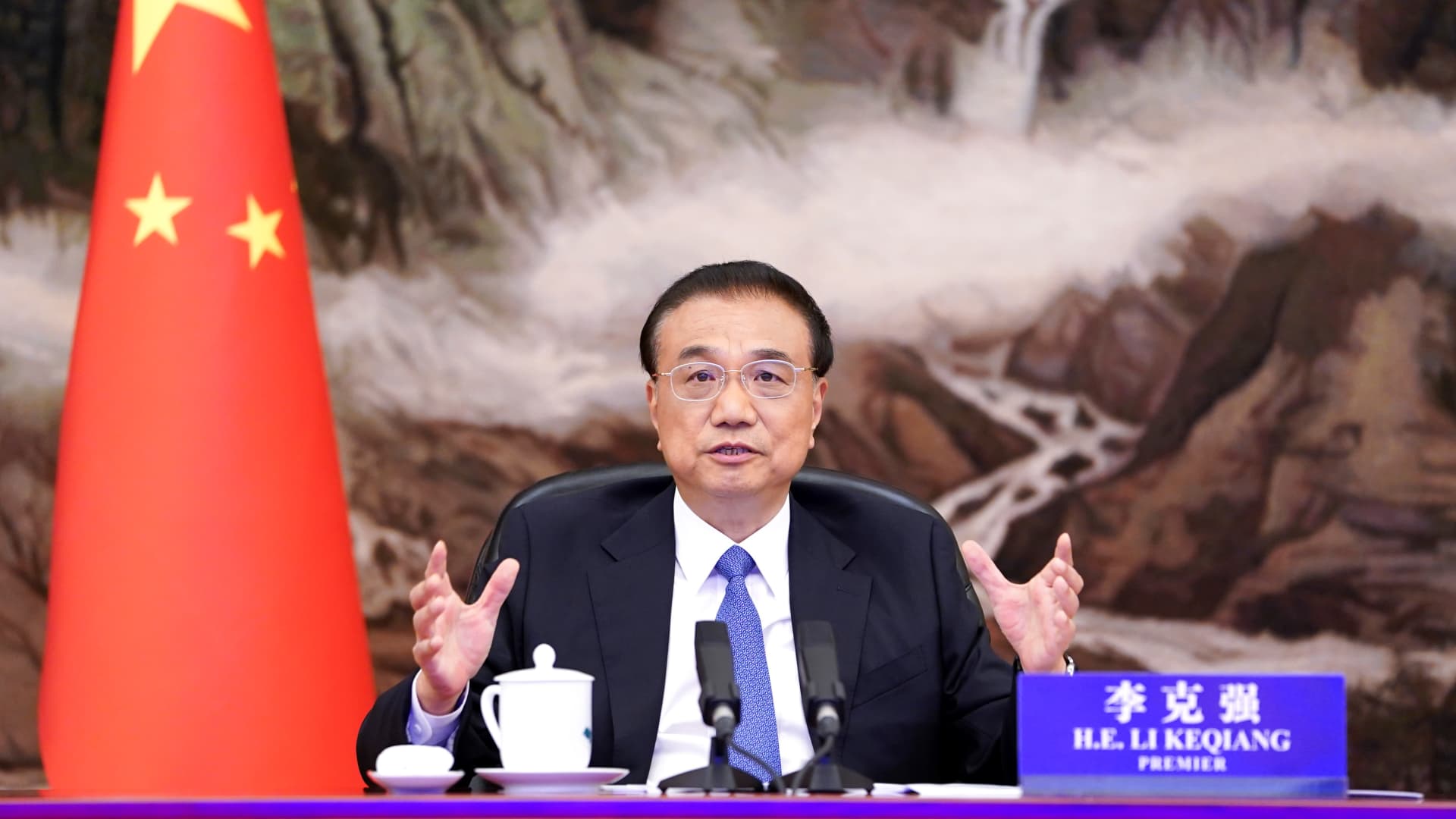

BEIJING — Chinese Premier Li Keqiang has called on six provinces to take the lead in supporting the country’s growth after data for July showed a slowdown across the board.

Retail sales, industrial production and fixed asset investment data released Monday missed analysts’ expectations and marked a slowdown from June. It comes as China’s economy registered growth of just 2.5% in the first half of the year.

“Now is the most critical juncture for economic rebound,” Li said at a meeting Tuesday, according to an English-language readout. He called for “resolute and prompt efforts” to strengthen the foundation for recovery.

Much of that responsibility lies with six “economically strong provinces” that account for 45% of national GDP, the readout said. It said the six provinces also make up nearly 60% of the national total for trade and foreign investment.

The leaders of the coastal, export-heavy provinces of Guangdong, Jiangsu, Zhejiang and Shandong spoke via video at an economic meeting with Li on Tuesday, the readout said. Leaders of the landlocked provinces of Henan and Sichuan also spoke.

The province-level municipalities of Shanghai and Beijing were not mentioned.

“Investment will accelerate in the six provinces as [the] central government will offer [a] green light to major investment projects,” said Yue Su, principal economist at The Economist Intelligence Unit. She said the provinces might even get assigned their own targets for measures like employment.

“Although there’s no emphasis on the [national] GDP target, the premier still attaches great importance to the growth rate by mentioning development [as] the key to resolving all problems,” she said.

They also said then that “provinces with the conditions to achieve the economic targets should strive to,” according to a CNBC translation of the Chinese.

Above-average median growth

The six provinces that were highlighted at Tuesday’s meeting had set GDP targets ranging from 5.5% to 6.5%, for a median goal of 5.75% growth. That’s according to CNBC calculations of figures published by state media.

In terms of actual growth in the first half of the year, that median was 2.65%, according to CNBC calculations of official data for the six provinces accessed through Wind Information. The provincial GDP growth rates ranged from 1.6% to 3.6% during that time.

I think the meeting reflects the fact that policymakers are disappointed about the July economic data.Larry HuChief China economist, Macquarie

Tuesday’s meeting highlighted the six provinces’ importance to fiscal revenue.

The four coastal provinces account for more than 60% of all provinces’ net contribution to the central budget, the readout said. “They should complete their tasks in this respect,” the statement said.

“I think the meeting reflects the fact that policymakers are disappointed about the July economic data,” Larry Hu, chief China economist at Macquarie, said in an email to CNBC. “Meanwhile, they are increasingly concerned about the property sector.”

“As a result, they would like to give another boost to the economy. The surprise cut by the PBOC this Monday is a part of the boost,” he said.

The central bank unexpectedly cut two interest rates on Monday, leading to expectations the People’s Bank of China will cut the main loan prime rate in about a week.

China’s economy has slowed this year, dragged down by Covid outbreaks and ensuing business restrictions. A worsening slump in the massive real estate sector has also weighed on the economy.

On real estate, Li only said that “the economically strong provinces” should support needs for basic or improved housing conditions, according to the readout.

Instead, Li emphasized the provinces need to boost consumption, especially of big-ticket items such as automobiles, the readout said.

Autos contribute more to growth

The Chinese premier called for more measures to support auto sales in June. Since then, related economic indicators have seen some of the fastest growth.

Automobile production climbed by 31.5% year-on-year in July, official data showed. Autos exports surged by 64% in July from a year ago, and helped boost China’s better-than-expected export growth last month, customs data showed.

The official retail sales report for July said auto sales growth slowed to a 9.7% year-on-year pace, down from 13.9% in June. Automobile sales accounted for 10% of China’s retail sales in July, which grew by a disappointing 2.7% last month from a year ago.

“The combination of falling auto sales growth and rising auto production growth implies a likely inventory build-up in the auto sector,” Goldman Sachs analysts said in a report Monday.