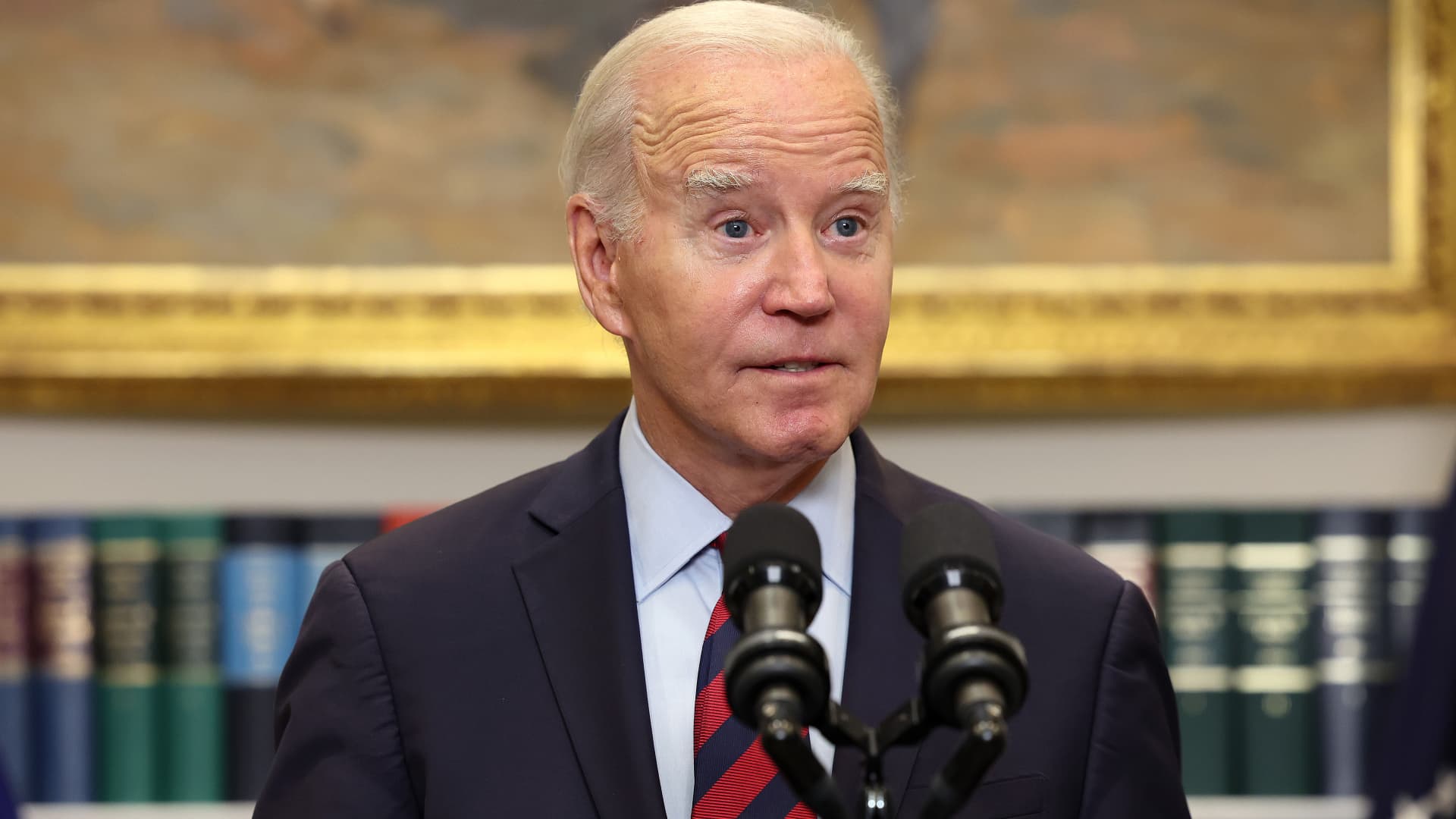

President Joe Biden’s plans to cancel up to $400 billion in student debt for tens of millions of Americans were foiled over the summer at the Supreme Court.

Still, Biden has managed to erase $127 billion in student debt so far for more than 3.5 million borrowers — more than any other president in history.

His administration has used existing programs that were previously hard to access for many borrowers to deliver that relief.

More from Personal Finance:

These credit cards have had ‘increasingly notable’ high rates

‘Cash stuffing’ may forgo ‘the easiest money’ you can make

Student loan borrowers reenter ‘messy system’

Here’s what borrowers should know about those options for aid.

Income-driven repayment plans

Income-driven repayment plans, which date back to 1994, allow student loan borrowers to pay a share of their earnings toward their debt each month, and to get any remaining debt forgiven after a set period. There are four different plans.

Yet, many borrowers paid into the system for years without getting that promised cancellation, said higher education expert Mark Kantrowitz.

“The loan servicers weren’t keeping track of the number of qualifying payments,” Kantrowitz said.

The Biden administration has evaluated millions of borrowers’ loan accounts to see if they should have had their debt cleared.

As a result, it has cleared nearly $42 billion for more than 850,000 people enrolled in these plans.

Most people with federal student loans qualify for income-driven repayment plans, and can review the options and apply at Studentaid.gov.

Public Service Loan Forgiveness

Navigating the Public Service Loan Forgiveness program has been famously difficult.

The program, signed into law by former President George W. Bush in 2007, allows certain not-for-profit and government employees to have their federal student loans discharged after 10 years of on-time payments. In 2013, the Consumer Financial Protection Bureau estimated that one-quarter of American workers may be eligible.

Yet, after getting wrong information from their servicers about the program’s requirements, millions of borrowers hit walls. People frequently found that some or all of their qualifying payments didn’t count because they had a loan or were enrolled in a payment plan not covered under the initiative.

The Biden administration has tried to reverse the trend of borrowers being excluded from the relief on technicalities. It has broadened eligibility and allowed people to reapply for the relief, as long as they were working in the public sector and paying down their debt.

Some 715,000 public servants have gotten their debt erased as a result, amounting to $51 billion in relief.

With the PSLF help tool, borrowers can also search for a list of qualifying employers under the program and access the employer certification form. They can also learn about all the program’s requirements at Studentaid.gov.

Total and Permanent Disability discharge

The Biden administration has also forgiven the student debt of more than 500,000 disabled borrowers. The $11.7 billion in aid was delivered under the Total and Permanent Disability discharge.

The U.S. Department of Education has gotten better at identifying borrowers who are disabled and in need of this relief by accessing information from the Social Security Administration, Kantrowitz said.

Borrowers may qualify for a TPD discharge if they suffer from a mental or physical disability that is severe, permanent and prevents them from working. Proof of the disability can come from a doctor, the Social Security Administration or The Department of Veterans Affairs.

Borrower defense

Another 1.3 million borrowers have walked away from their debt over the past few years thanks to the Borrower Defense Loan Discharge. These people received $22.5 billion in relief.

Borrowers can be eligible for the discharge if their schools suddenly closed or they were cheated by their colleges.

The Biden administration has more swiftly processed these applications and has started considering cases in a group rather than requiring each attendee of a school to prove they were misled.

“Borrowers who were affected by similar circumstances should have their loans discharged as a group,” Kantrowitz said.

Those who think they might qualify can apply with the Education Department.

Consumer advocates praise the president for his actions but are pressuring him to do more. On the campaign trail, Biden vowed to cancel at least $10,000 of student debt per person.

“Student debt cancellation tipped the balance in Democrats’ favor in the midterms,” said Astra Taylor, co-founder of the Debt Collective, a union for debtors. “Failing to deliver will demoralize and demobilize young people whose votes they cannot afford to lose.”