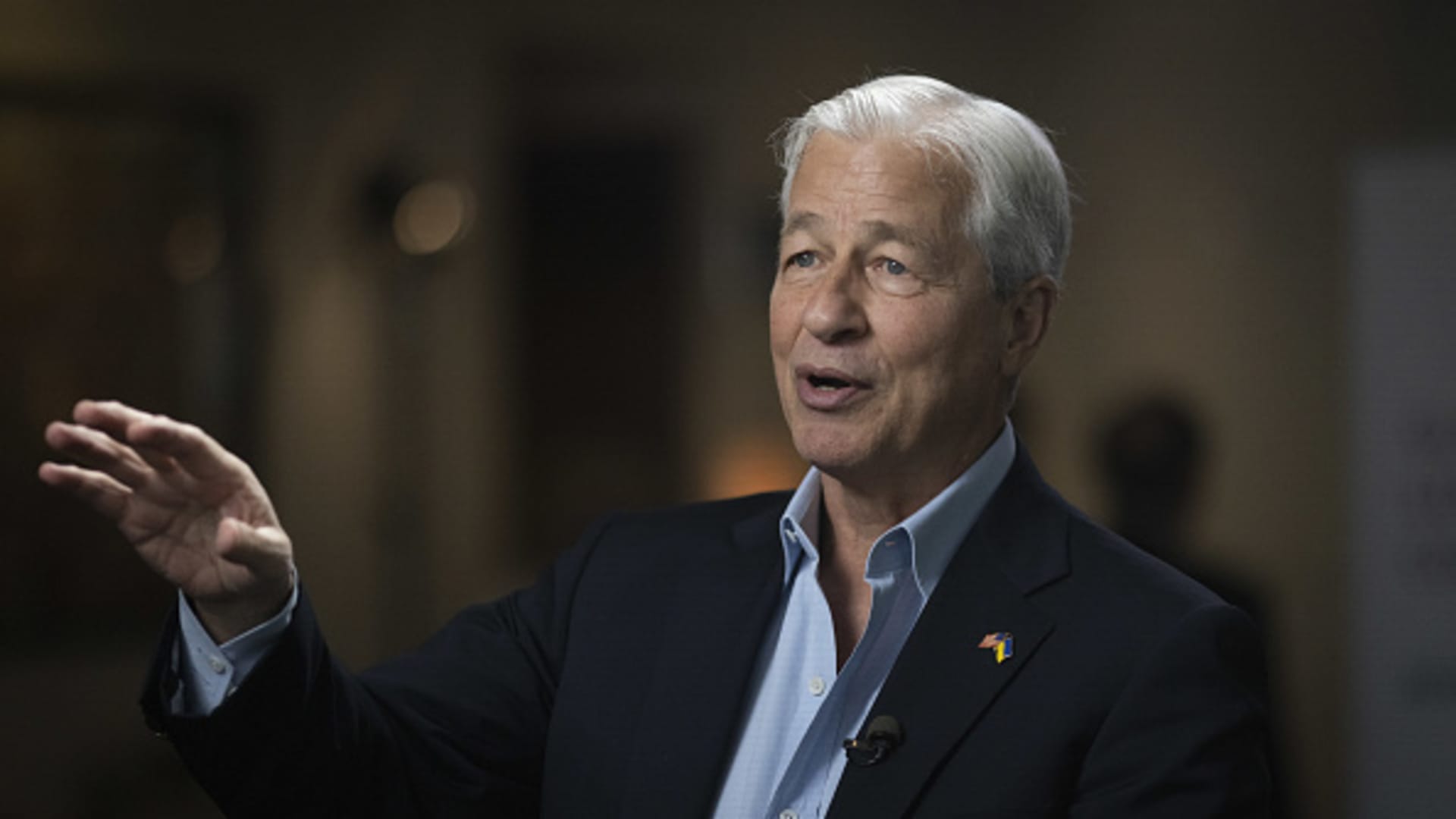

The crisis that led to the downfall of three regional U.S. banks in recent weeks is largely over after the resolution of First Republic, according to JPMorgan Chase CEO Jamie Dimon.

JPMorgan emerged as the winner of a weekend auction for First Republic after regulators decided that time had run out on a private sector solution. The Federal Deposit Insurance Corporation seized the bank and New York-based JPMorgan announced early Monday that it was acquiring nearly all of the deposits and most of the assets of First Republic.

“There are only so many banks that were offsides this way,” Dimon told analysts in a call shortly after the deal was announced.

“There may be another smaller one, but this pretty much resolves them all,” Dimon said. “This part of the crisis is over.”

In the wake of the sudden collapse last month of Silicon Valley Bank, investors have punished other banks that had similar characteristics to SVB. Companies with the highest percentage of uninsured deposits and unrealized losses on their balance sheet were most scrutinized.

But the $30 billion injection of deposits into First Republic last month bought time for the industry, allowing mid-sized banks to report first-quarter results in recent weeks that in many cases showed a stabilization of deposits. That eased investors’ fears that many more lenders would soon topple.

Shares of regional banks including PacWest and Citizens Financial slumped in premarket trading.

Down the road, investors are still exposed to risks created by the Federal Reserve’s interest rate hikes and their impact on assets including real estate, Dimon added.

This story is developing. Please check back for updates.