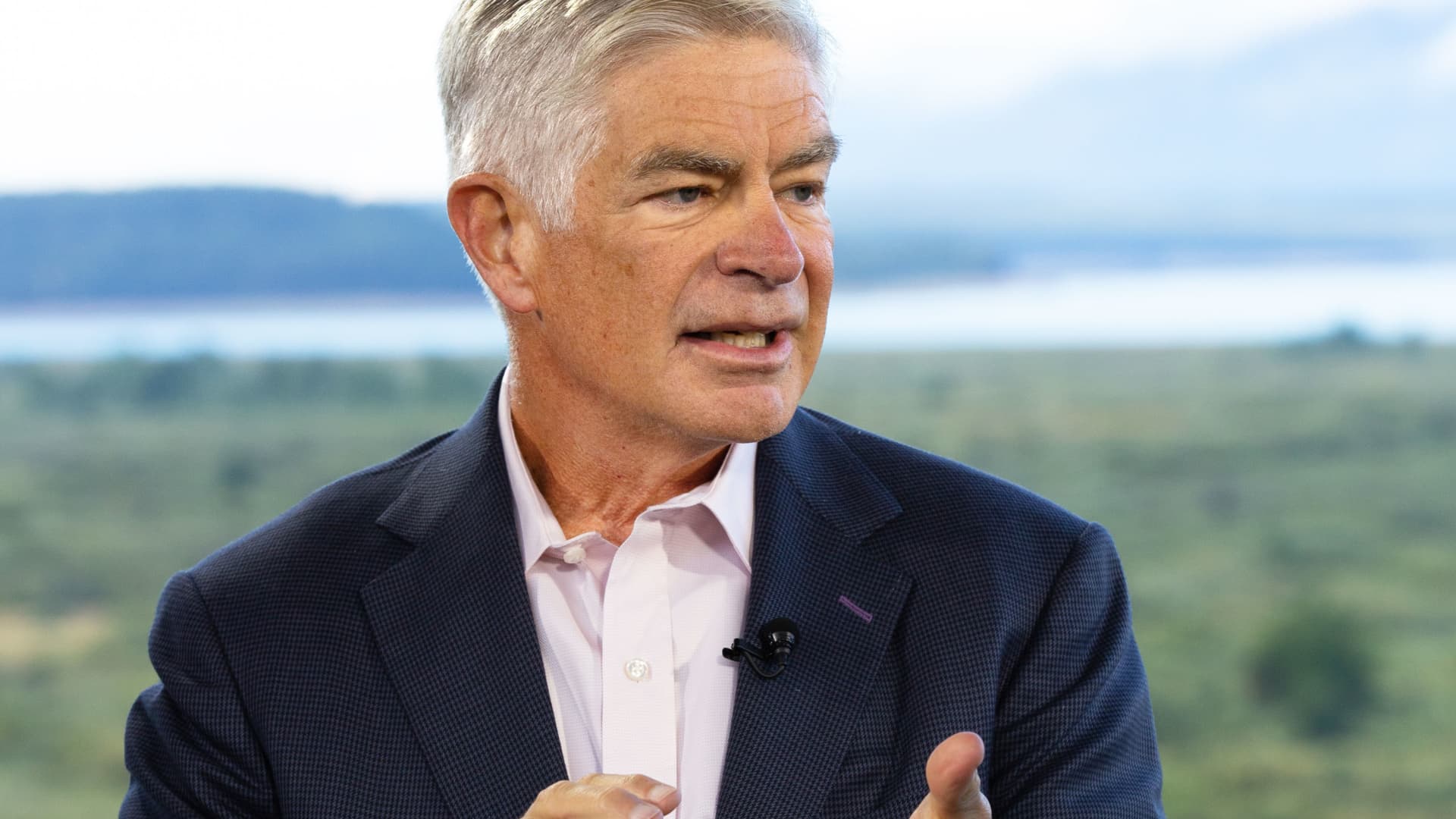

Philadelphia Federal Reserve President Patrick Harker on Thursday said higher interest rates have done little to keep inflation in check, so more increases will be needed.

“We are going to keep raising rates for a while,” the central bank official said in remarks for a speech in New Jersey. “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year.”

The latter comment was in reference to the fed funds rate, which currently is targeted in a range between 3%-3.25%.

Markets widely expect the Fed to approve a fourth consecutive 0.75 percentage point interest rate hike in early November, followed by another in December. The expectation is that the Federal Open Market Committee, of which Harker is a nonvoting member this year, will then take rates a bit higher in 2023 before settling in a range around 4.5%-4.75%.

Harker indicated that those higher rates are likely to stay in place for an extended period.

“Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work,” he said. “It will take a while for the higher cost of capital to work its way through the economy. After that, if we have to, we can tighten further, based on the data.”

Inflation is currently running around its highest level in more than 40 years.

According to the Fed’s preferred gauge, headline personal consumption expenditures inflation is running at a 6.2% annual rate, while the core, excluding food and energy prices, is at 4.9%, both well above the central bank’s 2% target.

“Inflation will come down, but it will take some time to get to our target,” Harker said.

Correction: The fed funds rate currently is targeted in a range between 3%-3.25%. An earlier version misstated the range.