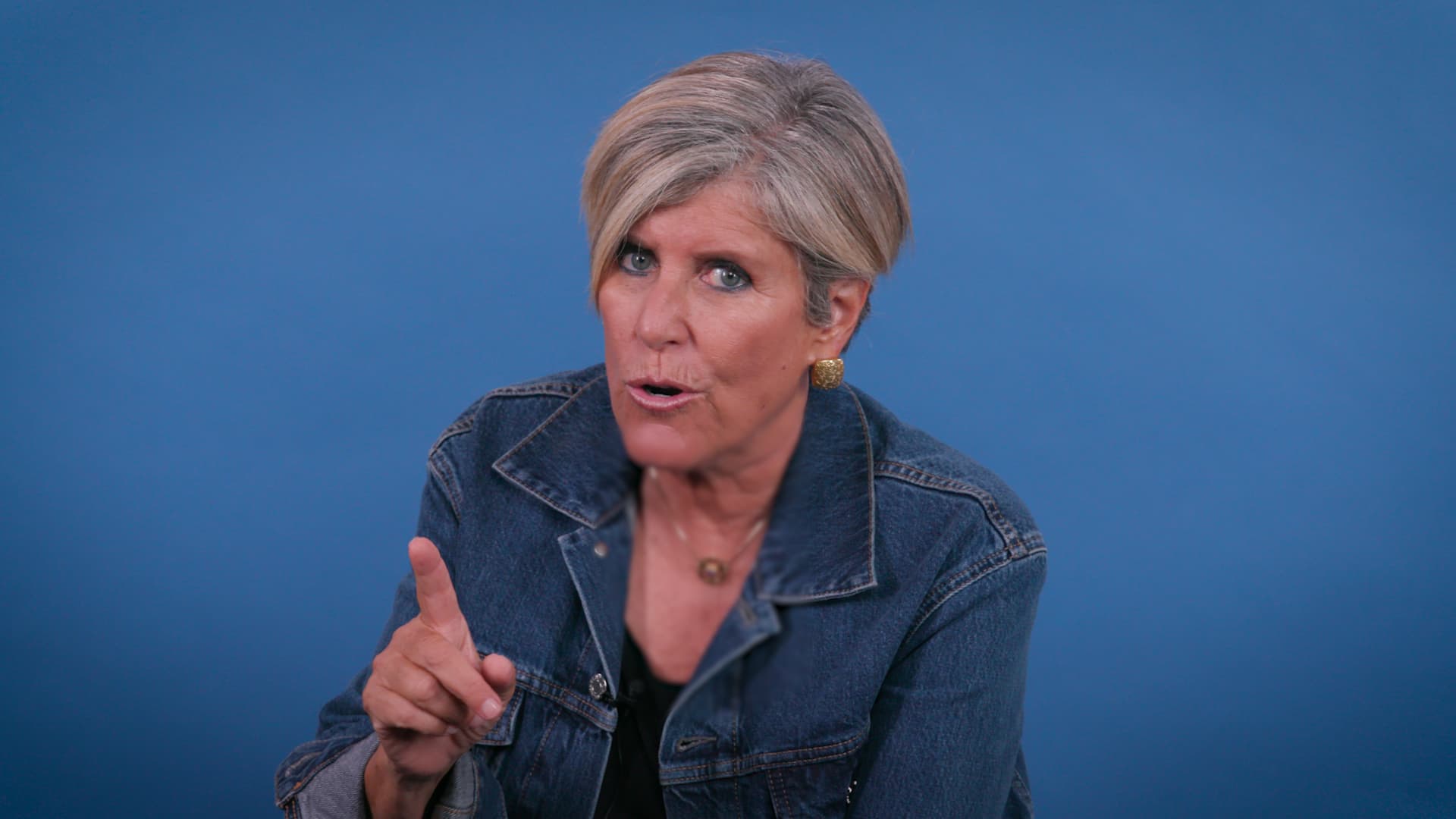

Before you get caught up in the Great Resignation and quit your job, you may want to think twice, said personal finance expert and best-selling author Suze Orman.

More than 4.4 million Americans quit their jobs in April, and job openings hit 11.9 million, according to the latest data available from the U.S. Department of Labor.

Yet at the same time, there are fears about an impending recession, rising inflation and headlines about layoffs.

“Everything is more expensive,” said Orman, who joined CNBC senior personal finance correspondent Sharon Epperson on CNBC’s Twitter Space conversation, “Invest with Pride: Ready. Set. Grow.“

“We may find that certain corporations start to cut back because their expenses are so high [and] their stocks maybe aren’t doing what they want them to be doing.”

More from Invest in You:

These are the 10 fastest-growing entry-level jobs

Suze Orman: Inflation is here to stay for some time. What you should buy

What new graduates need to know about money and jobs

44% of workers are worried about a layoff, job loss

Despite the collective optimism around the current job market, 44% of workers are worried about a layoff or job loss, CNBC’s All-America Workforce Survey found. Some 84% are concerned about a recession.

Economists are starting to raise their recession probability outlooks. On Monday, Goldman Sachs said it now sees a 30% probability of it happening over the next year, up from 15% previously.

Meanwhile, 68% of chief financial officers responding to the CNBC CFO Council survey think a recession will occur during the first half of 2023.

Inflation has also yet to slow down, although many had hoped it would. Consumer prices rose 8.6% in May, the highest increase since 1981.

For now, the labor market is still hot and many career experts believe job seekers have the upper hand.

An emergency fund offers ‘freedom’ between jobs

However, if you decide to walk away from your job, it’s imperative to have an eight- to 12-month emergency fund, said Orman, host of the “Women and Money” podcast. The savings will also protect you in the event of a downturn.

“If you lose your job, if you want to leave your job, that gives you the freedom to continue to pay your bills while you’re figuring out what you want to do with your life,” she said.

Orman’s target of eight to 12 months is on the high end. Many financial experts, such as certified financial planner Ted Jenkin, CEO at Atlanta-based Oxygen Financial, have told CNBC the ideal number is at least three to six months of emergency savings.

Yet many Americans aren’t even hitting that goal, according to a new Bankrate survey.

Nearly one in four has nothing saved at all, the lowest level the personal finance website has seen in its 12 years of polling. Some 27% have enough to cover six months or more of expenses. The rest fall in between.

To build up your savings, start skipping small things you don’t need, such as going out to dinner. Treat your emergency fund like a bill you must pay each month and even consider automatically depositing a portion of your paycheck into a savings or money market account.

Try to only use credit cards if you pay the bill in full each month and put any bonus money, such as a bonus or tax refund, into the emergency fund.

Once you have that money set aside, you’ll be able to afford a period of unemployment. However, while a layoff is outside of your control, walking away should be a very careful decision, Orman said.

“It is really important that if you are going to do something, do it with intelligence and a lot of thought,” she said.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.