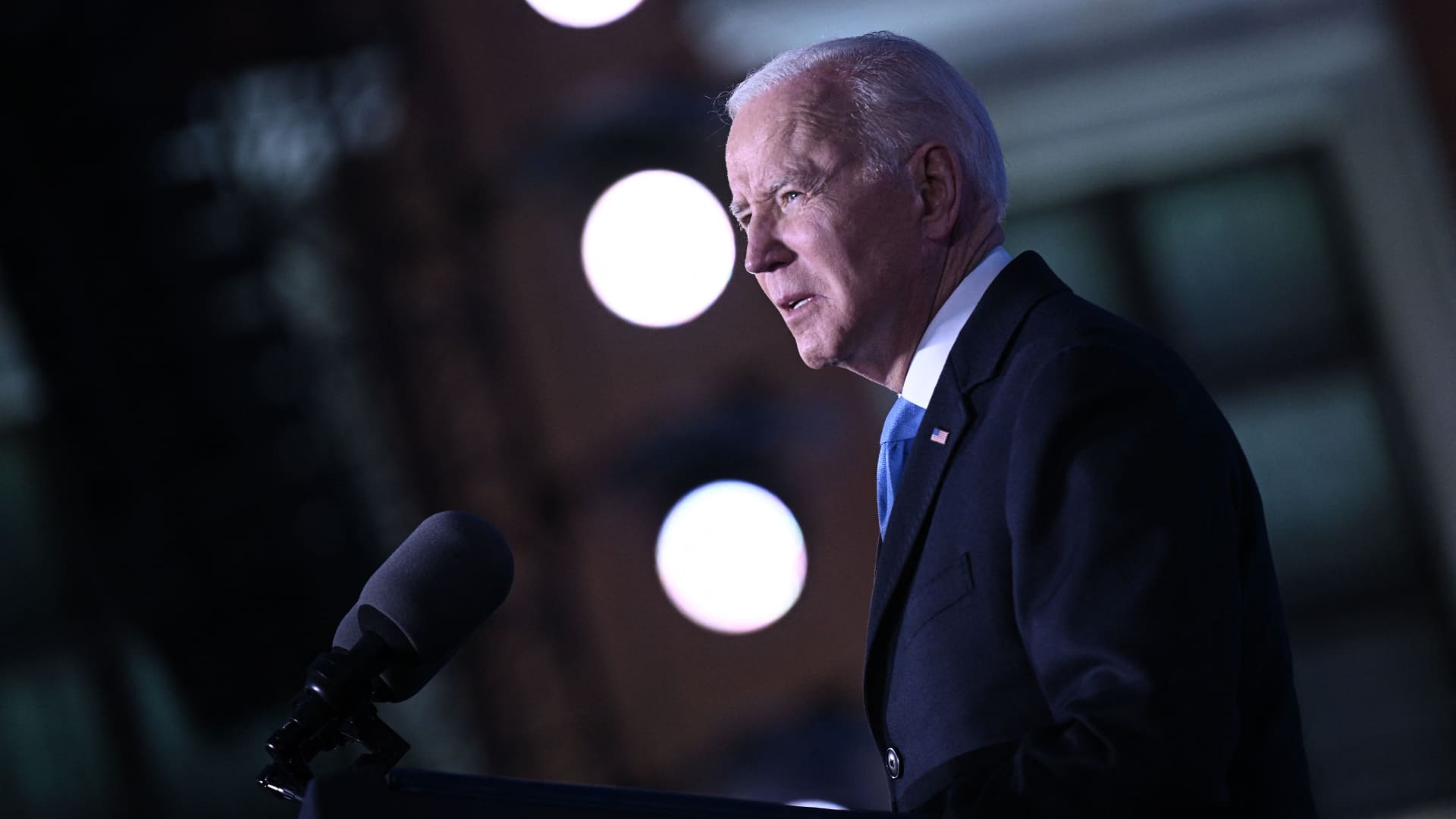

Nowhere in President Joe Biden’s more than 100-page budget for 2023 is any mention of student loan forgiveness or the payment pause for borrowers, continuing the uncertainty millions of Americans have been in about the future of their debt.

The White House only requested more funding — $2.7 billion — to improve customer service for borrowers.

More from Personal Finance:

7 things to know about the SEC climate rule

Here’s the average tax refund so far this year

How to avoid a 6-figure tax penalty on foreign bank accounts

Yet it’s unclear when people with student loans will have to interact with their servicers again. Most borrowers haven’t made a payment on their debt in more than two years, thanks to a pause on the bills that has been repeatedly extended.

Despite the omission of any information on the payment pause in Biden’s budget, the administration has suggested it was considering delaying the resumption of payments beyond May, when they’re currently slated to resume.

White House Chief of Staff Ron Klain said earlier this month that Biden wanted to make its decision around debt cancellation before turning the payments back on.

“The president is going to look at what we should do on student debt before the pause expires, or he’ll extend the pause,” Klain said on the podcast “Pod Save America.”

The White House would likely only include a request for forgiveness if it planned to ask Congress to implement it, said higher education expert Mark Kantrowitz.

Its omission could suggest the administration was still contemplating cancelling the debt without legislation, either through new regulations or executive action.

Meanwhile, he said, “they do not need to budget for an extension.”

Some Democrats and advocates have warned that it would be a disaster to restart payments before the mid-term elections in November.

Research shows borrowers may face significant hurdles come May. One estimate found nearly a third of loan holders could be at a high risk of missing their payments without another extension.

Even before the pandemic, the country’s outstanding student loan debt balance exceeded $1.7 trillion and posed a larger burden to households than credit card or auto debt. Average debt at graduation is around $30,000, and roughly a quarter of borrowers, or 10 million people, were estimated to be in delinquency or default.

A recent poll found that nearly 66% of likely voters are in support of Biden canceling some or all of student debt, with more than 70% of Latino and Black voters in favor.

Critics of a student debt jubilee say that it would be unfair to those who didn’t borrow for their education or who’ve paid off their loans and that it wouldn’t significantly stimulate the economy because college graduates tend to be higher earners more likely to redirect their monthly bill to savings than additional spending.

As of now, the lack of guidance at this point is frustrating for borrowers and servicers alike, said Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group for federal student loan servicers.

“Constantly shifting the repayment date arbitrarily means servicers have been forced to ramp up and ramp down, creating confusion and wasting lots of resources,” Buchanan said.