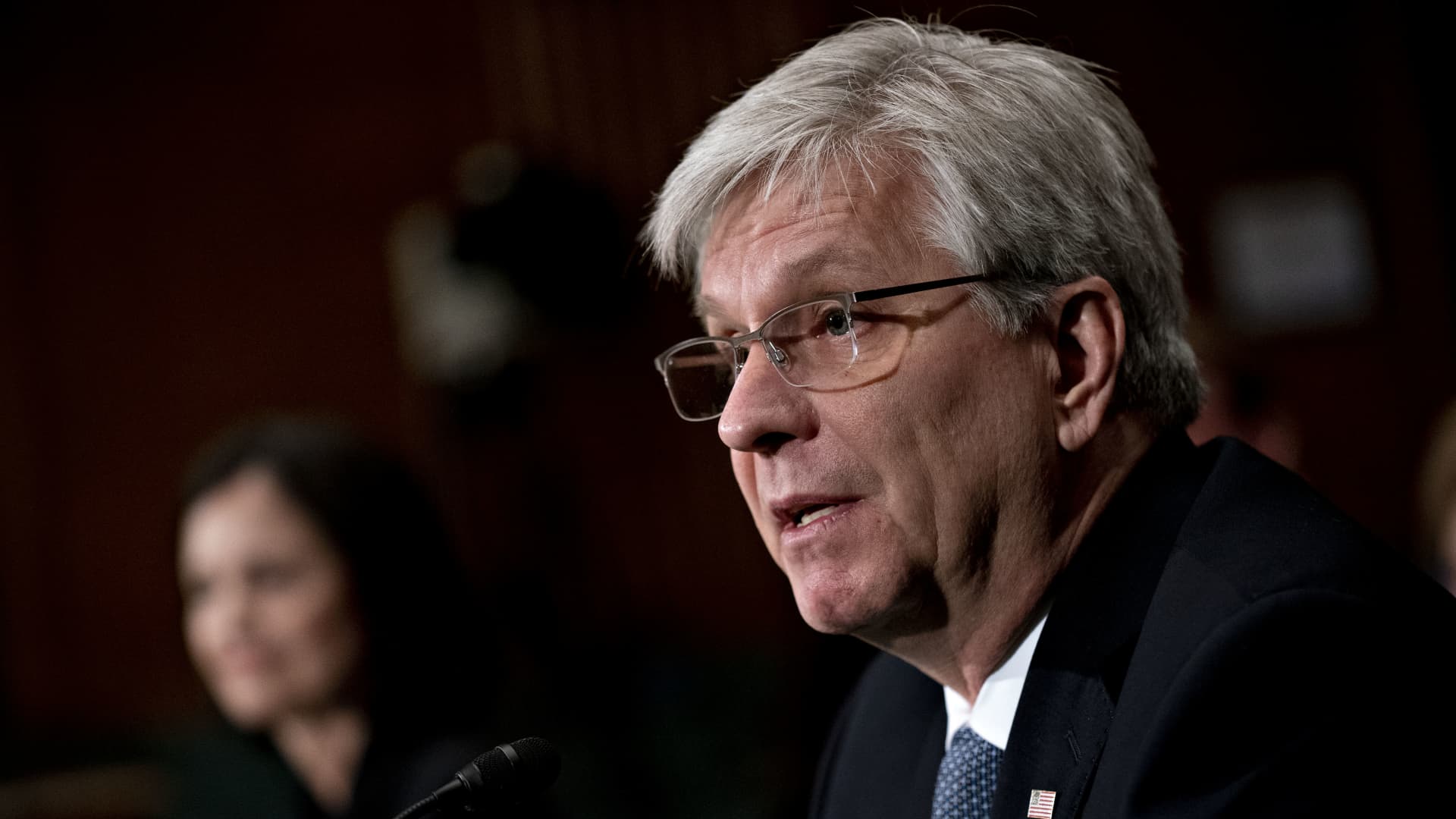

Federal Reserve Governor Christopher Waller told CNBC on Friday that the central bank may need to enact one or more 50-basis-point interest rate hikes this year to tame inflation.

Though he voted this week for just a 25-basis-point move due to uncertainty from the Russian invasion of Ukraine, Waller said he thinks the Fed may need to be more aggressive soon.

“I really favor front-loading our rate hikes, that we need to do more withdrawal of accommodation now if we want to have an impact on inflation later this year and next year,” he told CNBC’s Steve Liesman during a live “Squawk Box” interview. “So in that sense, the way to front-load it is to pull some rate hikes forward, which would imply 50 basis points at one or multiple meetings in the near future.”

In addition to the rate hikes, Waller said he thinks the Fed needs to start reducing its bond holdings soon.

The central bank balance sheet has ballooned to just over $9 trillion, and officials are preparing the process to start rolling off some of their holdings. Waller said that process should start “in the next meeting or two.”

“We’re in a different place than we were before,” he said. “We have a much bigger balance sheet, the economy’s in a much different position. Inflation is raging. So, we’re in a position where we could actually draw down a large amount of liquidity out of the system without really doing much damage.”

Waller’s comments came less than two hours after one of his colleagues, St. Louis Fed President James Bullard, said the Fed should raise rates in total at least 300 basis points this year. A basis point is 0.01 percentage point.

Bullard was one only policymaker this week to vote against the quarter-point increase, saying the Fed should have gone by half a point as part of a deliberate policy aimed at curbing inflation running at 40-year highs.

Prior to the meeting, Waller also had been pushing for a 50 basis point move, but said he had a change of heart for now.

“The data’s basically screaming at us to go 50, but the geopolitical events were telling you to go forward with caution,” he said. “So those two factors combined pushed me off of advocating for a 50-basis-point hike and supporting the 25-point hike that we enacted.”

The full Federal Open Market Committee also pointed to rate hikes that would push the benchmark fed funds rate, which banks charge each other for overnight lending, to 1.75% by year’s end.

Waller said he believes the Fed should shoot a little higher than that. He did not specify by how much but said he thinks the “neutral rate” that is neither stimulative nor restrictive is between 2%-2.25% and the Fed should “try to be above that by the end of the year.”

The rate hike approved this week was the Fed’s first in more than three years.