Check out the companies making headlines before the bell:

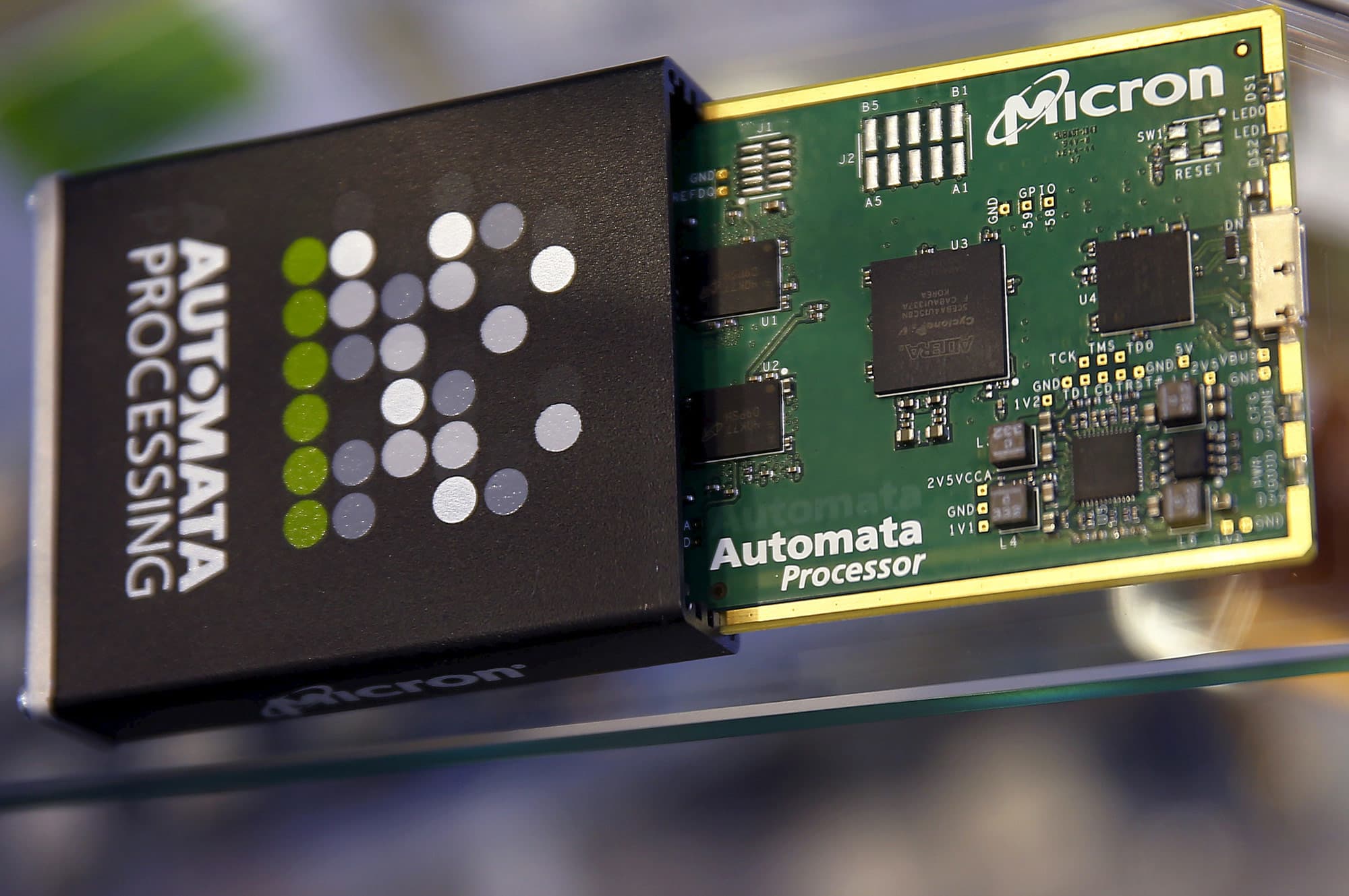

Micron Technology (MU) – Micron reported adjusted quarterly earnings of $2.42 per share, 9 cents above estimates, with the chip maker’s revenue also topping Street forecasts. However, its current-quarter forecast fell below consensus, due to computer-making customers facing shortages of other parts, and the stock fell 3.6% in the premarket.

Eli Lilly (LLY) – The drugmaker’s stock gained 2.2% in premarket trading after Citi upgraded it to “buy” from “neutral.” Citi points to valuation following a more than 15% drop in the share price, as well as its above-Street consensus earnings outlook for Lilly following a recent meeting with management.

Netflix (NFLX) – Netflix rose 1% in the premarket after announcing that it bought videogame maker Night School Studio in a move to diversify its revenue sources. Night School Studio is best known for the supernatural-themed video game “Oxenfree.”

Lucid Group (LCID) – Lucid plans to deliver its first electric luxury sedans in late October, after kicking off production at its Arizona factory on Tuesday. Lucid said its vehicles will have a greater driving range than comparable cars from rival Tesla (TSLA). The stock surged 7.3% in premarket trading.

Dollar Tree (DLTR) – Dollar Tree jumped 3.7% in the premarket after the discount retailer increased its share repurchase authorization by $1.05 billion to a total of $2.5 billion.

ASML (ASML) – ASML raised its annual sales outlook and the maker of semiconductor manufacturing equipment said it would see 11% annual growth through 2030 as demand for its products booms. The stock added 1% in the premarket.

AbbVie (ABBV) – AbbVie won FDA approval for its once-daily oral migraine treatment. The drug known as Qulipta was one of the treatments acquired in AbbVie’s $63 billion purchase of Allergan last year.

Sherwin-Williams (SHW) – Sherwin-Williams cut its third-quarter guidance with the paint maker pointing to raw-material shortages and higher input costs. It said it no longer expects to see improved supply or lower prices for raw materials during the fourth quarter as it had previously projected. Sherwin-Williams fell 2% in premarket action.

Affirm Holdings (AFRM) – The financial services company said it will offer a debit card as well as allow customers to execute cryptocurrency transactions directly from savings accounts. Affirm shares jumped 3.6% in the premarket.

Cal-Maine Foods (CALM) – Cal-Maine rallied 4.4% in premarket trading after it reported a smaller-than-expected loss for its latest quarter. The egg producer’s revenue topped Street forecasts as it benefited from higher egg prices.

Warby Parker (WRBY) – The eyewear maker debuts on Wall Street today, going public via a direct listing at a reference price of $40 per share. That gives the company an initial valuation of nearly $5 billion.