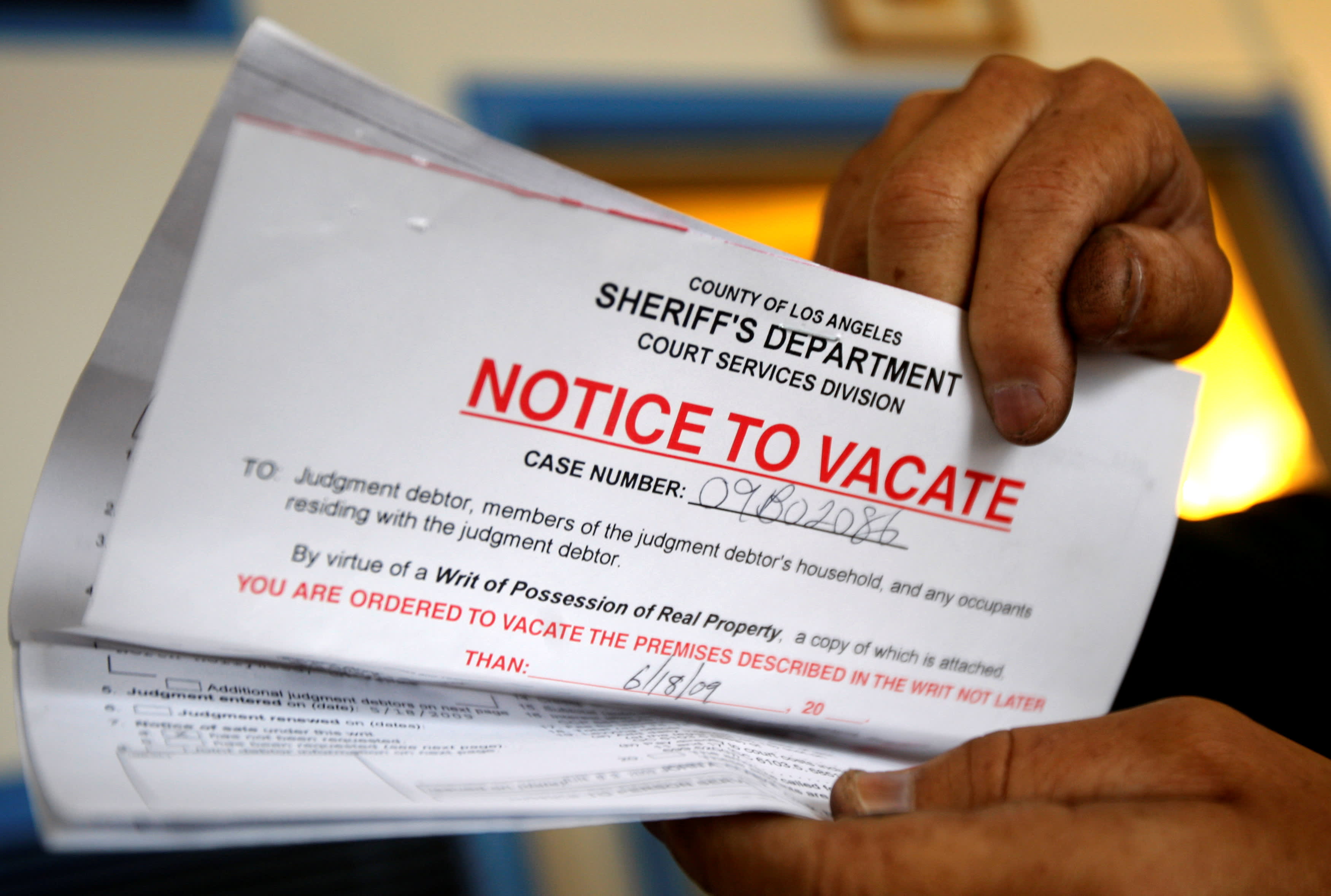

The Centers for Disease Control and Prevention on Tuesday released a new federal eviction moratorium, just days after the previous ban expired on July 31.

The new rules bought more time for some, but not all, of the millions of renters facing eviction. It’s also increased confusion for many in danger of losing housing.

Those who could be evicted when protections lift should consider what options they have now, in case they aren’t covered by the new rules, the current moratorium again lapses without Congressional action or it is overturned in court.

More from Invest in You:

10 work-from-home jobs that pay six figures

If you plan to quit, here’s what career experts say you should do

Has the 4-day workweek’s time come? Some predict it will catch on

“The worst thing that people can do is ignore [the problem],” said Caleb Kruckenberg, litigation counsel at the New Civil Liberties Alliance, a nonpartisan nonprofit based in Washington, D.C.

Here are some things to consider.

Make sure you’re covered by the new eviction ban

Under the current updated guidelines, renters in areas of the country that have “high” and “substantial” levels of coronavirus infections will be protected from eviction for an additional 60 days, through Oct. 3.

Some 80% to 90% of renters should be protected by the new rules.

Renters can check to see if they’re in such an area on the CDC’s website. Even if they are currently covered, it’s a good idea to continue to monitor coronavirus case levels in their area — renters will lose protection under the new moratorium if Covid-19 infections fall below a “high” or “substantial” level for 14 consecutive days.

Some 80% of counties in the U.S. currently fall under the new eviction ban guidelines.

Other parameters also apply. Renters must have an income less than $99,000 ($198,000 if filing taxes jointly) for 2020 or 2021, attest that they’ve experienced financial hardship due to the coronavirus pandemic and that being evicted would lead them to be homeless or having to move in with others.

Apply for rental assistance

People should also make sure that they have applied for all available government assistance for rent or housing, another stipulation of the eviction ban.

Congress has allocated more than $46 billion in emergency rental assistance, but so far very little of the money has gone out. Through the end of June, only $3 billion had reached eligible households, according to Treasury Department data.

Some of this may be because people aren’t sure how to apply for the help or are dealing with different bureaucracy depending on where they live, according to Kruckenberg.

Find your local legal aid program and go through their intake. They may be able to help you.John Pollockcoordinator of the National Coalition for a Civil Right to Counsel

“Unfortunately, it’s federal money and 50 different [state] solutions of how to get it to people, so there’s no streamlined process,” he said.

States have different rules and processes for giving out this money. For additional help, renters can utilize the Consumer Financial Protection Bureau’s tool that has a list of local programs. The National Low Income Housing Coalition also has a dashboard where people can search for all relief programs available in their area.

State eviction bans

Check to see if your state has a local eviction ban in place.

Many states, such as California, Hawaii, Illinois, New York and New Jersey, have banned evictions for those facing Covid-related hardships. In some cases, those local bans go for longer than the current federal moratorium.

State eviction bans may also cover those who aren’t living in an area with high enough Covid-19 case levels to qualify for the CDC’s moratorium.

Renters should make sure that they understand the rules in place in their state, as they differ from one another and the national guidelines. They should also check for different programs they may be eligible for at the city and county levels.

Talk to your landlord

If possible, renters worried about eviction could also communicate with their landlord.

While the CDC has blocked evictions, it has not waived any responsibility to pay rent. That means that people who have been unable to pay for the last year or more could end up owing large amounts in owed rent if they are evicted.

Renters could potentially make a deal with their landlord for repayment, said Kruckenberg.

“Call whoever you’re renting from and talk to them and see if you can work something out,” he said.

Even if your goal isn’t to strike a deal, keeping your landlord aware of your situation is a good idea, according to John Pollock, coordinator of the National Coalition for a Civil Right to Counsel.

“Being responsive, and being in touch with the landlord can be helpful,” he said.

Find a legal expert

The guidelines and rules for the new eviction moratorium, as well as the many different aid programs for renters, are confusing and complicated. Having a lawyer or other legal aid can be a huge help to those in danger of eviction.

And, there are free options available for many who may be struggling to cover basic expenses. One resource, LawHelp.org, lists free or low-cost options by state.

“Find your local legal aid program and go through their intake,” said Pollock. “They may be able to help you, and if they cannot help you, they will be the ones to know who else is in the area and might be able to provide you service.”

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How to make money with creative side hustles, from people who earn thousands on sites like Etsy and Twitch via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.