What is money? Why do we need it?

These are some of the big questions writer Frederick Kaufman explores in his book “The Money Plot: A History of Currency’s Power to Enchant, Control, and Manipulate,” which was published in the thick of the pandemic.

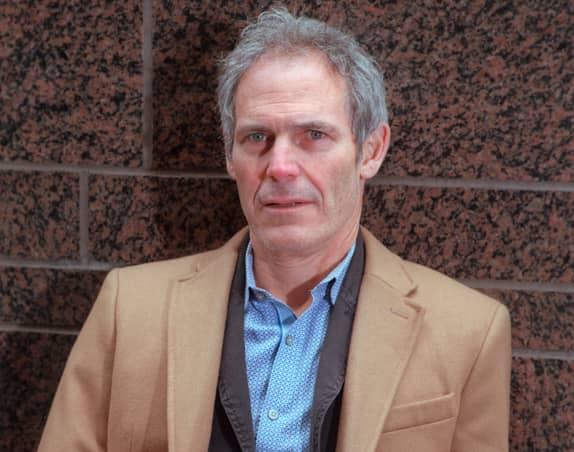

Kaufman, a journalism and English professor, is interested in what we project onto money, from our desires of abundance and freedom to — most of all — safety and security.

The book comes at a time when our most basic understandings of money are being challenged. (When I hear the word, I still picture cash, not bitcoin. What does one even picture when they picture bitcoin?)

One way to get an idea of what’s coming next is to look back. And in reading Kaufman’s book, which traces the history of money, you see how bitcoin is not all that different from the beads used as currency 40,000 years ago.

More from Personal Finance:

60,000 stimulus checks sent to dead people have been returned

Inflation-proof your spending by avoiding these purchases

54% of Americans support state cuts to unemployment

I recently interviewed Kaufman about his new book. (Disclosure: I was enrolled in one of his courses at the Craig Newmark Graduate School of Journalism at CUNY in 2017.)

The following exchange has been condensed and edited for clarity.

Annie Nova: What is the biggest way money has changed?

FK: Primitive money is very material: It’s a feather, it’s a bead. Over time, it becomes very metaphorical — a coin, paper money. And then finally, of course, there’s very little material money in the world. Only about 5% to 10% of money in the world is in any material form. And then one might say the end game is cryptocurrency. It has all the attributes of primitive money, it’s our security, except it has no material parallel.

AN: Why do we look to money for security?

FK: In the Middle Ages, the Christians start defining the future, and that’s going to be doomsday, and the apocalypse. Everything is counting down to that. This transforms commercial culture into this focus on expiration dates, and think about money: It’s all about expiration dates. It’s about when you get paid. It’s when your quarterly report is due. It’s all of retirement savings. And a mortgage, of course, is based on, when does it expire? We’re securitizing the future and gaining some control over it. That’s the essence of what money is.

AN: There’s a cost to this, however, right? A mortgage is security, but it’s also 30 years of payments.

FK: It’s one of the ironies of money. We create this fiction and then we become captive to it.

AN: Is it a coincidence that we’ve become so much more interested in cryptocurrencies during a pandemic?

FK: If you look back at the history of apocalyptic moments, people fly toward security. And that’s what money is. Some people see their security blanket as gold, some see it as crypto. Some see it as cash. We also see increased cash holdings during the pandemic. All this indicates the true essence of money: security, making sure we can continue in our status, making sure the narratives we have about ourselves can continue into the future.

Why are you using the money the way you’re using it? It’s because you’re defining a narrative of what you want to be in the future.Frederick Kaufman

AN: What happens when people’s stories get disrupted?

FK: If you really examine, why do you have a retirement account? Why are you working? Why are you using the money the way you’re using it? It’s because you’re defining a narrative of what you want to be in the future, and when that’s cut off because of a lack of money, that’s traumatic. And we’re seeing this country go through a tremendous period of trauma right now.

AN: What do cryptocurrencies have in common with the primitive forms of money you write about?

FK: Primitive money was more of a talisman than a store of value or a medium of exchange. The rings and beads had magical powers to bring the bearer safe into whatever lay ahead. Likewise, cryptos play the role of primitive amulets, particularly those that have no value whatsoever, like dogecoin, yet still promise to deliver good fortune. It’s interesting to add that when the Europeans first came to settle, they forgot to bring enough money. So, much like those who mine bitcoin, they started to manufacture their own wampum.

AN: Why do you think there’s so much skepticism about cryptocurrencies?

FK: Money is a story we all believe. Wall Street has been telling that story, and trying to predict how it ends before the rest of us know the ending. Of course the bankers will become uncomfortable when a new set of shamans and soothsayers tell a new story with a new ending.