Biden’s Fiscal Year 2022 Revenue Proposal aims to catch crypto tax evaders by reinforcing existing information reporting rules and information sharing agreements between jurisdictions.

What is Information Reporting?

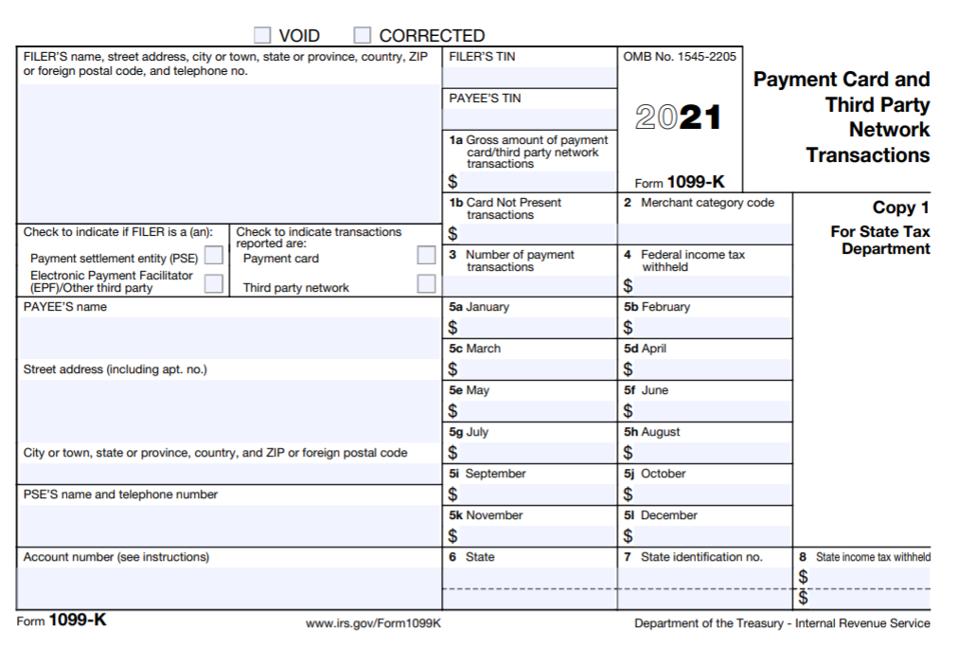

Information reporting is the primary way that regulators like the IRS knows about your crypto activity. Cryptocurrency exchanges are required by law to collect your personal identification information (name, address and social security number) and report your annual activity to the IRS by using forms such as 1099-K, 1099-B and 1099-MISC. If exchanges fail to report this information correctly, they get subject to hefty penalties.

Expanded 1099-K Reporting

Currently, crypto exchange users with $20,000 in gross volume and 200 transactions in a given year receive Form 1099-Ks. This form shows personal identification information and gross receipts by month.

The proposed guidance reduces the 1099-K reporting threshold to $600 and subjects more crypto exchange users to IRS oversight. It also expands the data reported on the Form 1099-K by including gross purchases, physical cash, payments to and from foreign accounts, and transfer inflows and outflows. If adopted, this new reporting system would be effective after December 31, 2022.

Reporting of Transactions Over $10,000

The proposal also recommends an additional reporting requirement when businesses receive cryptocurrency in excess of $10,000 in a transaction. For example, say you purchased a car using 1 bitcoin valued at $40,000. The proposed provision would require the dealership to report that transaction along with your personal identification information to the regulators. This provision is also applicable to cryptocurrency exchanges when users move assets in excess of $10,000 between exchanges.

Reinforced Communication Between Exchanges Globally

According to Biden’s proposal, cryptocurrency can easily be used for tax evasion because of its digital nature and the ability to trade, store and conceal them in offshore exchanges without ever having to leave the country. The US has already established information exchange relationships with foreign jurisdictions to share information about bad actors.

The proposal intends to strengthen these existing relationships by sharing more information automatically (global automatic exchange of information framework with respect to crypto assets) with foreign jurisdictions to catch bad actors. This system will uncover US individuals who hold crypto assets in offshore accounts under shell companies. If adopted, this will be effective after December 31, 2022.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.