Jonathan Curry of Tax Notes recaps the tax provisions of President Biden’s American Families Plan and discusses with Dean Zerbe of Alliantgroup LP the finer details and its likelihood of passing Congress.

This post has been edited for length and clarity.

David Stewart: Welcome to the podcast. I’m David Stewart, editor in chief of Tax Notes Today International. This week: Analyzing the American Families Plan. On April 28 the Biden administration revealed more details on its American Families Plan, the second part of President Biden’s Build Back Better Plan. We learned the new package would raise $1.5 trillion in revenue from wealthy taxpayers and investors to cover new support for families and workers.

What does this new plan reveal about the Biden administration’s plan for the tax code? How has America reacted? And what’s the likelihood that such a package can get through Congress? Here to talk more about this is Tax Notes White House reporter Jonathan Curry. Jonathan, welcome back to the podcast.

Jonathan Curry: Hey, Dave.

David Stewart: Can you start with an overview of the tax proposals included in the American Families Plan?

Jonathan Curry: Sure. At a high level, most of these proposals are aimed at wealthy taxpayers and investors. First he’s calling to raise the top individual tax rate back to 39.6 percent. If you recall back in 2017, Republicans lowered it from 39.6 percent to 37 percent, and now this is just reversing that. He also wants to raise the top tax rate for capital gains and dividends to 39.6 percent. That’s a pretty big change.

He also mentioned wanting to end the special tax treatment for carried interest. By raising the top tax rate on capital gains to 39.6 percent, that tax break would already effectively be taken care of. But by making the change in the law, this would be more of a permanent solution in case Congress wants to change rates in the future.

He also wants to limit the tax treatment for like-kind exchanges to gains under $500,000. He wants to make permanent the [Tax Cuts and Jobs Act]’s limit on excess business losses. Going down the list even further, he wants to ensure that the 3.8 percent net investment income tax is applied consistently, but only to those making more than $400,000. If you’ve heard that threshold mentioned a million times in the campaign, it’s popping up here back again.

He also wants to give the IRS a ton of money largely for enforcement to the tune of $80 billion over a decade. By comparison, the IRS budget is currently only about $12 billion a year, so this would be adding another $8 billion on top of that. He said the efforts would be focused on enforcement for high-income taxpayers primarily. He said that they would not be increasing audit rates if you’re earning under $400,000.

My personal favorite in this list, though, is he wants to eliminate stepped-up basis for gains that exceed a $1 million threshold. I’ve covered trusts, estates, and taxation of the wealthy, so this has always been kind of a hot topic. It’s not actually eliminating stepped-up basis because the basis of an asset would still be stepped up. It’s just that now when it’s stepped up, you have to pay taxes on the gain and the assets value. Again, that’s only above that $1 million threshold.

Clearly he has quite a few revenue raisers, but that’s not the only side of the tax plan. This package of proposals is called the American Families Plan for a reason. It’s not because he wants to raise taxes on the wealthy families. It’s because he wants to spend a lot of money on American families.

Part of that is through direct spending like hundreds of billions of dollars to pay for expanded universal pre-K, free community college, national paid family and medical leave program, and so on. But a large portion of this plan, about $800 billion in all, is about expanding tax credits for workers and families like the child tax credit and the earned income tax credit.

Earlier this year, the American Rescue Plan temporarily expanded the child tax credit as well as the dependent care credit, the EITC, and the Affordable Care Act premium tax credit. But those expansions were temporary. They would all be expiring by the end of this year. This plan would extend the child tax credit expansion through 2025 and make the refundability portion of it permanent. It would permanently extend the expanded EITC, dependent care credit, and the premium tax credit.

David Stewart: We’re currently talking about the American Families Plan, but we also have the American Jobs Plan, which came out a few weeks ago and we discussed in an earlier episode. How did these two plans differ?

Jonathan Curry: From a spending side, the American Jobs Plan is focused more on traditional infrastructure as well as environmental priorities. It’s offset through tax hikes on corporations. The American Families Plan is plainly more family-oriented, and this one is offset by tax increases on higher-income taxpayers.

David Stewart: What’s been the response to the American Families Plan from lawmakers, corporations, and the tax community at large?

Jonathan Curry: It varies depending on who you ask. If you were to talk to Republicans in Congress, they’re not really keen on any of the tax increases in either of Biden’s plans. From what I’ve heard they’re more in favor of user fee style pay-fors. If you think of infrastructure like roads and bridges, they’re looking more at a raise in the gas tax or a vehicle miles traveled tax. Something that where people who use the infrastructure are the ones that bear the cost of it.

We’ll also see a lot of interest groups rally around their pet causes. My colleague Kristen Parillo had a story about the reaction to effectively ending like-kind exchanges. Remember, Biden’s not proposing to completely eliminate those, but by imposing that $500,000 cap I’m told that those will put up a pretty hard cap on the market for those kinds of transactions. The response to that was pretty brutal from their perspective.

With the stepped-up basis proposal, for example, Biden has that $1 million threshold. But there are people who argue that they’re going to be taxpayers who you wouldn’t normally think of as being the rich who we’re going to kind of fall victim to this. I was talking to a lawyer in New York about a similar proposal to end stepped-up basis for those above a $1 million threshold.

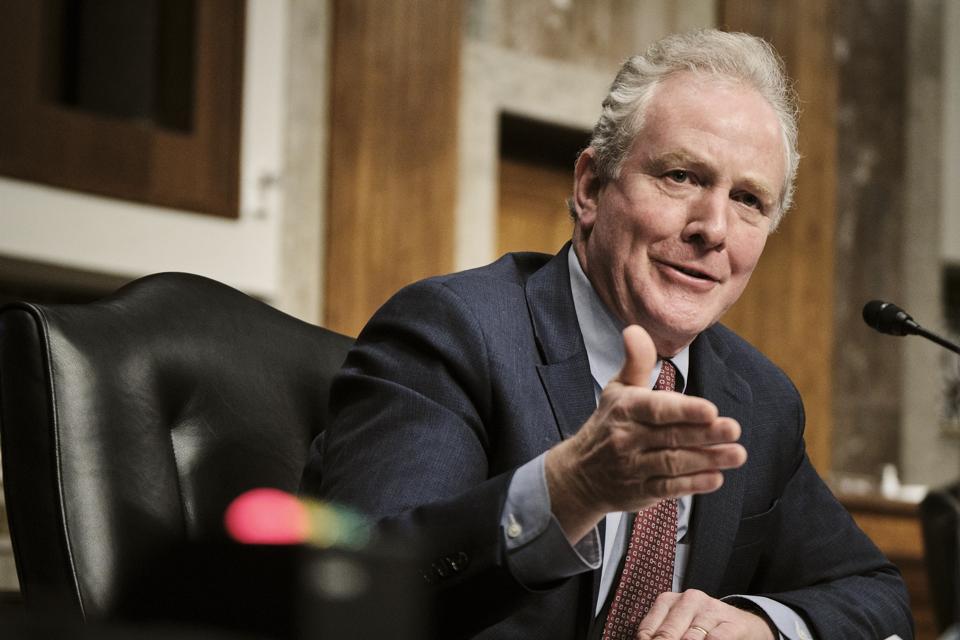

Sen. Chris Van Hollen, D-Md., from the Senate Budget Committee, had a proposal on this called the STEP Act. That proposal, similar to Biden’s, has that threshold. This lawyer who lives in Harlem was telling me that there are people that she knows who maybe had bought a house back in the 1950s for $50,000, one of those brownstones, and now it’s worth $3 million. There’s a huge gain there that suddenly they might have to pay taxes on, even though you wouldn’t normally think of them as being your typical wealthy family.

WASHINGTON, DC – APRIL 27: Sen. Chris Van Hollen (D-MD) questions Zalmay Khalilzad, special … [+]

Getty Images

We might see that old quote come to mind: “Don’t tax me, don’t tax thee; tax that man behind the tree.” You’ll see a lot of people sort of rallying to defend their cause and saying, “Well, not this one, but let’s try that one instead.”

David Stewart: What are the next steps for these two plans?

Jonathan Curry: The White House has said over and over that they’re open to hearing other folks’ ideas and how to pay for things. One thing I’ll note though: The American Rescue Plan Act earlier this year didn’t change a whole lot from what Biden proposed initially to what Congress ultimately passed.

But that package was seen as more of an emergency economic recovery package. These two new plans, the American Jobs Plan and the American Families Plan, are more perspective. They’re more of a policy wish list without as much urgency behind them. I wouldn’t be surprised if lawmakers see a lot of room to craft their own sort of alternatives to the plan. If that’s the case, this could really drag out for quite a few months.

I’ll also point out that while Biden has a lot of proposals here, they’re pretty high level. With the American Jobs Plan, the Treasury Department followed up a week later and released a several pages-long report on the corporate and international tax changes that he proposed. But even that didn’t give a lot of new detail. It just gave more of a policy justification for why they’re doing what they’re doing.

They might do something similar here with the American Families Plan tax changes on the wealthy, making the case in more detail for why Biden wants to do this. Even they don’t, I’ll be looking forward to seeing the White House budget proposal because we’ve been told Treasury is going to include its green book. That always is packed with details, filling in the gaps on what to actually expect. It’s not quite legislative language, but it gives you a much better sense of precisely what they want to do.

As for what comes next, I chatted more about this with Dean Zerbe. He’s a former tax counsel of the Senate Finance Committee and a national managing director at Alliantgroup.

David Stewart: All right. Let’s go to that interview.

Jonathan Curry: I’m now talking with Dean Zerbe. We’re going to talk a little bit more about Biden’s big plan. The American Families Plan has both revenue-raising and revenue-losing aspects to it. Do you expect much resistance in Congress to the tax credit expansions Biden is proposing?

Dean Zerbe: That’s a good question. I don’t think so. In general, Congress is pretty happy when they’re giving away the candy. That tends to not raise too many problems when you’re providing benefits and assistance. There might be a little bit of blinking about the overall number or bottom line about how much money is being spent, but that’s the big picture.

In terms of the specific proposals like the child tax credit, I don’t really expect there to be much pushback from the Democrats on that. It’s really going to be kind of a Democratic-only vote I believe out there.

On the revenue raisers, I think in general they’ll be supportive of them. I do think there’ll be some provisions that they’ll have to modify or get some pushback on as well. It’ll be little bit of a different journey on the revenue raisers. It’s always the problem that when you’re giving it away everyone’s happy and loves you, but when you’re taking it away, people start to get pretty unhappy and grumpy about it. We’ll see how it all unfolds.

Jonathan Curry: It sounds like the tax credits need a little refinement there, but there might be a little more challenge to the tax increases. Earlier in the podcast we went over some of the provisions in the plan. Which one of these do you think is going to face the most opposition in Congress?

Dean Zerbe: The capital gains proposal is probably the one that’s going to get a lot of grind. The increase to 39.6 percent will go through, but I think the capital gains is going to attract a lot of javelins from folks on it, particularly [if] they get it to the highest levels where it may be actually losing money and not be a revenue raiser. That will really grind it.

The sweet spot for them may be around 28 percent. That’s where you hit the tipping point of getting the rate up, but you’re still raising money as opposed to them losing money on it. Capital gains will be the one.

I think the close second is this question about stepped-up basis. That may also attract a fair amount of grind from members.

I anticipate that while they may invite the Republicans for tea and cookies, at the end of the day this is really going to be a Democratic-only boat. They’ll use reconciliation. They’ll need the 50 votes there. It’s a 50-57 House. That’s where they’re going to probably have to show some flex in terms of accommodating senators in terms of capital gains.

I think members will question, “What are we doing if it’s not raising monies?” For stepped-up basis, they will particularly try to accommodate small and medium business owners as well as family farms. To their credit, the administration has already noted that. But it’s easy to say it. It’s another thing to try to turn that into statutory fixes.

Jonathan Curry: You mentioned the stepped-up basis in capital gains. I wrote a story recently about how some think tanks scored Biden’s proposals or various aspects of it, including the capital gains.

As you noted, if you raise the capital gains rates up to 39.6 percent by itself, it’s actually scored as losing revenue because people don’t want to sell the gains. Those gains are never realized. But I’ve also seen that if that’s paired with something like ending stepped-up basis, then that changes the picture. All of a sudden it flips to being a pretty big revenue raiser.

If one of these fails, does that mean the other one falls as well? Or are these linked and interconnected in a way that they have to go together the package? Can it be divided up?

Dean Zerbe: That’s an interesting point about the relationship between the two. We’ll have to see what the Joint Committee on Taxation actually comes out with. They are the official scorekeepers. I get lots of people have their own magic eight ball that they want to use, but it’ll be up to the JCT on that.

I do think you’re right, though, that there would be some connectivity in terms of the question about the capital gains rates. I’m skeptical for the reasons you mentioned: that people will be wanting to control what they’re up to in terms of selling. Obviously people can’t control everything so that may limit what they’re up to.

It’ll still be the difficulty of trying to get the carveouts crafted for family farms, businesses, and small and medium business owners. One of the difficulties they face is that while people may have the vision right now of former Amazon CEO Jeff Bezos or somebody like that being involved, you’re going to be dealing with a lot of folks who are saying, “Look, this was a family business. I get it. I’m rich, but I’m rich one day in my life for this business or farm I built up for 40 years. Why is it I’m getting thumped?”

Blue Origin founder Jeff Bezos speaks after receiving the 2019 International Astronautical … [+]

AFP via Getty Images

They’ve recognized that, but trying to translate that into how you make that exception happen is not easy. When I was on the Senate Finance Committee, we struggled with that and they may find that equally challenging.

You’re right. There is some connection there. I do think though, that members may just feel that this is quite a hit that they’re putting on folks in terms of capital gains. It just remains to be seen.

This is a significant change from where we’ve been before. In other words, it’s one thing to raise ordinary income up or down a few points. That’s where folks have been, but this is a dramatic increase from where we’ve been for a long time. We haven’t heard anything yet from members on it, but they may really sharpen their pencils and think hard. Are they comfortable with how this is going to play out or work out? We’ll see.

It’s going to be one of the more challenging areas that they’ve got. I’m sure there is a relationship between the two provisions, but members will want to understand completely how they see this is going to impact businesses and investment.

Jonathan Curry: Another aspect of Biden’s plan on the revenue-raising side isn’t actually a proposal to the tax code per se. It’s about giving the IRS a pretty massive funding increase up to $80 billion. Do you think the IRS can use that money effectively to accomplish the goal of closing the tax gap and raising revenue through increased audits of high-income taxpayers?

Dean Zerbe: Yes. They proposed this big increase in the IRS’s budget and they’ve got big dreams of what they’re going to accomplish with that $700 billion in additional revenue over that period. I would say that is a pretty eye-blinking number in terms of where the IRS has historically been.

Let’s start with some basics. Does the IRS need additional resources? Yes. Do they need to improve their infrastructure, particularly in the IT area? Absolutely. Do we need a more marked enforcement presence particularly in certain sectors? Absolutely. All those are in agreement.

I think where there’s concern is to have a high comfort level that that’s going to translate into such a significant increase in dollars, and basically assume that or predict that. That’s going to be a challenge at the Congressional Budget Office and JCT. We’ll see it that way.

I’ve been through a lot of these and people always are promising sugar plums dancing in terms of revenues raised by various enforcement efforts. More often than not the dreams don’t meet the reality. Again that’s not to say we shouldn’t be doing these things, but to say, “Well, yes, this is going to be how we’re going to pay for these things.” There should be a lot of caution there.

In terms of your question about whether the IRS handle this, having a steady stream of set income over the years is important. That will help a lot. I think to immediately say, “Hey, here’s the money bags. We’re opening them at both ends and pouring them into the IRS.” That’s a pretty big challenge for the service to deal with. They can use some money immediately. Then it’s more the steadiness of the dollars over time are what’s going to matter.

Equally important is how they spend those funds. In other words, it can’t all be thumping. A lot of people in this country, the vast majority, do want to pay their taxes and comply. But the IRS also needs to provide in terms of service — getting their phones answered, getting their correspondence answered, having taxpayer assistance, and having the advocate there.

In other words, you need to balance the service part of the IRS with the enforcement. Both sides really need to be improved. You’ll get more compliance dollars coming in by doing both of those.

They need the funding. It’s good to get the commitment for that. Everyone needs to keep their feet on the ground of what’s possible in terms of revenues coming in. I think it’s quite ambitious for the administration to say this is going to pay for a lot of their hopes and dreams. There’s a lot of caution deserved in terms of what’s possible in terms of additional enforcement and service efforts by the IRS.

Jonathan Curry: That’s very interesting. I’ll note that there’s quite a few former IRS commissioners who have come out sort of as supportive the funding increase. But there’s also been a few, including former IRS Commissioner John Koskinen, who was quoted in a recent article by my colleague Bill Hoffman, questioning what they’re going to do with all that cash if it just suddenly shows up at once.

WASHINGTON, DC – APRIL 6: IRS Commissioner John Koskinen testifies before the Senate Finance … [+]

Getty Images

We’ve talked about what’s in the proposal, but there are also some noteworthy tax proposals that are missing from this plan. I’m a trust and estates guy, so the first thing missing to me was there was no direct changes to the estate tax. There’s also no repeal or modification to the section 199A deduction for passthroughs or the state and local tax deduction cap, which has been a big priority for some congressional Democrats.

Why do you think that is? Do you anticipate that those proposals are going to stay on the sidelines for long?

Dean Zerbe: You’re right. Those are certainly the big ones. Estate tax is kind of putting your hand in a raccoon sack. There’s members on both sides of the aisle. It’s a difficult area for them that again gets to the family farms to the small and medium business owners, and just in general it’s a very emotional issue.

Part of it is that the current estate tax regime ends in 2025. It may be a little bit of, “Why do we need to go through all this misery when it’s all going to go back to old law in 2025?” But I think they may still look at it.

If they were to look at say the top rates for very big estates, I think they could probably take that on without too much grind. I’m thinking really that the Democrats are going to be doing this, trying to get 50 votes to reconciliation. That’s something they might come back to, particularly maybe if they are having problems, getting all of what they want through the step-up in basis issue. That’s an area that I wouldn’t quite assume nothing’s going to happen just yet, but you’re right. It is interesting that they didn’t.

Section 199A is a very interesting provision and very important to small and medium business owners, particularly in the manufacturing space. It’s a difficult provision for the administration. They’ve made a lot of talk about wanting to encourage domestic manufacturing. It’s a little tough on the one hand to say, “Hey, we really want to encourage ‘Made in the USA’ and domestic manufacturing. But by the way, we want to get rid of this tax break that is for those folks that are doing domestic manufacturing.” It’s a challenge for them in that regard.

I don’t know if there’s a lot of hearts beating fast on the Hill to get rid of it. To be honest, I don’t know how much on the Hill they know about the proposal. I think they’re going to have a hearing that may touch on it and that may build it up. It’s still kind of in thinking part, not something that President Biden campaigned much on. That matters, too.

In other words, when I think of an administration coming in on their tax proposals, they’re strongest when they’re talking about provisions like, “Hey, I campaigned on this. I got the votes for this. It was very clear what I was.” That makes members say, “Well, OK. The president’s got a mandate. Let’s let’s at least look at this and see kind of why not?”

When it’s more of, “Well, we didn’t ever talk about this. We didn’t ever really mention it. But if you look at this footnote on page three, it refers to a study.” Then it feels pretty attenuated and members begin to think, “Well, maybe this isn’t really first on the list of things to do.”

The SALT deduction cap is a very tricky item for them because of all the rhetoric about taxes and taxes on the wealthy, because we’ve all seen it. The breakdown on who benefits from the SALT deduction skews to high-end folks in terms of the benefits.

Any kind of pull back on it has the difficulty of then the Democrats being seen as well, “Hey, that’s a big break for the very wealthiest” kind of deal. There are ways they could do it to provide some modest benefit for more middle-income families and then phase it out.

Now they’re a little bit in a difficult situation. As you know, there’s a number of members who came out on the Democratic side of the House that said, “No, we won’t go if we don’t get something on SALT.” I don’t think that they specified what that meant, which is helpful, but it’s going to be a challenge for House Speaker Nancy Pelosi, D-Calif., given she’s only got a five-seat majority to address that.

You’re right. It wasn’t out there. It’s going to be difficult for them. It’s a very expensive item, but again it’s something that goes away in 2025. There tends to be a view of, “Why are we spilling all this blood for a provision that’s going to be gone in just a bit.” But we’ll see. That’s going to be something that they’re going to have to address one way or the other in this bill. And that’s going to not make it a speedy bill on this.

It was impressive how quickly the administration got through the first reconciliation bill that they put forward, the spending relief package. But this package will be tied with the infrastructure package and it’s going to be a slower boat because of challenges like this of how to deal with certain provisions that are out there.

Jonathan Curry: Looking ahead then, how do you anticipate that these packages — the American Jobs Plan and the American Families Plan — moving through Congress? You mentioned a little bit that they’re going to be tied to infrastructure. Is this going to be one mega bill or do you anticipate it being split up?

Dean Zerbe: I’ve been looking at that and trying to shake my crystal ball as best I can on how they’re going to do that. The latest sense I get is that they are going to try to do this as one package.

I thought they might break it up. My impression now is they will do it as one package. That’s where really the Democrats are right now is looking at the overall bottom line of what they want. Even though you and I are talking about all these revenue raisers and things, they’re more focused right now on the bottom line. How big is this package going to be? $3.2 trillion? $2.5 trillion? That’s what they’re really having to talk to members about and see what their comfort level is.

My read is that they are looking at doing it all as one package. I think they’ll be able to do that. Again, it’s tight. We had to deal with it when I was in the Senate Finance Committee with a 50-50 setup for the Republicans. We did it. It’s not easy. You tend to pick up a lot of amendments. Every hour you’re on the floor it seems like another senator comes in and has another few billion dollars that they want to add here or there. But I think they’ll be able to do it.

I think their desire is to try to get it out the door by July. That is a very ambitious timeline. They’ve just really not even kind of gotten to the basic framework of “Yes, here’s how much dollars we want to have.” Much less down the road of, “Well, here’s the revenue raisers we want. Here’s what we’re up to.” So they’ve really not got the tax out and the hammers on that part of it. And that’s not going to be easy either.

I think July is pretty ambitious right now. Maybe they’ll feel that they’re beginning to see the end of days before they go for their August recess and then it would be looking to be done in September. There are scenarios I understand where they think it’ll unwind. These are kind of dreams of the Republicans that they’ll kind of put their foot in it. I don’t see that right now.

There’s a lot of agreement on a lot of things. There’s a lot of spending. We haven’t been talking about that, but there’s a lot of money to make people happy with out there. And a lot of things that on the Democratic side there’ll be fans of.

I expect there’ll be able to get a bill. I have to kind of rein back here and there on things that folks want. In some of these tax areas, the knife might get a little bit duller in terms of what they’re trying to do on the revenue raisers. I think they’ll have the general framework of what they’re trying to put forward in place.

Jonathan Curry: I think you made a good point noting Pelosi’s pretty ambitious timeline of trying to get this done by July, but you also said it could stretch out even further than that. Is there a point where this runs the risk of running out of steam and just falling apart potentially?

WASHINGTON, DC – APRIL 29: U.S. Speaker of the House Nancy Pelosi (D-CA) speaks during a news … [+]

Getty Images

Dean Zerbe: I understand the Speaker’s desire to go, go, go. We saw that ourselves. You’ve got these narrow windows to make things happen. I remember when former President George W. Bush got reelected there were ambitious plans on certain tax provisions and then Hurricane Katrina happened. That just took the wind out of the sails of doing all that. Everything was focused rightfully on Katrina and relief there.

Events take things over, and it’s always so difficult to predict or anticipate. There’s always something coming around the corner. I think they’re wise to try to move. There’s always something that could gum them up. It may be that people will start to get concerned about the dollars. You may have issues with the economy, but more practically if you’re not getting it done or feeling movement by the fall, you’re already beginning to get the specter of the next election cycle.

As listeners know, the Republicans feel the winds in their sail for that. Folks will start getting nervous about where they are with redistricting kicking in. I think the more you’ve got members still in the golden globe of the election results and saying, “You bet. Let’s do it. Let’s get going,” then all the better.

The more they’re saying, “Hey, who’s my opponent? Hey, what’s happening come this next November?” That’s going to get them more nervous about what they’re doing and be thinking more about concerns and issues that maybe aren’t as prevalent at this point where there’s still the feeling of, “Well, the president’s gotten elected. He has an agenda. I want to make that happen.”

I’m sure the Speaker doesn’t need any guidance from me, but the sooner, the better. If you’re starting to drift into later fall, that would not be where you’d want to be.

It affects another issue too, that we haven’t really touched on but I know matters so much to many of your listeners, which is effective dates. The more it moves into the fall, the more you’re looking at effective dates that would then bleed into the next year or maybe a blended rate on ordinary income. It just kind of becomes an administrative grind and it tends to be easier to just say, “We’re going to take this and start it all January 1.”

That’s something that’s a little bit in play as well, too. That’s something I would expect you’ll start to see when they lay down markers or what they’re proposing. They have to put down effective dates at that point because that’s the only way you can get a score. The first thing the JCT will ask is, “Well, what’s the effective date?” When you think about it, it makes common sense that you can’t score something if you don’t know when it’s effective. That will be another issue that’ll play into it.

Right now they’ve got a pretty good road ahead of them. It doesn’t immediately look like any roadblocks or problems, but better to get it out the door than to just meander and wander, if you will.

Jonathan Curry: Certainly. It’ll be very interesting to see how this all plays out.

Well, Dean, that does it on my end. Thank you so much for taking time to talk with us today. It’s been a pleasure, and we’ll be keeping an eye out to see how things play out.

Dean Zerbe: Thanks so much, Jonathan. Appreciate it.