Warren Buffett finally has an official successor at Berkshire Hathaway.

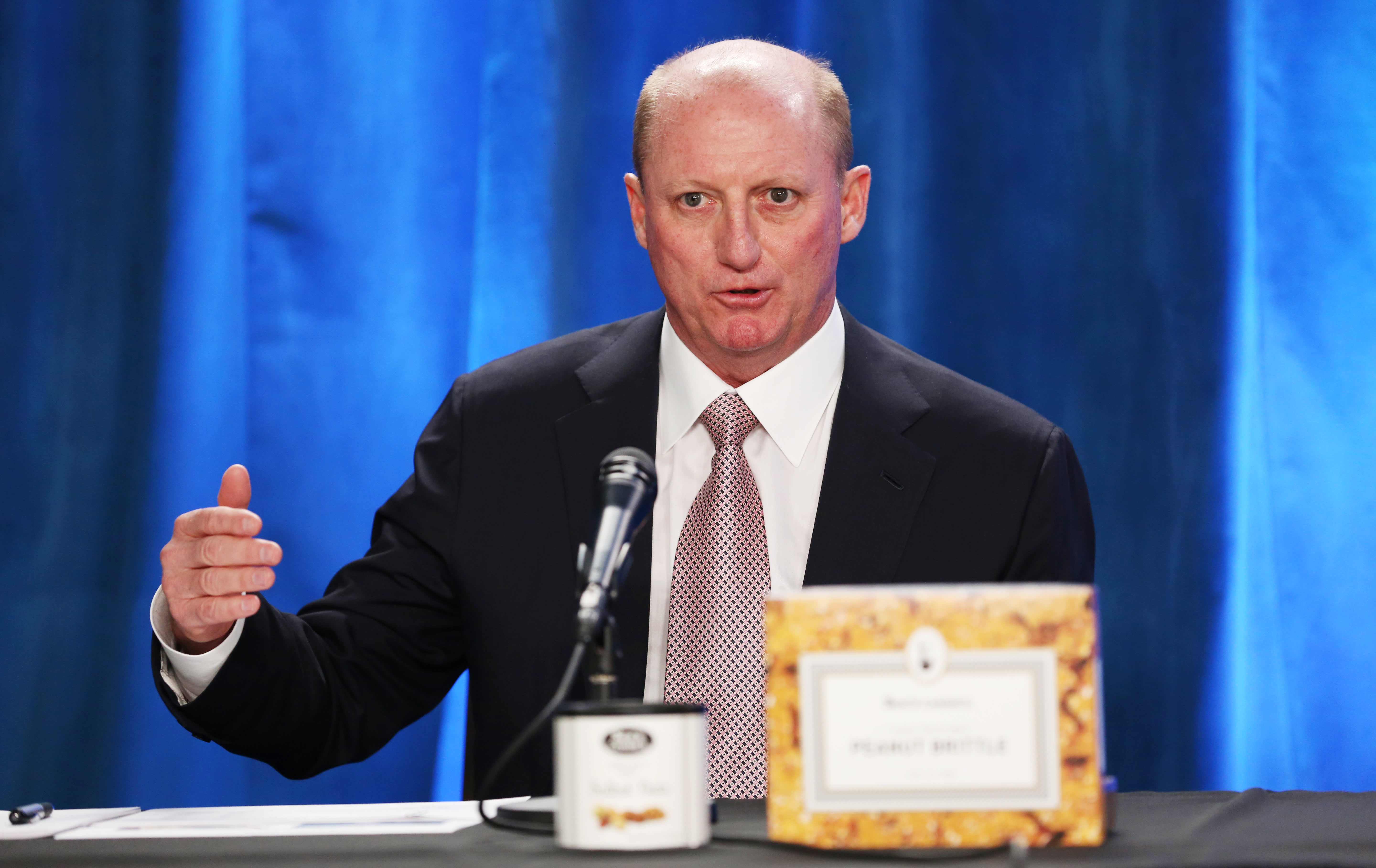

On Monday, the 90-year-old investing icon put to rest years of speculation over who would eventually take the reins from him at Berkshire when he confirmed that Gregory Abel, 59, currently a vice chairman of the $640 billion company, is next in line to be its CEO.

“The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning,” Buffett told CNBC on Monday.

So who is Greg Abel? Here are a few things to know about the person who is first in line to replace the Oracle of Omaha at Berkshire:

- Abel has been with Berkshire Hathaway for more than two decades, most recently overseeing the company’s energy holdings as the CEO of Berkshire Hathaway Energy.

- Abel was born in Edmonton, Canada, where he’s said he grew up in a working-class neighborhood with a salesman father. He grew up loving hockey (his uncle, Sid Abel, played over a dozen seasons with the Detroit Red Wings). “I remember getting together with other neighborhood kids as soon as we could after school,” Abel told the Horatio Alger Association in 2018. “We played hockey nearly every day in summer and winter and stayed out until we were called in for dinner.”

- Growing up, Abel made money through odd jobs, like delivering advertising flyers and filling fire extinguishers for the company where his father worked, Levitt Safety, according to The Globe and Mail.

- He graduated from the University of Alberta in 1984 with a degree in commerce and worked as an accountant after college, first for PricewaterhouseCoopers, and then with geothermal electricity company CalEnergy, which later became MidAmerican Energy. Abel told the University of Alberta publication New Trail that he became interested in accounting, “when I came to realize how critically important it was to understand things such as income and cash flow statements.”

- Abel first joined Berkshire Hathaway when the company acquired a controlling interest in MidAmerican in 1999, by which time Abel was energy company’s president. He became CEO of MidAmerican in 2008 and the company later changed its name to Berkshire Hathaway Energy (BHE).

- Abel first landed on Buffett’s radar in the mid-1990s, when he moved to the U.K. to handle CalEnergy’s takeover of a British utility. His handling of that matter reportedly impressed Walter Scott Jr., a shareholder in CalEnergy who also happens to be a childhood friend of Buffett’s and a member of Berkshire’s board of directors. Greg is the kind of person that, whenever he’s been asked to do something, he’s willing to go and do it,” Scott said of Abel in a 2011 interview with Fortune.

- Today, Abel serves as BHE’s CEO and chairman, overseeing Berkshire’s various energy holdings, which include subsidiaries focused on coal, natural gas, hydroelectric, wind, solar, geothermal, and nuclear energy. BHE has more than 23,800 employees in total, and the company reported more than $20.9 billion in revenue in 2020. Abel also serves on the board of directors for companies such as The Kraft Heinz Company (in which Berkshire owns a minority stake), insurance company AEGIS Insurance Services, and the Hockey Canada Foundation.

- While his salary at Berkshire Hathaway can vary from year to year, Abel made a base salary of $16 million in both 2019 and 2020, along with annual bonuses of $3 million each of those years, according to Berkshire’s SEC filings. In 2016, though, he received $41 million in compensation, thanks to a large incentive bonus he earned because Berkshire Hathaway Energy’s profits surged that year. (Buffett has said that he wanted his successor to be “somebody that’s … already very rich — which they should be if they’ve been working a long time — and really is not motivated by whether they have 10 times as much money than they and their families can need or a 100 times as much.”)

- Abel has been labeled “an astute dealmaker,” by The Wall Street Journal. ”I always make time for Greg when he calls, because he brings me great ideas and is truly innovative in his thinking and business approach,” Buffett said in 2013.

- Decades into his career, Abel has said he’s still passionate: “I want to have an impact. I want to roll up my sleeves and be actively engaged in making our company successful,” he told the Horatio Alger Association in 2018. ”I think hard work leads to good outcomes,” he said. “In my schooling, in sports, and in my business positions, I learned that if I put in a lot of work and was well-prepared, then success would be more likely.”

Abel had been seen as one possible successor for Buffett, along with Ajit Jain, 69, since both men had been promoted to vice chairman roles at Berkshire in 2018. However, both Buffett and his longtime friend and business partner, Vice Chairman Charlie Munger, had been reluctant to actually confirm who would eventually step in once Buffett retires.

Monday, Buffett told CNBC that Jain would be next in line after Abel, adding age was a factor in the company’s decision, as younger Abel would likely have more time at the reins of the company.

After promoting both Abel and Jain to their vice chairman roles, in 2018, Buffett lauded both executives. “They both have Berkshire in their blood. They love the company. They know their operations like the back of their hand,” Buffett said on CNBC at the time.

Meanwhile, Munger has also praised both Abel and Jain, calling them “proven performers” while adding in a shareholder letter that “in some important ways, each is a better business executive than Buffett.”

Check out: Meet the middle-aged millennial: Homeowner, debt-burdened and turning 40

Don’t miss:

3 investing lessons Warren Buffett shared at the 2021 Berkshire Hathaway meeting

Meet the 2 men who may succeed Warren Buffett at Berkshire Hathaway