Early last month, President Biden met with a group of prominent historians, seeking their guidance on how to build a transformative presidency.

Axios described the two-hour session as a “for-the-history-books marker of the think-big, go-big mentality that pervades his West Wing.”

Biden peppered his guests with questions about America’s most consequential presidents: George Washington, Abraham Lincoln, Lyndon Johnson, and the like.

But one president got special attention: Franklin D. Roosevelt. According to Axios, Biden began one comment to historian Doris Kearns Goodwin with a disingenuous but revealing disclaimer: “I’m no FDR, but . . .”

“But,” indeed.

Biden has repeatedly cited Roosevelt as an inspiration, emphasizing FDR’s vaunted pragmatism. “I’m kind of in a position that FDR was,” Biden told The New Yorker last summer, before immediately insisting that he wasn’t comparing himself to Roosevelt. “What, in fact, FDR did was not ideological; it was completely practical.”

If Biden wants to copy FDR’s practicality, he should take a lesson from the early New Deal: He shouldn’t raise taxes. At least not right away.

Practical Virtues

Biden is clearly hoping to emulate Roosevelt’s famously strong start: Inaugurated in the midst of a crisis, FDR responded with a cascade of proposals.

During the administration’s “First 100 Days,” Congress enacted almost all of them, bringing that catchphrase into common usage and establishing a speed record that has haunted every president since.

Biden is about three-fourths done with his own first 100 days, and he’s off to a decently brisk start, with one major legislative achievement and several more in the planning stages. Direct comparisons are impossible since different presidents grapple with different challenges; Roosevelt faced more dire economic conditions, for instance, while Biden is dealing with a global pandemic.

Still, if measured by ambition, Biden seems to be in the same ballpark as Roosevelt; both had plans for addressing not just immediate problems but also the structural flaws and persistent inequalities of American society. As Axios put it, they both had a “think-big, go-big mentality.”

Roosevelt, of course, had the wind at his back during his first 100 days, not least because he had an enormous majority in each congressional chamber. But he had something else, too: an exquisite sense of timing.

When Biden said FDR was practical rather than ideological, he meant that Roosevelt was focused on fixing the actual problems of actual people.

“How do we keep America from going totally in the tank and staying in the tank?” Biden asked by way of explanation. “And what he [Roosevelt] did was he focused on the things that would create jobs, and include more people, and generate more security, physical as well as personal security.”

Biden is right: FDR was relentlessly focused on policies that would improve the lives of struggling Americans. But his practicality also extended to the politics of getting his program through Congress. He was a master tactician with a keen sense of political timing. And that’s something that Biden understands, too.

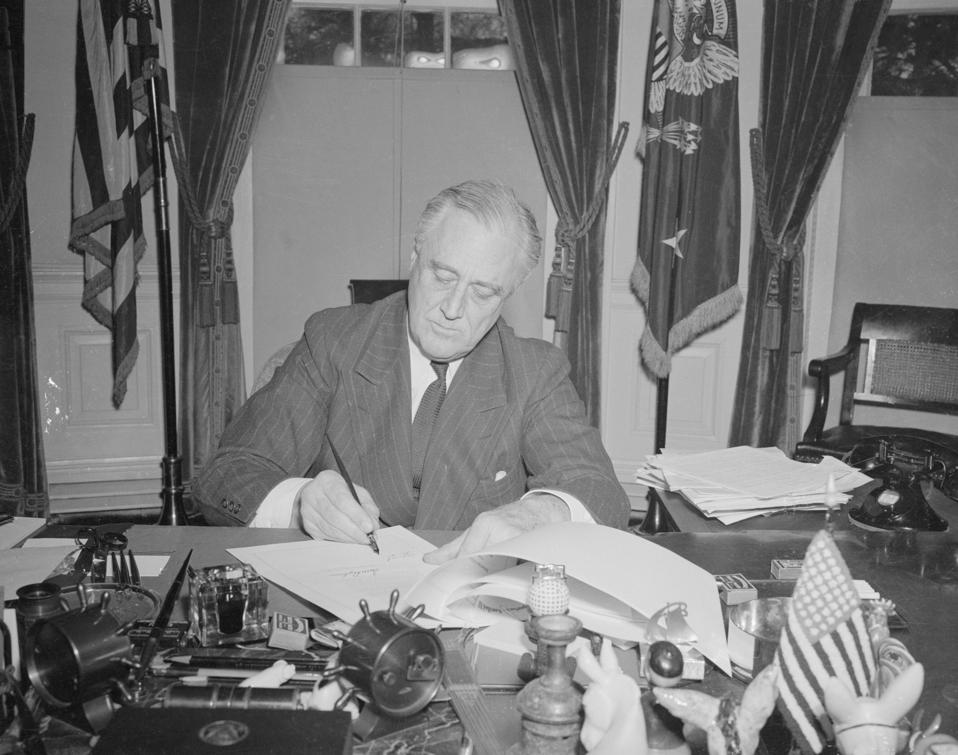

(Original Caption) Washington, DC.: President Franklin D. Roosevelt is shown signing the historic … [+]

Bettmann Archive

“Successful presidents — better than me — have been successful, in large part, because they know how to time what they’re doing,” Biden said during his March 25 press conference. “Order it, decide, and prioritize what needs to be done.”

As Biden organizes the rest of his first-term agenda, he might pause to consider one of Roosevelt’s most important decisions about timing and priorities: During his first two years as president, FDR ignored tax policy. He proposed no significant tax increases of any kind.

No New Taxes

We remember FDR as one of the great taxers of American history, and the reputation was well earned. Roosevelt is famous for his successful efforts to raise income and estate taxes in the mid-1930s, especially as part of the Wealth Tax Act of 1935. And during World War II, he pushed upper-bracket statutory rates north of 90%.

He was also a great closer of loopholes, inveighing against tax avoidance by wealthy taxpayers. His most famous antiavoidance campaign came in 1937 when he tried to stage manage the public shaming of specific taxpayers, many of whom were eventually hauled before Congress.

But he also defended at least some of his corporate tax reforms, including the Undistributed Profits Tax of 1936, as efforts to crack down on tax avoidance by wealthy stockholders who were using corporations to shield their income from taxation at the individual level.

For all his efforts to “soak the rich” (as his enemies described his agenda), FDR also presided over a range of less progressive taxes. In some cases, he merely tolerated their existence, despite the urging of his own economists that they be scaled back.

That was the case with excise taxes on many consumer goods, especially on alcohol and tobacco; fiscal experts decried their regressivity, but FDR tolerated them to keep deficits under some semblance of control.

But Roosevelt also engineered a large tax increase on middle- and low-income Americans during World War II when he endorsed drastically lower exemptions for the individual income tax; once paid only by the rich, the levy became a burden for almost every working American by the end of the war.

Even more important, at least over the long run, Roosevelt insisted on using payroll taxes to finance Social Security — a politically brilliant but economically controversial decision with enormous importance for the long-run shape of U.S. public finance.

Roosevelt, in other words, richly deserves his reputation as the greatest taxer of 20th-century America. But — and this is crucial — he did not begin his presidency by raising taxes. In fact, he more or less ignored tax policy during his first two years in office.

To be clear, other politicians were not ignoring tax policy. Two of the New Deal’s signature laws included tax provisions.

The taxes imposed by the National Industrial Recovery Act and the Agricultural Adjustment Act were not incidental to either measure — indeed, the latter’s processing tax would figure prominently in the Supreme Court’s invalidation of the act two years after its enactment.

But the taxes were minor components of the broader federal revenue system. More to the point, Roosevelt took no interest or active role in shaping them.

Meanwhile, throughout 1933 and 1934, Congress was exploring ways to crack down on tax avoidance. The famous hearings conducted by Ferdinand Pecora on the origins of the Wall Street crash had thrown the spotlight on taxes paid — and not paid — by investors like J.P. Morgan Jr. Congress responded to the resulting public uproar with an investigation of tax avoidance techniques then in widespread use.

Treasury offered its assistance and technical commentary during that investigation, as well as the subsequent effort to draft legislation in 1934. But Roosevelt declined to elevate the issue publicly. He offered general support but no vigorous statement endorsing the measure.

He also instructed his new Treasury secretary, Henry Morgenthau Jr., to avoid making significant recommendations for the bill taking shape in the House Ways and Means Committee.

Federal Government Political System

getty

Roosevelt had simply decided to hold his fire. It wasn’t that he didn’t care about taxes — he just wasn’t ready to tackle the issue.

He was aware that aspects of the Ways and Means Committee bill, including a drive to limit the deductibility of business losses, would prove deeply unpopular in the business community. He saw no reason to antagonize business leaders more than necessary — not when he was seeking their cooperation with other elements of his economic reform program, such as the National Industrial Recovery Act.

Roosevelt was, however, already planning a future drive for tax reform. He understood that the time for tax was fast approaching — as fast as the next election.

Even as Morgenthau was following FDR’s instructions and keeping his mouth shut on Capitol Hill, he was hiring a team of tax economists and asking them to develop plans for sweeping progressive reform.

At the same time, Treasury lawyers working for the department’s chief counsel, Herman Oliphant, were conducting their own studies of upper-income tax avoidance; that research would prove central to the department’s planning for the tax legislation unveiled the following year and later included in the 1935 Wealth Tax Act.

For the time being, however, Roosevelt let Congress dominate the making of tax policy. He made no major proposals and suggested no significant increase in federal revenues. This alone was surprising, given the state of federal finances.

To some extent, Congress and President Herbert Hoover had given Roosevelt some breathing room, having passed a major tax hike in 1932. But deficits were soaring in the early years of the Depression.

In fiscal 1930 the country had been running a surplus equal to 0.8% of GDP. By the following year, the surplus had become a deficit of 0.5%. In 1932 the deficit was 4%; in 1933 it was 4.5%; and in 1934, 5.8%.

Those numbers were ample justification for a tax increase, but Roosevelt was unmoved. He knew that tax hikes created enemies. And Roosevelt didn’t need more enemies — at least not yet.

Roosevelt’s decision to put taxes on the back burner worked well for him. He managed to get most of his New Deal priorities enacted quickly.

And when the time came to pivot to tax, in mid-1935, he got those reforms enacted quickly, too. As a matter of economics, his delay also meant that he avoided imposing a major tax increase in the midst of an economic slump (as orthodox economists of the day would have preferred). This “success” may have been more inadvertent than intentional, but it was fortuitous nonetheless.

And when Roosevelt needed an issue for the 1936 campaign, his soak-the-rich tax platform fit the bill nicely. His political timing, as always, proved flawless.

Biden’s Tax Increases

There may be good reasons why Biden may choose to ignore Roosevelt’s lesson about the wisdom of delaying tax increases early in a transformative presidency.

Biden, for instance, may be genuinely worried about deficits, presumably because of their inflationary effect. That seems plausible, if a little hard to reconcile with the scale of the spending programs being discussed by his administration.

In general, the White House seems sanguine about the economy’s ability to tolerate deficits without succumbing to inflationary pressures, at least over the short term.

US President Joe Biden speaks in Pittsburgh, Pennsylvania, on March 31, 2021. – President Biden will … [+]

AFP via Getty Images

Biden might also want to raise taxes, especially on wealthy individuals and corporations, in response to pressure from his left.

In a recent piece for The Washington Post, Katrina vanden Heuvel rejected the notion that progressives should feel any obligation to pay for new spending programs. She suggested, however, that taxes on wealthy individuals and corporations can have ancillary benefits that extend beyond the actual revenue collected:

While progressives rightly object to the double standard that Democratic programs have to be paid for while Republican tax cuts do not, these tax increases do begin to redress our dangerously extreme inequality.

Sen. Elizabeth Warren, D-Mass., is championing a small wealth tax on the super-rich. House progressives have backed higher tax rates for corporations that have extreme disparity between CEO and average worker wages.

Biden’s tax program may reflect this kind of thinking — and by extension the rising power of progressives within the Democratic Party. Biden seems unlikely to pursue many of the most cherished proposals advanced by progressives, including a wealth tax.

But a strong drive for progressive tax reform could be a practical necessity for a president in today’s Democratic Party.

Conversely, tax increases might also be helpful on the other side of the Democrats’ broad ideological spectrum, where fiscal responsibility (or at least the appearance of it) can be a valuable asset. With Sen. Joe Manchin III, D-W.Va., insisting on a paid-for infrastructure bill, tax hikes could be a necessary part of the package.

Still, the short-run prospects for Biden’s tax priorities — including corporate rate increases, a global minimum tax on profits from foreign subsidiaries, new taxes on capital gains, and increases in the top rate on individual income — all seem dubious. Some may survive. Indeed, some may prove necessary in the difficult struggle for votes that will mark the next stage of Biden’s first 100-plus days.

But Roosevelt’s lesson remains a powerful one: Reform is possible without revenue — especially in an era when deficit worries seem to have receded dramatically.