Biden is proposing to increase the highest long-term capital gains tax rate from 20% to 39.6% for those who make over 1 million dollars of income. This tax hike would negatively impact crypto whales who are sitting on large amounts of unrealized gains.

How Are Cryptocurrency Capital Gains Taxed Currently?

Capital gains tax is the tax you pay when disposing capital assets like cryptocurrency and stocks. The tax rate is applied to the profits made (the difference between the sales price and how much you paid for the coin) when cashing out and/or exchanging one cryptocurrency to another.

Short-term capital gains occur when you sell a coin after holding it for less than 12 months. These gains are taxed as regular income and the marginal tax rate ranges from 10% to 37%.

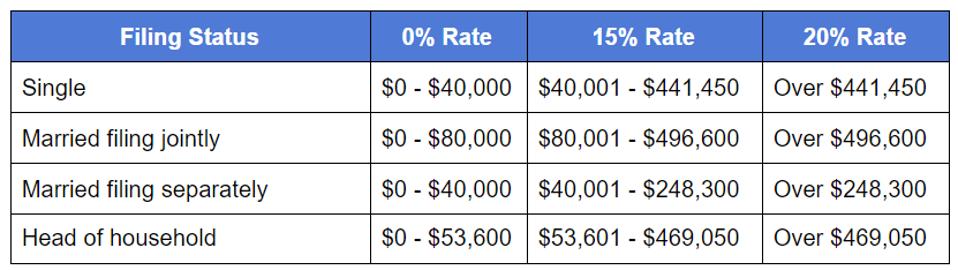

Long-term capital gains occur when you sell a coin after holding it for more than 12 months. These gains are taxed at either, 0%, 15% or at the highest 20% rate depending on your filing status and income level.

2020 Long-term Capital Gains Tax Rates

IRS

Biden’s Proposal

Biden is proposing to increase the highest long-term capital gains tax rate from 20% to 39.6% for those making over 1 million. Although the tax rate doubling seems alarming, it might not have a widespread impact. In 2018, about 153 million taxpayers filed tax returns with the IRS. Among them, only about 540,000 reported an adjusted income over a million dollars, representing less than 1% of US taxpayers. If the bill were to pass, this small segment of taxpayers would incur a significantly higher tax bill for long-term capital gains. This small segment of high-income taxpayers may also include crypto hodlers sitting on large unrealized long-term gains wanting to cash out those positions before the higher tax rate kicks in. Therefore, we may see large sell-offs by crypto hodlers before the new rules come into effect (perhaps followed by re-purchases at a higher cost basis).

Biden’s policy also increases the highest ordinary income tax rate from 37% to 39.6%. This means that individuals earning wages in cryptocurrency, generating ordinary income from crypto mining, staking, or short-term capital gains, and making over approximately $500,000 of annual income, would see a slight increase in taxes.

It should be noted that the specifics around how the 1 million dollar threshold is applied and the effective date of the new rules are still unknown.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.