New Stimulus Payment

The third round of Economic Impact Payments (EIP3), stimulus money for individuals — even retirees — was authorized as part of the American Rescue Plan Act of 2021 that was signed into law March 11, 2021. Payments are already arriving in bank accounts and mailboxes throughout the U.S.

In order for EIP3 to reach you (if it hasn’t already), the IRS relies on 2019 or 2020 tax returns filed or on benefit records, such as Social Security retirement, survivor or disability benefits, Railroad Retirement benefits, Supplemental Security Income or Veterans Affairs benefits. If you fall into any of these categories, you will receive your EIP3 payment automatically (as long as you are eligible — see below). And, in fact, you may have already seen a payment of $1,400 deposited into your bank account — or more, if you are married or have dependents.

In addition, those who registered for the first EIP (EIP1) using the Non-Filers tool on IRS.com in 2020 do not need to take action.

Notwithstanding, you need to know that as of March 24, approximately 127 million EIP3 payments had been distributed. If you have not received yours, take a moment to check the status of your payment by using the “Get My Payment” tool found on IRS.gov.

Who Needs to Act to Get The Stimulus Payment?

If you don’t fall into any of the categories we just discussed above, you do have to take action. To get your EIP, file a 2020 Form 1040 tax return even if you have no taxable income.

If you want to the tax filing electronically, which I recommend to benefit from efficiency and speed, be sure to read the IRS special instructions. For example, the electronic filing will ask for your 2019 AGI (more on AGI — adjusted gross income — below). What if you did not file a 2019 tax return, or your 2019 return has not been processed yet? Special IRS instructions note that you should enter $0 for your prior year’s AGI. There is also the Recovery Rebate Credit, which I will write about in a subsequent post.

No Social Security Number?

Some people are not able to get Social Security numbers. In order to file their taxes, they obtain an ITIN (Individual Taxpayer Identification Number).

The IRS issues ITINs to “individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration.”

Does a taxpayer who does not have a Social Security number get an EIP3? In most cases, the answer is “no,” but there are some exceptions.

The American Rescue Plan Act requires a “valid identification number” to qualify for EIP3. The act defines that term as a Social Security number issued by the Social Security Administration.

As for the exceptions, an adopted dependent can use an adopted taxpayer identification number instead of a Social Security number. For those members of the U.S. armed forces who are married, only one spouse needs to have a Social Security number. And if a couple files a joint tax return, a spouse who has a Social Security number will receive a $1,400 (instead of $2,800) payment if the other spouse does not have a Social Security number and is not eligible for a payment.

AGI Caps

Another eligibility factor for an EIP3 payment is related to your AGI. If you are single, your AGI cannot be higher than $80,000, while those who are married filing jointly cannot surpass $160,000. If you are filing as head of household, the cutoff is $120,000. AGI is your gross income less adjustments, such as contributions to retirement accounts. Also see “Definition of Adjusted Gross Income.” Even if your AGI was too high in 2020 to qualify for an EIP3 payment, you might be eligible for rebate credits on your 2021 tax return if your AGI declines this year, points out Wall Street Journal writer, Laura Saunders.

Payment Details

If your EIP is coming to you by mail instead of through direct deposit to your bank account, you will receive a paper check or a prepaid debit card (Economic Impact Payment Card, or EIP Card).

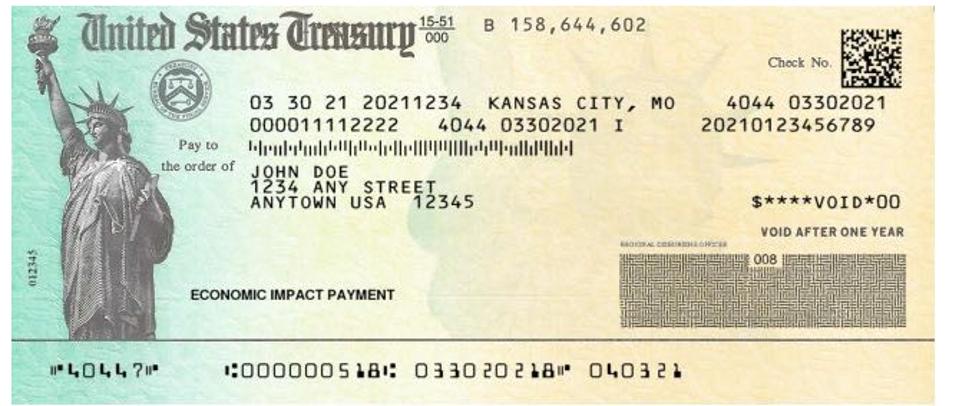

Paper checks will arrive in a white envelope from the U.S. Department of the Treasury. The check (see the image below) will look similar to a tax refund that arrives by mail, but it will have “Economic Impact Payment” in the memo field.

Economic Impact Payment check.

IRS

Is This Card Legit?

In this day and age, you never know if a credit/debit card you receive unannounced is legitimate. The envelope will look like this, a white envelope that has a U.S. Department of the Treasury seal:

Economic Impact Payment Card envelope.

IRS

The EIP Card inside will look like this:

Economic Impact Payment Card.

IRS

The Visa debit card will have the name MetaBank (the issuing bank) on the back.

You’ll need to activate the card before you can use it to make purchases or to receive cash from your bank’s ATM or make a deposit into your bank account. (Instructions can be found in the envelope.) You can check your card balance online, by phone (800-240-8100) or through a mobile app (the Money Network Mobile App, found at the App Store or on Google Play). You can get more information at EIPcard.com.

Rebate Credit

My next post will cover the recovery rebate credit. In the meantime, if you have questions or comments about any retirement/investment topic, send them to me at forbes@juliejason.com. Please indicate that you are a forbes.com reader as well as the state you live in.