More and more wealthy art collectors are cashing in on low interest rates to borrow against their Picassos and Basquiats, adding to risks of a leveraged boom and bust in the art market.

The Fine Art Group, an art advisory and finance firm, said loan requests surged by 30% in 2020 compared with 2019 as collectors sought to borrow against their collections to invest in more art or other businesses. Bank of America, a leading art lender, saw its art loan business surge 30% last year, while JPMorgan and Goldman Sachs also saw strong growth, according to industry executives.

“A lot of our clients are entrepreneurs, and they use leverage across their businesses and personally,” said Freya Stewart, CEO of art finance at The Fine Art Group. “They have a lot of valuable capital tied up in their art collections and they want to release that capital for other uses.”

While the big banks dominate art lending because of lower rates, art finance firms and auction houses are increasingly expanding their loan business to attract more clients.

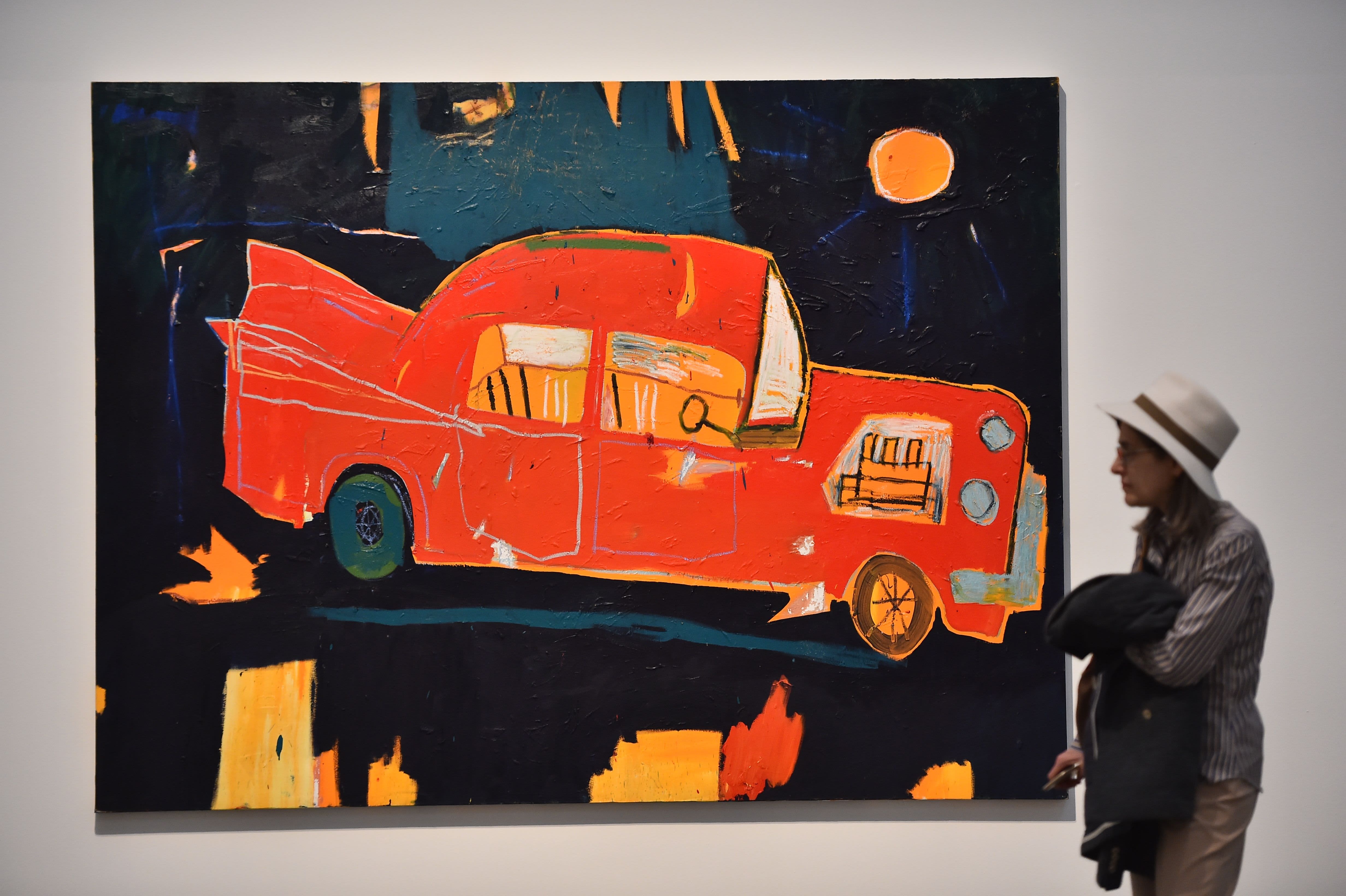

A woman visits the exhibition “Jean-Michel Basquiat”, a retrospective on Jean-Michel Basquiats career from graffiti in New York to more complex work, on October 27, 2016 at the Mudec Museum in Milan.

Giuseppe Cacace | AFP | Getty Images

Banks typically charge 2% to 5% on art loans, depending on the client’s other assets and businesses, while art lending firms and auction houses often charge 6% to 9%. The term of an art-backed loan is typically a year, and owners can usually borrow as much as half of the appraised value of an artwork. This means an owner of a $10 million work by Pablo Picasso, for instance, could typically get a loan for as much as $5 million.

A $400 billion market

Sotheby’s is making the biggest push among non-banks. The auction house recently formed a partnership with former hedge fund manager Alex Klabin to grow its lending business and develop alternative financing structures.

Klabin is now executive chairman of the auction house’s financial arm, Sotheby’s Financial Services. Previously, he co-founded Blackstone Group-backed Senator Investment Group, parting ways with the multibillion dollar hedge fund about a year ago.

The value of privately held art is more than $2 trillion, Klabin said, yet the art lending business is valued at only about $20 billion. He estimates the potential market for art loans could easily top $400 billion.

“We think there is a tremendous growth opportunity ahead of us,” Klabin said.

Sotheby’s CEO Charles Stewart said the rise of younger collectors, who tend to see art as more of a shorter-term asset, is also driving the growth in art loans.

“It’s not the same mindset as, ‘you’re going to own something forever,’ ” Stewart said. “There’s a view that you buy something, and then when you want something else or are done with it, you sell it and reoffer it. Things take on more of an investment mindset. So that creates opportunity for some of these financial services.”

Reselling art loans

Lenders say the big opportunity — and the new risk — is in the business of reselling art loans to investors.

Yieldstreet, an online investing platform, just added an $11 million junior loan participation to its Diversified Art Fund 1, which pools together art loans backed by Andy Warhol, Roy Lichtenstein and other top artists. The fund, driven by analytics from the company’s Athena Art Finance unit, has sold nearly $40 million in loans to investors, with a targeted net return of 9.5%.

Cynthia Sachs, managing director at Yieldstreet and the CEO of Athena Art Finance, said the company is considering launching a second art fund as demand grows from borrowers and investors.

“We are really creating a credit market around art,” Sachs said. “People talk about art as an asset class. But you can’t have an asset class without a credit market.”

Sotheby’s said it’s still in the early stages of its expansion. But industry experts expect the auction house could also launch its own fund or securitization structure, packaging art loans as an investment opportunity for other clients or outside investors.

“We’re going to look at all kinds of ways of lowering our costs of capital and building out a sophisticated funding framework,” Klabin said.

A notoriously fickle market

The question is whether investors are fully aware of the risks of using art — a notoriously illiquid, opaque and fickle market — as loan collateral and an investment product. Artists who can be hot one year can flop the next. Borrowers, no matter how wealthy they are perceived to be, can have their own blow-ups.

Honoree and Capital Limited CEO Mr. Jho Low attends Angel Ball 2014 at Cipriani Wall Street on October 20, 2014 in New York City.

J. Countess | Getty Images

Sotheby’s famously lent about $100 million to Jho Low, a Malaysian businessman-turned-fugitive who agreed to forfeit $700 million in assets following accusations that he helped mastermind a multibillion-dollar fraud from Malaysian sovereign wealth fund 1MDB. The loan was repaid, thanks in part to a strong market for the art works that Sotheby’s held as collateral.

Sotheby’s says its expertise in art valuations and its deep knowledge about its clients reduce any risks of defaults on art loans.

“We really do think we have an actual edge because we are so attuned to both the auction and private market here in a way that really nobody else is,” Stewart said. “If at some point there is the need to add additional collateral or to sell something, we know how to do that quickly, effectively.”

Yieldstreet’s Sachs added that since the loans are only for half the value of a work of art, or even less, there is a “huge cushion” in the event of defaults. The fund also lends against works by artists that are easiest to sell.

“We focus on the most liquid, least volatile part of the market,” Sachs said. “We structure the deals with all those risks in mind.”