Beneficial owners of small LLCs will soon need to disclose their identity to the federal government.

RANJAN SAMARAKONE

Small limited liability companies, including many that own commercial real estate, will soon have to disclose to the federal government details on their ultimate ownership, thanks to anti-money-laundering legislation in the 2021 national defense authorization act. Owners of existing and future business entities, and the professional firms that form and administer them, should get ready for the new law.

The disclosure requirements will apply only to certain smaller entities, not just limited liability companies, of types that Congress thought created maximum potential for use in money-laundering and other illegal activities. The inclusions and exclusions are intricate and extensive. They mean that many ordinary limited liability companies formed for real estate investments will need to report their ownership.

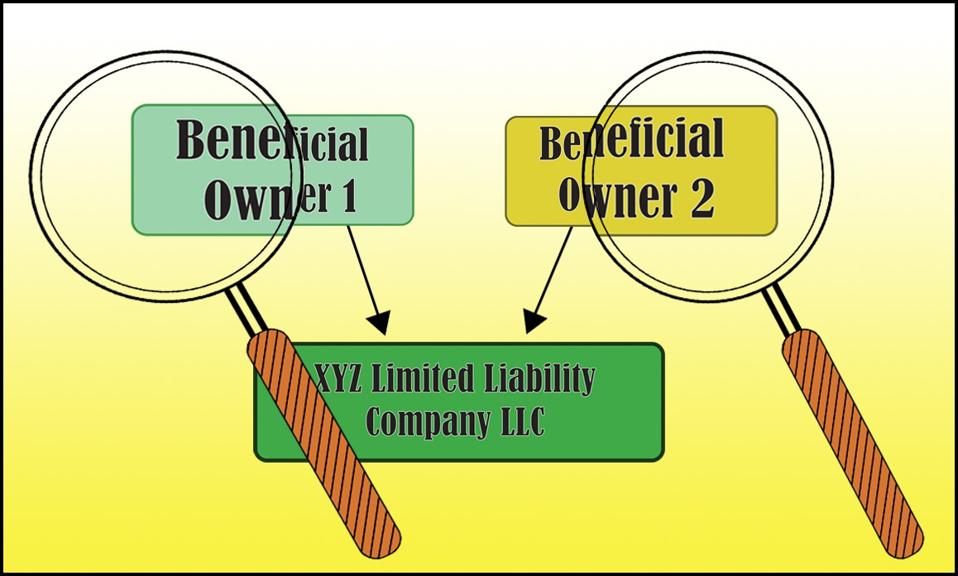

Once a company is subject to the new reporting requirements, it must disclose its “beneficial owners.” That includes anyone who exercises “substantial control” over the company, or owns or controls more than 25% of its equity. The law requires a tracing of ownership up to actual people, not just more companies. Those actual people will have to disclose their name, date of birth, address, and a government-issued identification number – driver’s license, passport, or a new identifier for this purpose.

When a third party such as a law firm submits this information for a company, whoever submits it must provide the same information about themselves.

The new requirements will take effect at the beginning of 2022, perhaps sooner. Pre-existing companies will then have two years to make their disclosures. New companies will have to do it immediately. If beneficial ownership of a company changes, then the legislation requires an update within a year, maybe sooner. Congress wants all these filings to be coordinated with state-by-state filings already required.

The new law takes aim at the practice of issuing certificates evidencing ownership of a company, where the company doesn’t know who actually holds the certificate and hence the corresponding ownership interest, so-called “bearer” certificates. Issuance of such certificates, never common, is now illegal. The law says nothing about existing bearer certificates.

MORE FOR YOU

Failure to file accurate disclosures could trigger substantial penalties, such as $500 a day or two years in federal prison, with exceptions for some errors corrected quickly. The penalties even seem to apply to law firm employees who make the filings for clients. That may concern law firm risk management committees, who may decide clients should handle the filings themselves. Would that increase or decrease the likelihood of inaccuracy?

The legislation says the new disclosures will be used “only” for law enforcement, tax administration, and similar purposes, and must remain confidential. But the government’s new organized collection of juicy information will attract interest from all kinds of people, starting with divorce lawyers, private investigators, reporters, and activists looking for people to harass. It would take a simple amendment of the law to allow access for, e.g., any “legitimate” purpose.

Even without such an amendment, financial institutions will be able to obtain copies of a particular company’s disclosures, if they get permission from that company. If the company doesn’t grant permission, the financial institution will presumably not do business with the company. So the permission requirement is purely theatrical or informational.

Limited liability companies subject to the new law may now need to provide copies of their federal disclosure filings in the closing process for transactions, and also copies of any updates after closing. Requirements triggered by the new law may show up in loan documents, leases, limited liability company agreements, and other contracts. Although many of those documents already require everyone to comply with all laws that apply to them, transactional lawyers often add specific requirements whenever a significant new law comes along.

Thousands or millions of companies will now have a new legal requirement to comply with, to help the government catch some bad guys. Those bad guys will need to figure out new ways to do business without disclosing their identities to the federal government. That will make life a little harder for them. But bad guys are good at that sort of thing.

One might ask how much of this new burden is really necessary given that many of the targeted companies already file ownership information with their tax returns. That isn’t always true, of course, such as for many single-member LLCs. And tax returns are filed months after the fact. Still, it might have made sense to limit the new reporting requirements to gaps in the existing tax reporting regime. Congress would also need to tell the IRS to make available to law enforcement the massive amount of information it already receives on ownership of small companies.