Fearless Girl statue by the New York Stock Exchange – what you need to know about new capital gains … [+]

Getty Images

We have seen the stock market rocket to several new record highs in the past few months. This is on top of the fantastic bull market that ran for more than 10 years ahead of the quick (but scary) Coronavirus bear market. Hopefully, in 2020, we will continue to see the U.S. stock market climb to record highs. The considerable gains in the stock market are incredible for your net worth, but they may result in some painful capital gains tax bills when you eventually sell your investments. How much you end up owing in taxes on your investments’ gains will mostly depend on two factors: 1) How much the value of your investments has increased and 2) How long you have held your investments.

When you sell an investment (stocks, bonds, mutual funds, ETFs, real estate) for more than your cost basis (what you paid for it), your net profit will be taxed as either a long-term or short-term capital gain.

Whether your investment gains are taxed as long-term capital gains or short-term capital gains will depend on how long you have held your shares in each investment. The period of time to keep in mind is one year. If you owned the investment (or even just certain shares of the investment) for one year or less, you would incur short-term capital gains. For assets held longer than one year and one day, the profit will be taxed as long-term capital gains.

Long Term Capital Gain Brackets for 2021

Let’s take a look at how long-term gains are actually taxed. In many cases, long-term capital gains will have favorable tax treatments. That means you will likely pay fewer taxes on long-term capital gains than you would other types of earned income, like your salary. Long-term capital gains are taxed at the rate of 0%, 15%, or 20%, depending on a combination of your taxable income and marital status.

MORE FOR YOU

For single tax filers, you can benefit from the zero percent capital gains rate if you have an income below $40,400 in 2021. Most single people will fall into the 15% capital gains rate, which applies to incomes between $40,401 and $445,850. Single filers, with incomes more than $445,850, will get hit with the 20% long-term capital gains rate.

The brackets are a little bigger for married couples filing jointly, but most will get hit with the marriage tax penalty here. Married couples with incomes of $80,800, or less, remain in the 0% tax bracket, which is excellent news. However, married couples who earn between $80,801 and $501,600 will have a capital gains rate of 15%. Those with incomes above $501,600 will find themselves getting hit with a 20% long-term capital gains rate.

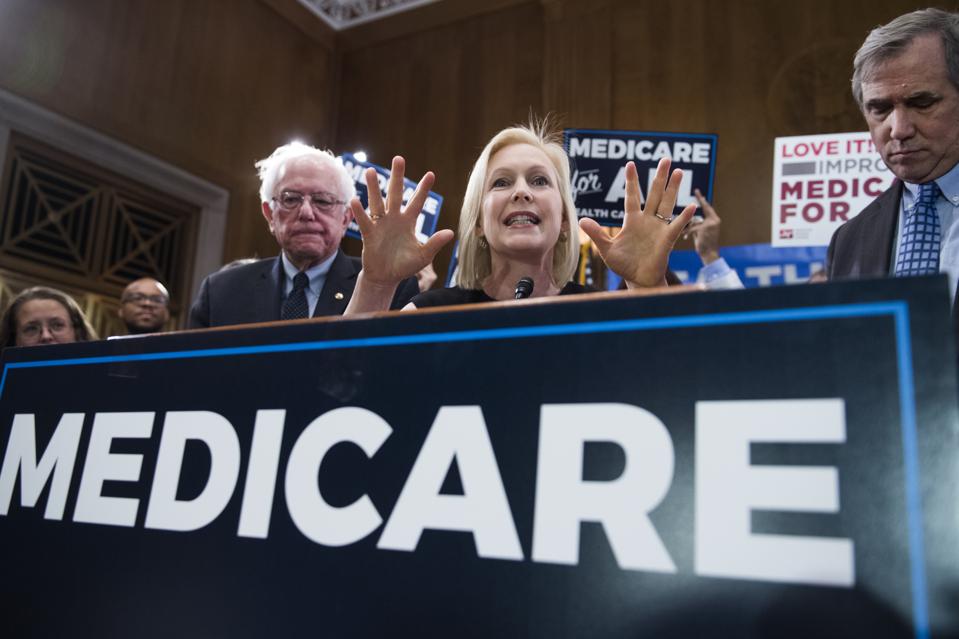

Depending on your income you may owe an addition Medicare surtax on your investment income.

CQ-Roll Call, Inc via Getty Images

Additional Medicare Taxes for Higher Earners

There may be additional taxes or lost tax deductions for people with higher incomes. For example, married taxpayers with incomes of more than $250,000 will also be required to pay an additional 3.8% net-investment surtax. (Medicare surtax applies to incomes above $200,000 for single filers) This Medicare surtax is applied to all investment income regardless of whether the capital gains are long-term or short-term capital gains.

Short-Term Capital Gains

Short-term capital gains are typically taxed as ordinary income. If you hold an investment for less than one year, any gains, or losses, will be treated as short-term capital gains or short-term losses. The good news is that up to $3,000 of short-term losses can be deducted against regular income each year. That provides a great opportunity to lower your taxes with tax-loss harvesting.

Pay Few Taxes With Tax-Loss Harvesting

The soaring stock market doesn’t mean all investments have seen large increases in value. I have a new client whose previous advisor appeared to have the golden touch for picking terrible investments, as well as buying at just the wrong time. Every single mutual fund and stock that this client held with the previous advisor was down since they were purchased with that advisor. The fact that they were all proprietary and commissioned with ridiculously high fees probably didn’t help their net investment returns.

The good news is that this gave us some opportunities to do some proactive tax planning and take advantage of the generous tax-harvesting laws. We were able to capture more than $3,000 in short-term capital losses, which they used to offset regular income. Similarly, we were able to use some of the other investment losses to offset investment gains he had in another investment account.

Taxes on Investments in Retirement Accounts

Gains in your 401(k), Traditional IRA, Defined Benefit Pension Plan, 403(b), and Tax-Sheltered Annuities (TSA) will be tax deferred. You most likely won’t owe any taxes on your retirement accounts until you make a withdrawal. If you have a Roth 401(k) or Roth IRA, your withdrawal will be tax-free, assuming you follow Internal Revenue Service (IRS) rules.

The capital gains rules are a bit different when you sell real estate holdings.

The tax laws are different for those selling their primary residences.

The Washington Post via Getty Images

Taxation of Capital Gains On Real Estate

The capital gains rules are different when you own real estate. There are two main tax rules you need to know about when discussing taxes on the sale of real estate.

When you sell your primary residence, you may be able to avoid paying a substantial amount of taxes on your gains. Homeowners who are single (not married) may be able to exclude up to $250,000 in capital gains on the sale of their primary residence. This number doubles to $500,000 for a married couple selling their primary residence. There are a few rules you need to follow to get this large tax break; most notably, you must have lived in your primary residence for at least two of the past five years.

According to Zillow

Z

Keep in mind that the taxable gain is based on the cost basis of your home, which is not the same as the purchase price. So, keep track of all those home improvements or remodeling projects that you spent money to improve your home, which can increase the cost basis of your home. The higher your cost basis, the smaller your tax bill will be once you finally sell your home. For example, if you purchase a McMansion in Beverly Hills for $5 million, then spend $1 million remodeling it, you would have a cost basis of $6 million. If you are married and lived there for two of the past five years, you could sell it for $6.5 million without having to pay any capital gains taxes on the sale.

The rules are slightly different for investment properties. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you owned the property. That process is known as depreciation recapture. It is a topic too complicated to discuss here, completely. I just need you to be aware that on investment properties, your cost basis is likely less than you put into the property. Talk with your Certified Financial Planner and CPA before selling your investment property to make sure you understand the tax consequences. If you are selling one property to buy another, you may be able to defer taxation with a 1031 exchange.

Investment Long-Term Capital Gains Example

Here is a quick example of how all of these long-term capital gains stuff works. Let’s say you and your spouse have a taxable income of $510,000 (excluding your investment income) and purchased shares in a company in January 2017. Let’s use Apple

AAPL

Should You Avoid Short-Term Capital Gains?

Taxes should only be part of the equation when making decisions on whether to hold or sell investments. That being said, you should be aware of how long you have held the investment and try to avoid short-term capital gains. The IRS tax code encourages long-term investing or holding an investment for at least a year. In most cases, long-term capital gains rates will be lower than your earned income tax rates.

As a fiduciary financial planner, I typically use diversified portfolios for my clients. We try to avoid tons of buying and selling that will incur unnecessary taxes. For the typical investor or retirement saver, there is little to no reason to be constantly buying and selling beyond investing new contributions to your account.

Make your buying automatic, put money away each and every month into a well-diversified portfolio. Use low-cost index funds and go on enjoying your life. There is no benefit to checking your investment account 50 times a day. All you will be doing is increasing your chances of making a big investment mistake, or at the very least, stressing yourself out.