The IRS has released updated instructions on how to answer the infamous virtual currency question – “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in virtual currency?” - on 2020 Form 1040. The updated version as of December 31, 2020, clarifies what’s covered under the term, “virtual currency”, and makes cryptocurrency purchases subject to this question.

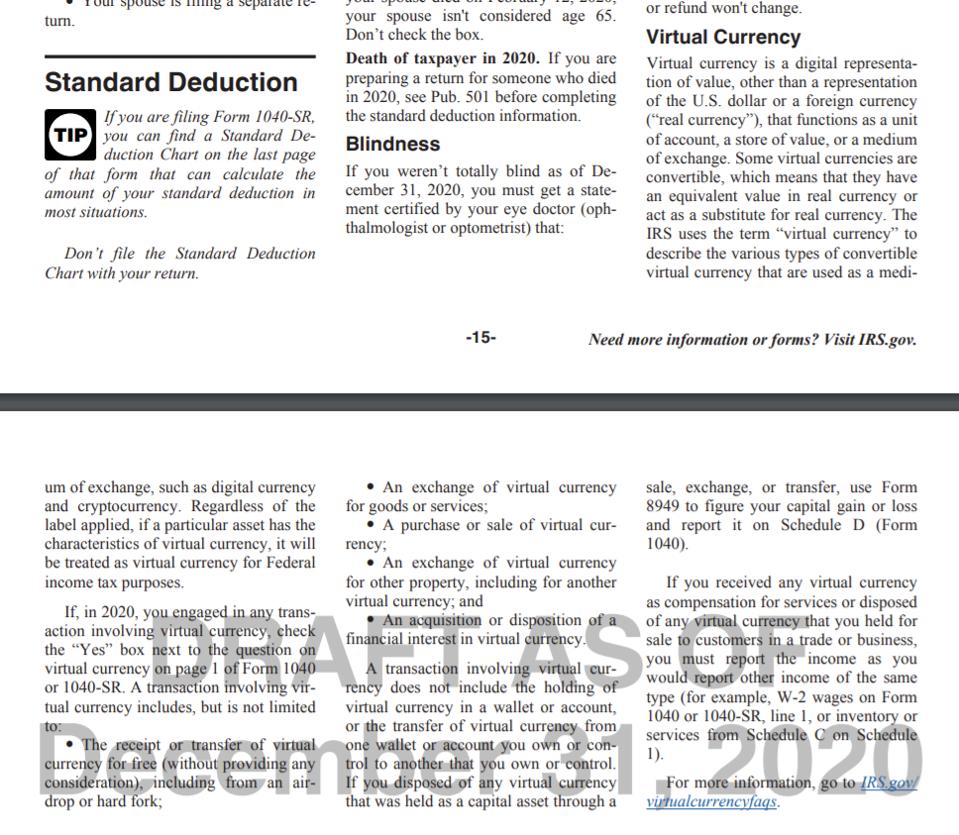

IRS Form 1040 Instructions updated as of December 31, 2020

Shehan Chandrasekera

The new draft instructions explain how the IRS interprets virtual currency.

“The IRS uses the term “virtual currency” to describe the various types of convertible virtual currency that are used as a medium of exchange, such as digital currency and cryptocurrency”

The IRS also taking a very broad approach when it comes to what could be treated as virtual currency for the purposes of this question.

“Regardless of the label applied, if a particular asset has the characteristics of virtual currency, it will be treated as virtual currency for Federal income tax purposes”

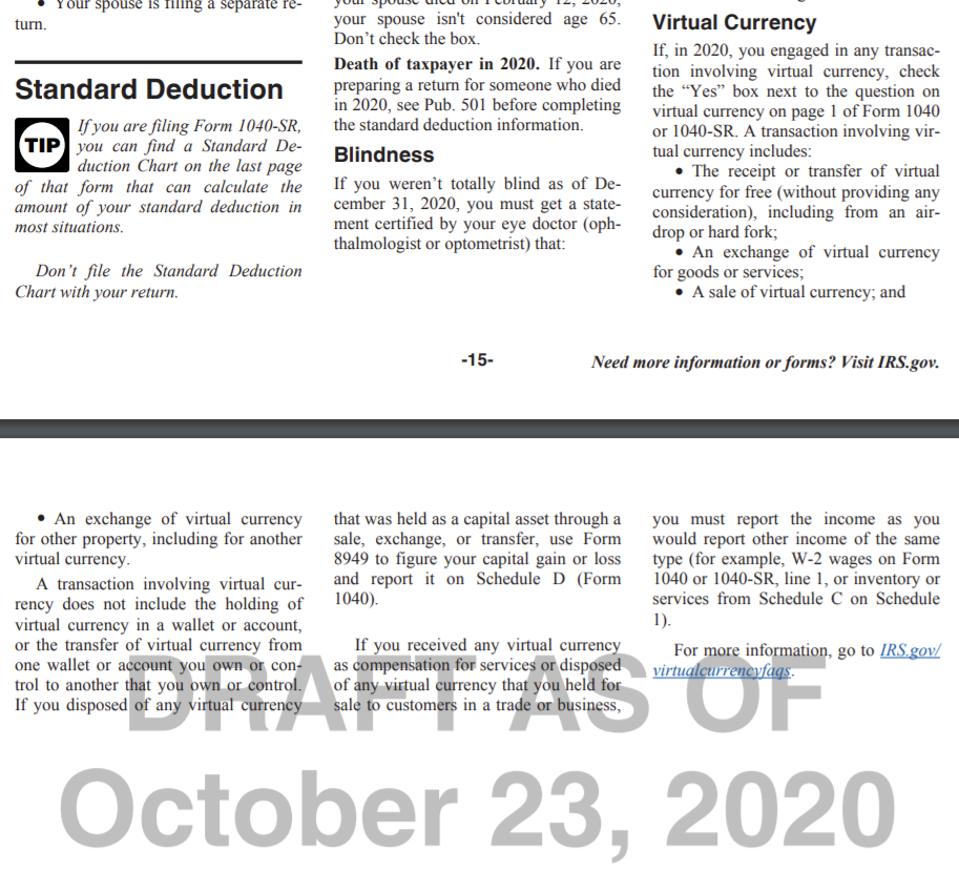

Next, the updated instructions clearly state that transactions involving virtual currency include purchases of virtual currency. This means if you purchased cryptocurrency during 2020, you will have to check “yes” on the virtual currency question on page 1 although this may not trigger any taxable event. Prior draft instructions dated October 23, 2020 did not explicitly mention this.

IRS Form 1040 Instructions updated as of October 23, 2020

Shehan Chandrasekera

MORE FOR YOU

Since the inclusion of the virtual currency question on 2019 Schedule 1, What’s exactly covered under this question has been a hot topic in the crypto community and among tax practitioners due to limited instructions around it. The updated instructions attempt to demystify at least some ambiguities.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.