As the nation awaits the President’s signature on the Consolidated Appropriations Act, 2021 – a 5,500 page spending and COVID stimulus bill – tax nerds march ahead undeterred, knowing that should that signature arrive, the need to undertake significant tax planning will be upon them before the ink is dry.

UNITED STATES – DECEMBER 25: Metro DC Socialists hold a Christmas morning photo op for Santa to … [+]

CQ-Roll Call, Inc via Getty Images

There are no shortage of tax law changes in the bill, but one section in particular requires attention sooner than others; Section 206, which allows businesses to retroactively both borrow a PPP loan and claim an Employee Retention Credit for 2020.

If those words didn’t mean a whole lot to you, let me explain.

As part of the CARES Act passed in March of 2020, Congress created two mutually exclusive incentives that would provide funds to business owners designed to allow them to keep employees on staff throughout the pandemic.

Most notably, the Paycheck Protection Program supplied billions in forgivable loans to businesses with fewer than 500 employees. If a business took advantage of the program – and most who were eligible did – they were barred from taking advantage of the second incentive, the Employee Retention Credit (ERC).

The ERC – which as opposed to the PPP, was not limited by the number of employees – is a refundable payroll tax credit that was only available to taxpayers who EITHER 1) had their business fully or partially suspended during at least one quarter in 2020, or 2) had a precipitous drop in gross receipts for quarters in 2020 relative to the same quarters in 2019.

MORE FOR YOU

Once a business experienced a quarter in which either 1 or 2 above occurred, they could claim a maximum credit of $5,000 per employee who was paid “qualified wages.” The definition of “qualified wages” was subtly different if the business had more than 100 full-time equivalent employees.

The Consolidated Appropriations Act, 2021 made changes to the ERC primarily in two separate sections: 206 and 207 of the Taxpayer Certainty and Disaster Relief Act. There are additional changes made in Section 303 pertaining to businesses in a non-COVID-19 disaster area, but we’re going pun on that conversation for now, focusing instead on Sections 206 and 207.

First, let’s establish the difference between the two sections, as I’ve seen this become a source of confusion on the ol’ interwebs. Section 206 of the law changed who may claim the ERC – but not the computational rules – for the period March 12, 2020, through December 31, 2020.

Then, Section 207 of the Act extends the ERC, which was originally slated to expire at the end of 2020, until July 1, 2021, More importantly, however, Section 207 dramatically changes the computational rules for the final six months of the program.

In this article —Part 1 of a two-partner –we will ONLY take on Section 206 of the Act. We’ll look at how that provision, for the first time, opens up the ERC to the countless businesses who took out a PPP loan during 2020.

But before the expanded availability of the ERC can mean a whole lot, we should probably remind ourselves how the credit works for 2020. After all, not many business owners originally paid the credit much attention, because once they borrowed a PPP loan, it was off the table. So let’s get caught up…this is how the credit will work for 2020; as we’ll see in Part 2, the credit is much different in 2021.

Employee Retention Credit, Computational Aspects

In short, a for-profit business or tax-exempt organization can claim a refundable payroll tax credit of up to $5,000 per employee for wages paid between March 12 and December 31, 2020, but only for wages paid during a calendar quarter in which the business is either:

1) Scenario 1: Shut down by government order, or

2) Scenario 2: Experiencing a large drop in year-over-year gross receipts.

To qualify for the first scenario, for any quarter in 2020, the operation of the employer’s trade or business must have been “fully or partially suspended” during the quarter due to “orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial social, religious, or other purposes, due to COVID-19.” Once this occurs, the quarter is an “eligible quarter,” but a business will only get a credit on wages paid during the part of the quarter the business was shut down. To illustrate, assume your business was closed from March 15 through April 15th. You will have an eligible quarter for both Q1 and Q2, but as we’ll see shortly, for Q1, eligible wages can only be paid from March 15 – March 31st, and for Q2, eligible wages can only be paid from April 1 – April 15th.

To meet the second test, for any quarter in 2020, the “gross receipts” from the “trade or business” of the employer must be less than 50% of what they were for the same quarter in 2019. Once this happens, every quarter is an “eligible quarter” until the END of the quarter in which the business’s receipts have returned to at least 80% of what they were for the same quarter in 2019. By way of example, if receipts in Q1, Q2, Q3 and Q4 of 2019 were $100,000, $120,000, $100,000 and $150,000, and for the same quarters in 2020 receipts were $40,000, $70,000, $85,000 and $125,000, the “eligible quarters” for 2020 are Q1 (the first quarter in which receipts are less than 50% of 2019), Q2 (still less than 80% of 2019) and Q3 (the end of the first quarter in which receipts have returned to at least 80% of the same quarter of 2019).

Moving on, if during ANY quarter in 2020, either Scenario 1 or 2 applied to your business, “qualified wages” paid to employees during the quarter – or relevant part of the quarter, in the case of Scenario 1 – will give rise to a credit. But…before we can take on that step, we need to understand that the rules change a bit if you had averaged more than 100 “full-time equivalent employees (FTEs)” during 2019.

If you have MORE than 100 average monthly FTEs for 2019, only wages paid to an employee during an eligible quarter to NOT PROVIDE SERVICES are eligible for the credit. In other words, you MUST be paying an employee to NOT work, either because business has been shut down or receipts have dropped significantly.

If you have LESS than or equal to 100 average monthly FTEs for 2019, then ALL wages paid to an employee during an eligible quarter can give rise to a credit, even if the employee is currently at work.

Let’s take a look at some examples:

Example. Q is a chain of full-service restaurants with more than 100 average monthly FTEs in 2019. State X forced Q to go to take-out only for Q2 and Q3 of 2020. Q continues to pay its kitchen staff to come in and prepare food every day. Even though Q has had its operations partially suspended, because Q has more than 100 FTEs for 2019, only those wages paid to employees NOT TO WORK are eligible for the credit. Thus, the amount Q pays its kitchen staff to cook are not eligible for the ERC.

Assume, however, that Q also paid wages to waiters and bartenders who are NOT coming in to work. These wages WOULD be eligible for the credit.

If instead, Q had LESS than 100 average monthly FTEs in 2019, ALL wages paid during Q2 and Q3 to ALL employees would be eligible for the credit; even the wages paid to kitchen staff who were continuing to work.

I can’t overstate how important this distinction is. A business could fight to make the argument that its operations were partially suspended for a quarter during 2020 – for example, if the employees were all forced to telework – but if the business has more than 100 FTEs, it will all be for naught, as the business can only claim the credit for wages paid to employees NOT to work. And if employees are teleworking, well…that won’t satisfy that requirement.

Now we can move on to the determination of qualified wages. Approach it in steps:

Step 1: Identify that the business had an “eligible quarter” in 2020; either because business was partially or fully suspended or because gross receipts have dropped precipitously.

Step 2: Determine how many average monthly FTEs the business had for 2019, as that will drive whether the credit is based on wages paid only to employees NOT to work (over 100 FTEs), or to ALL employees during an eligible quarter (under 100 FTEs).

Step 3: Starting March 12, 2020, for every employee to whom the business paid eligible wages to during an eligible quarter, you get a credit equal to 50% of those wages. But there’s a number of additional restrictions:

First and foremost, the MAXIMUM amount of wages you can take into account for ANY ONE EMPLOYEE for the ENTIRE year is $10,000. So once you’ve paid an employee $10,000 in qualified wages, you are tapped out at a $5,000 credit.

Example. Business X has its operations shut down by government order for Q2 and Q3 of 2020. During Q2, X pays employee A $8,000 in qualified wages. During Q3, X pays A another $6,000 in eligible wages. In Q2, X can claim a credit of $4,000 (50% of $8,000) related to A. In Q3, X’s credit for wages paid to A is limited to $1,000 (maximum wages of $10,000 less $8,000 taken into account in Q2). For the rest of 2020, X cannot take ANY additional credit related to employee A.

You can increase the wages paid to an employee by the employee’s allocable share of certain health care costs. Alternatively, if you didn’t pay someone wages – for example, if they were on furlough – but you did cover their health care costs, you can claim the credit against JUST the health care costs.

Let’s put it all together:

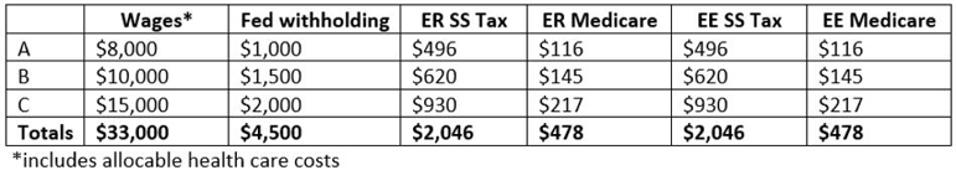

Example. In Q2, my business is entirely shut down by government orders. I have fewer than 100 average monthly FTEs in 2019. During Q2, I pay the following wages and payroll taxes:

ERC

nitti

The credit is $16,500, 50% of the qualified wages, correct?

Close, but not quite. Don’t forget, the maximum wages for any one employee are $10,000, so C’s wages are capped at that amount. Thus, the total credit is $14,000 (50% of $8,000 + $10,000 + $10,000).

With that background established, we can now examine how Section 206 of the Act changes the above rules. Except, as I said before; they don’t. What they change, is that for the first time, a business who borrowed a PPP loan may claim the ERC for 2020.

Let’s take a look:

Changes to the ERC: Treatment of Taxpayers who Originally Borrowed PPP Loans and Were Barred from Claiming the ERC

If we were going to summarize in one sentence what Section 206 of the Act endeavors to accomplish, it would be this: “All of you who borrowed a PPP loan can now go back and claim the ERC for 2020.”

That’s it; that’s all. But implementing that idea is easier said than done, primarily for this reason: the backbone of both the PPP and ERC is payroll costs: PPP loans must be spent primarily on payroll in order to be forgiven, and as we just learned, the ERC is predicated on qualified wages.

The problem that arises, then, is an obvious one. Congress will let us have BOTH the PPP and ERC for 2020, but not on the same dollars of payroll costs. And it’s the safeguards that are necessary to prevent double dipping that makes Section 206 of the Act – should you dare to read it – so unwieldy. Layer on what I think(?) are a few drafting errors, and suddenly a read of the new bill does not make perfectly clear what exactly a PPP borrower is supposed to do in order to retroactively claim the benefits of the ERC.

Why don’t we approach this in a systemic manner and break down Section 206 to its component parts, so we can highlight opportunities, unanswered questions, and potentially, errors.

The Headline: No More Prohibition on Claiming BOTH the PPP and ERC

Let’s start with the biggest news first: Section 206(c)(2)(B) strikes Section 2301(j) from the CARES Act. Section 2301(j) had previously provided that “if an eligible employer receives a covered loan under paragraph (36) of section 7(a) of the Small Business Act (a PPP loan), such employer shall not be eligible for the credit under this section.”

With that gone, the next question is one of effective dates: at what point was Section 2301(j) removed from the CARES Act? Section 206(e) provides that, in general, the amendments made by this section take effect as if included in the provisions of the CARES Act to which they relate. Thus, it certainly appears that PPP borrowers are now eligible for an ERC back to the beginning of the program – March 12, 2020. It’s just a matter of how to claim that credit.

But before we can address that, let’s look at some of the other changes made by Section 206:

Treatment of Allocable Health Care Costs

Section 206(b) reorganizes Section 2301 of the CARES Act, and as we’ll discuss later, this drafting may cause a problem for certain taxpayers. This section begins by striking Section 2301(c)(3)(C), which had previously included in the definition of “qualified wages” eligible for the ERC the allocable share of qualified health plan expenses paid to an employee along with the qualified wages.

That does NOT mean, however, that a taxpayer claiming the ERC no longer gets to increase qualified wages by allocable health care costs. Instead, Section 206(b)(2) then MOVES the former Section 2301(c)(3)(C) to Section 2301(c)(5)(B). More importantly, it changes the language in this section to align with the favorable interpretation by the IRS that allocable health care costs are eligible for the credit EVEN IF no wages are paid to the employee; i.e., an employee is on furlough. The previous language in Section 2301 required wages to be paid to an employee before health care costs could be allocated to the wages and a credit claimed against them. That is no longer the case.

Let’s pause for a second and take note of something we’ll come back to later: Section 2301(c)(5) is now broken into two parts: A and B.

Section 2301(c)(5)(A) will now read: “In general, the term wages means wages (as defined in section 3121(a) of the Internal Revenue Code of 1986) and compensation (as defined in section 3231of such Code), and

Section 2301(c)(5)(B) will now add to the definition of wages in (c)(5)(A) allocable health care costs.

In summary, the inclusion of health care costs in qualified wages has been moved from Section 2301(c)(3)(C) to Section 2301(c)(5)(B). Stick that in the back of your brain; it will matter soon.

Coordination between PPP and ERC

Now that Section 2301(j) has been removed from the CARES Act and PPP borrowers can claim the ERC, we’ll need some ground rules to avoid claiming a credit and forgivable expenses for the same amounts.

Section 206(c)(1) amends Section 7A(a)(12) of the Small Business Act, which was formerly Section 1106 of the CARES Act. This new Section 7A(a)(12) – after amendment by the PPP provisions of the latest bill – includes in forgivable PPP expenses “payroll costs” as defined in Section 7(a)(36) of the Small Business Act. Section 206(c) amends the definition of forgivable PPP payroll costs by adding, “Such payroll costs shall not include qualified wages taken into account in determining the credit allowed under Section 2301 of the CARES Act or qualified wages taken into account in determining the credit allowed under subsection (a) or (d) of section 303 of the Taxpayer Certainty and Disaster Relief Act of 2020.”

Stated in another way, this Section 206(c) established an important ordering rule: any payroll costs – W-2 wages or health care costs – for which a taxpayer claims an ERC (or a new disaster ERC as allowed by the latest bill) are NOT eligible to be forgiven as part of the PPP process. Thus, while a taxpayer may BOTH claim the ERC and borrow a PPP loan, they cannot do it on the SAME wages or health care costs, and the priority goes to the ERC rather than the PPP.

But…Section 206(c)(2) then modifies Section 2301(g), which previously allowed a taxpayer to elect out of the ERC provisions. Why this would have been done previously, I have no idea, other than to opt to take other credits against the same wages.

Under Section 206(c)(2), Section 2301(g)(1) will now allow a taxpayer to elect to not include certain wages and allocable health care costs in the computation of the ERC credit. Clearly, this would be done so as to preserve those costs for PPP forgiveness.

Section 2301(g)(2) is then further amended to require the SBA to issue guidance providing that if a taxpayer elects under Section 2301(g)(1) to count wages for PPP forgiveness rather than the ERC credit, if it turns out that PPP payroll costs are NOT forgiven, the payroll costs can STILL be treated as qualified wages for purposes of the ERC.

Putting it all together, assume a taxpayer borrowed $100,000 as a PPP loan on April 3, 2020. During the second and third quarters of 2020, the taxpayer has “eligible quarters” and is thus eligible for the ERC. Over the 24-week covered period, the taxpayer spends $80,000 on W-2 wages and qualified health care costs and $20,000 on rent. Included in those wages are $40,000 of qualified wages eligible for the ERC. The taxpayer would rather have the $40,000 in payroll costs forgiven than claim an ERC on those amounts. The general rule of new Section 7A(a)(12), however, provides that the $40,000 of qualified wages are eligible for the ERC, and are NOT eligible to be forgiven.

The taxpayer may then elect, however, under Section 2301(g)(1) to treat the $40,000 of qualified ERC wages as “payroll costs” for purposes of PPP forgiveness. If the loan is fully forgiven, no ERC can be claimed on the $40,000 of wages. It appears, however, that if the loan is eventually not forgiven, Section 2301(g)(2) and future guidance from the SBA will allow the $40,000 of qualified wages to revert BACK to the ERC and be eligible for the credit.

The big remaining question about the changes made by Section 206(c), is how these decisions and elections are to be made when many taxpayers have already applied for forgiveness. If the taxpayer had previously applied for forgiveness, how do they make the election under Section 2301(g) to count the payroll costs in the PPP forgiveness that has already been applied for? Unless I’m missing it (I am), I don’t see where Section 206 accommodates a situation in which a business has ALREADY FILED for forgiveness in 2020 and now wants to claim the ERC. I presume the business is treated as having made the election under Section 2301(g)(1) to have passed the payroll costs on from the ERC to the PPP, and are no longer eligible for the credit?

And for those PPP borrowers who have not yet applied for forgiveness, do we now have ANOTHER factor to consider? If a borrower has enough “payroll costs” to satisfy both the ERC and PPP programs, can they have their cake and eat it too?

For example, assume a taxpayer borrowed $100,000, but in the 24-week covered period that also comprised eligible quarters, incurred $180,000 of W-2 and payroll costs, with $50,000 of the costs also meeting the definition of “qualified wages” for the purposes of the ERC. Even with the general rule that the $50,000 of qualifies wages are not forgivable PPP costs, the taxpayer would still have $130,000 of forgivable payroll costs; more than enough to achieve full forgiveness.

But you can see where this is heading: very few business owners bothered to understand the concept of “qualified wages” because once the business got its hands on a PPP loan, the ERC was not available. But now, with the ERC being brought back for 2020 even for PPP borrowers, it is necessary for every borrower to quickly get a handle on 1) whether they had an “eligible quarter” for ERC purposes during 2020, and then 2) quantify the “qualified wages” so as to make a determination whether those wages are better utilized in claiming an ERC or forgiven as part of the PPP, or if they have enough total payroll costs to get the best of both worlds.

Section 206(c) then makes one final modification, striking Section 2301(l)(3), which had required a taxpayer to recapture an improperly claimed ERC if they borrowed a PPP loan. Now that a taxpayer may have both, this provision was superfluous.

OK, Great. But how do we Claim the Retroactive Credit?

Allowing PPP borrowers to claim the ERC doesn’t mean a whole lot if we don’t understand 1) when the changes are effective, and 2) if the changes are retroactive, how the taxpayer claims the retroactive benefits.

Clearly, the changes are intended to be retroactive. To that end, as discussed previously, Section 206(e) provides a general rule that ALL the changes above are to be implemented as if they were part of the initial CARES Act passed in March of 2020. That would, of course, seem to mean that PPP borrowers can still claim the credit for the past nine months. But how? Those credits, which would have reduced payroll tax deposits or generated a refund on Form 7200, would have been claimed as part of payroll tax filings over the previous three quarters. What can be done now?

The logical conclusion is that this is intended to be simple: every business owner can go back, review 2020 for eligible quarters and qualified wages, decide which costs to leave out of the PPP forgiveness or whether to elect to move the costs from the ERC to the PPP, and then claim the credit on the final eligible costs, presumably by filing amended Forms 941X for the 2nd and 3rd quarters of 2020. That makes sense, right?

So why doesn’t the Act just come out and say that?

Well, it doesn’t, which is what makes this difficult. We can surmise that this is intended to be a windfall retroactive credit because, among other things, Section 207(n) of the Act compels the IRS to conduct a “public awareness” campaign to alert business owners to the fact that they were eligible for the ERC in 2020, and continue to be in 2021.

While Section 206 of the Act may be silent as to the default mechanism for claiming the 2020 ERC, paragraph (e)(2) does allow an elective alternative that avoids the need for filing amended Forms 941 by instead reporting a “catch-up” credit in whatever quarter the Act becomes law. But if I’m reading this correctly, the catch-up provision is confusing at best, and flat-out incorrect at worst.

Section 206(e)(2) states that for purposes of Section 2301 of the CARES Act – the ERC provision – an employer who has filed a payroll tax return BEFORE the date of enactment of the latest relief bill may elect to treat any “applicable amount” as an amount paid in the calendar quarter which includes the date of enactment of the relief bill. This certainly sounds like a taxpayer can “catch-up” the full credit available to them in 2020, but what is an “applicable amount?”

Section 206(e)(2)(B) defines an “applicable amount” as the wages which are:

- Described in the revised Section 2301(c)(5)(B), OR

- Allowed to be treated as wages under Section 2301(g)(2) of the CARES Act as amended, and

- Were paid between January 1, 2020 and October 1, 2020, and

- Were not previously taken into account by the taxpayer in claiming an ERC.

Again, one would think that this provision simply allows the taxpayer to claim the full 2020 credit on the current Form 941, but the cross references don’t make that clear. We’ve already addressed these sections mentioned in the first two bullets, but let’s refresh our memories:

Section 2301(c)(5)(B) is where Congress moved the definition of “health care costs” and stated that they are part of wages.

Section 2301(g)(1) allows a taxpayer to elect to count qualified wages as forgivable wages for purposes of the PPP rather than ERC costs, but then Section 2301(g)(2) provides that if the debt doesn’t end up being forgiven, the qualified wages can again count towards the ERC.

Here come the questions:

Why would the first bullet allow you to count only those cost in Section 2301(c)(5)(B), which deals with allocable health care costs, and not the qualified wages themselves? Is this purposeful, or a mistake? If purposeful, might Congress be saying, “Hey, the ship already sailed on a lot of PPP loans. We can’t let you go back and claim ERC credits for qualified wages paid because many applications for forgiveness have already been filed, and those applications don’t reflect the new general rule of Section 7A(a)(12) that qualified wages for purposes of the ERC are not forgivable costs? But that would run contrary to what we believe is the point of Section 206, to allow for a retroactive credit in full.

That also doesn’t make a ton of sense, because it would still require the taxpayer to go through a significant amount of work to compute qualified wages and health care costs, only to then find that the taxpayer would only claim the credit against the health care costs, and NOT the wages themselves.

So what is the other option? Did Congress mean to cross-reference to Section 2301(c)(5), thereby pulling in both paragraphs A and B, which would include in the catch-up both qualified wages and allocable health care costs? That is the more logical conclusion, and would yield a MUCH larger catch-up credit, but as posited earlier, what does that mean for taxpayers who have already filed for forgiveness and included in their forgivable costs “qualified wages” that would be eligible for the ERC? How can a taxpayer elect to include qualified wages in the PPP application under Section 2301(g)(1) if the application has already been filed?

And even if we assume that the cross reference in the first bullet was intended to land on Section 2301(c)(5) — instead of 2301(c)(5)(B) — pulling in ALL wages and payroll costs, why is there then an OR between the two bullets. Why would you be allowed to take a catch-up credit for wages/health care costs OR wages that were previously elected to include in PPP forgiveness only for the forgiveness to be denied. Wouldn’t that make much more sense as an “AND?”

I’m sure you sense my frustration. I’ve read Section 206 of the latest relief bill more times than any reasonable person should, and I still have NO IDEA what it means for my clients, and how much work they and I have to do in the near future. Sure, we know they can claim an ERC for 2020 even though they borrowed a PPP loan, but how much? Is it:

1. The qualified wages paid in 2020 that we don’t elect under Section 2301(g)(1) to be treated as forgivable payroll costs for purposes of the PPP, PLUS health care costs, PLUS any wages that we elected to include in forgiveness, only to have them revert back to the ERC when forgiveness was denied? Or is it….

2. The allocable health care costs – and only the allocable health care costs – OR any wages that we elected to include in PPP forgiveness, only to have them revert back to the ERC when forgiveness was denied?

The hope, obviously, is that the answer is #1, and Section 206 was simply a victim of hasty drafting.

Fortunately, should the bill get signed into law, we shouldn’t have to wait long for clarity: the Act orders the IRC to issue guidance posthaste.

In Part 2, we’ll come back and take a look at Section 207, and how it changes the ERC for 2021. Hopefully it creates fewer questions that Section 206.

Spoiler: it does not.