No matter how much time and energy you invest into politics, you probably know student loan debt has become just as much a political issue as a financial one. Both sides of the aisle have suggested some relief for student loan debt, including the Trump Administration’s current halt on payments and interest for most federal student loans through early 2021. Not only that, but President-Elect Joe Biden has made some sweeping promises in terms of forgiving student loan debt for a large swath of borrowers.

But, what exactly does a Biden Presidency mean for your student loans? That really depends on which student loan relief measures his administration chooses to focus on, as well as who ultimately controls Congress once the Georgia run-off elections are complete on January 5th.

While no one knows for sure what kind of relief could pass to help with our crushing student loan debt problem, here are some potential measures that could take place — and what you can do to prepare.

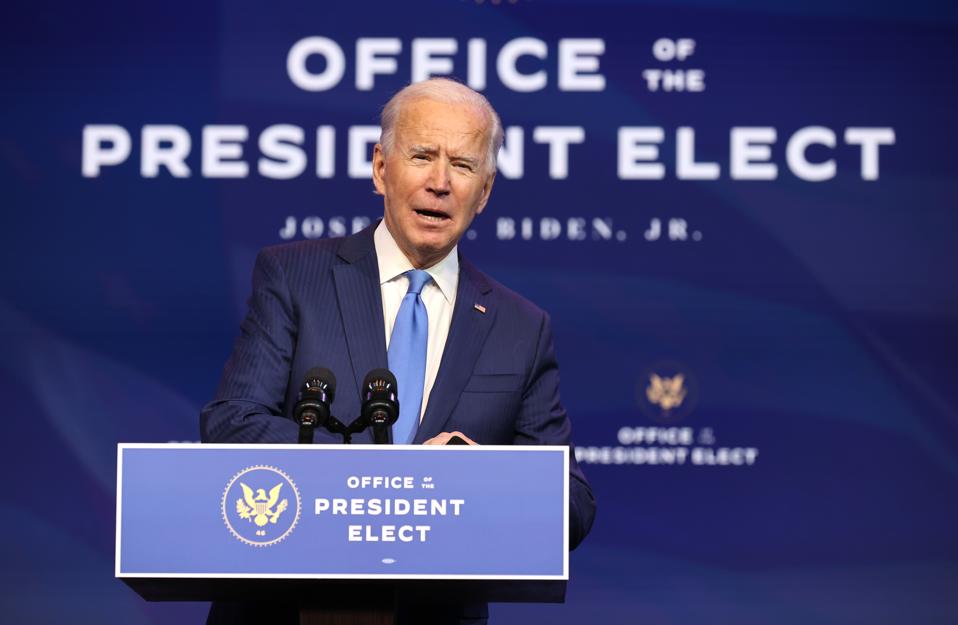

WILMINGTON, DELAWARE – DECEMBER 11: U.S. President-elect Joe Biden speaks during an event to … [+]

Getty Images

Potential Cancellation Of Some Student Loan Debt

With more than 45 million borrowers owing a collective $1.6 trillion in student loan debt, forgiving some amount of student loans is at the forefront of relief measures currently being discussed. However, the amount of debt that could be forgiven varies depending on who you ask.

On the high end of the scale, Senate Democratic Leader Chuck Schumer (D-NY) and Senator Elizabeth Warren (D-MA) are calling for President Biden to pass relief that would forgive $50,000 in federal student loan debt per borrower. They believe he could use executive authority to cancel this much debt for every American who owes money on their student loans, and all without any tax liability for those who receive forgiveness.

MORE FOR YOU

However, such a high rate of forgiveness passing is incredibly unlikely if Republicans control the Senate after January 5th. Further, the Biden administration has proposed forgiving a lower amount of up to $10,000 per borrower in federal student loans, which is more likely to come to fruition.

Unfortunately, it’s likely that some income caps would apply to this forgiveness, although there is no firm discussion yet. For example, Biden supports the HEROES Act, which would offer forgiveness only for borrowers who are economically distressed.

When can you expect student loan forgiveness to pass? Unfortunately, it’s a waiting game for now.

In the meantime, you still don’t have to make a payment on most federal student loans until after January 31, 2021. Further, the interest rate on eligible federal student loans is still set at 0% until then. If the HEROES Act were to become law, waived payments and interest on federal student loans would also be extended through September 30, 2021.

Lower Monthly Payments On Income-Driven Repayment Plans

Income-driven repayment plans let borrowers pay a percentage of their “discretionary income” on their student loans before having their remaining balances forgiven after 20 to 25 years. The catch is, any remaining loan balances will be treated as taxable income in the future, which means you could face a giant tax bomb later on if you have a lot of debt forgiven.

On Biden’s website, a proposal that would lower monthly payments for low-income borrowers is outlined. Due to suggested updates to income-driven repayment plans, individuals making $25,000 or less per year would not owe any payments on their undergraduate federal student loans, nor would they accrue any interest. All other borrowers would pay just 5% of their discretionary income over the $25,000 threshold. Not only that, but Biden proposes changing the tax code so forgiven debts wouldn’t be treated as taxable income later on.

Expansion Of Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) works pretty well for those who can actually qualify, although Biden hopes to simplify this program and cut the timeline you need to participate in half. Per the Biden website:

“Biden will create a new, simple program which offers $10,000 of undergraduate or graduate student debt relief for every year of national or community service, up to five years. Individuals working in schools, government, and other non-profit settings will be automatically enrolled in this forgiveness program; up to five years of prior national or community service will also qualify.”

Better Access To Bankruptcy

The Joe Biden administration also believes that private student loan companies may be “profiteering” off of too many student loan borrowers. As such, they want to pass legislation that makes it easier to discharge private student loan debt in bankruptcy.

Further, he hopes to make it easier for the Consumer Financial Protection Bureau (CFPB) to punish private student loan companies who aren’t being transparent with their customers, as well as those who don’t offer flexible payment plans to borrowers experiencing financial hardship.

What About Future College Students

With all the talk about erasing current student loan debt, many wonder what happens with the future students of the country. Since student loan debt cancellation doesn’t fix the core of the issue (increasing college costs), the Biden administration has proposed another lofty goal there.

First, Joe Biden ran on a platform of making two-year community college free for anyone who wants to attend. Further, the hope is to make public colleges and universities tuition-free for families who earn less than $125,000.

It remains to be seen whether truly “free college” could pass. However, the Biden administration has also proposed additional relief measures that could help, such as an expansion in who can qualify for Pell Grants and new grant programs for under-resourced, four-year institutions.

How Can You Prepare For 2021 Changes To Your Student Loans?

When it comes to student loan relief that may come to pass once Joe Biden becomes President of the United States, nobody knows what is going to happen. With that in mind, you should probably steer clear of making too many moves with your federal student loans right now, other than keeping up with monthly payments once the current forbearance ends. For example, you may want to wait on refinancing federal student loans with a private lender right now since it’s possible some of your federal loan debt will be forgiven.

It’s likely whatever relief measures could pass will become clear in the next few months, although there are no guarantees. In the meantime, all anyone can do is wait it out and hope for the best.