getty

The Internal Revenue Service (IRS) has released the very-probably-unless-Congress-does-something-soon final version of Form 1040, U.S. Individual Income Tax Return for 2020 (downloads as a PDF). There are several notable changes to the form proposed for the tax year 2020 – the tax return that you’ll file in 2021.

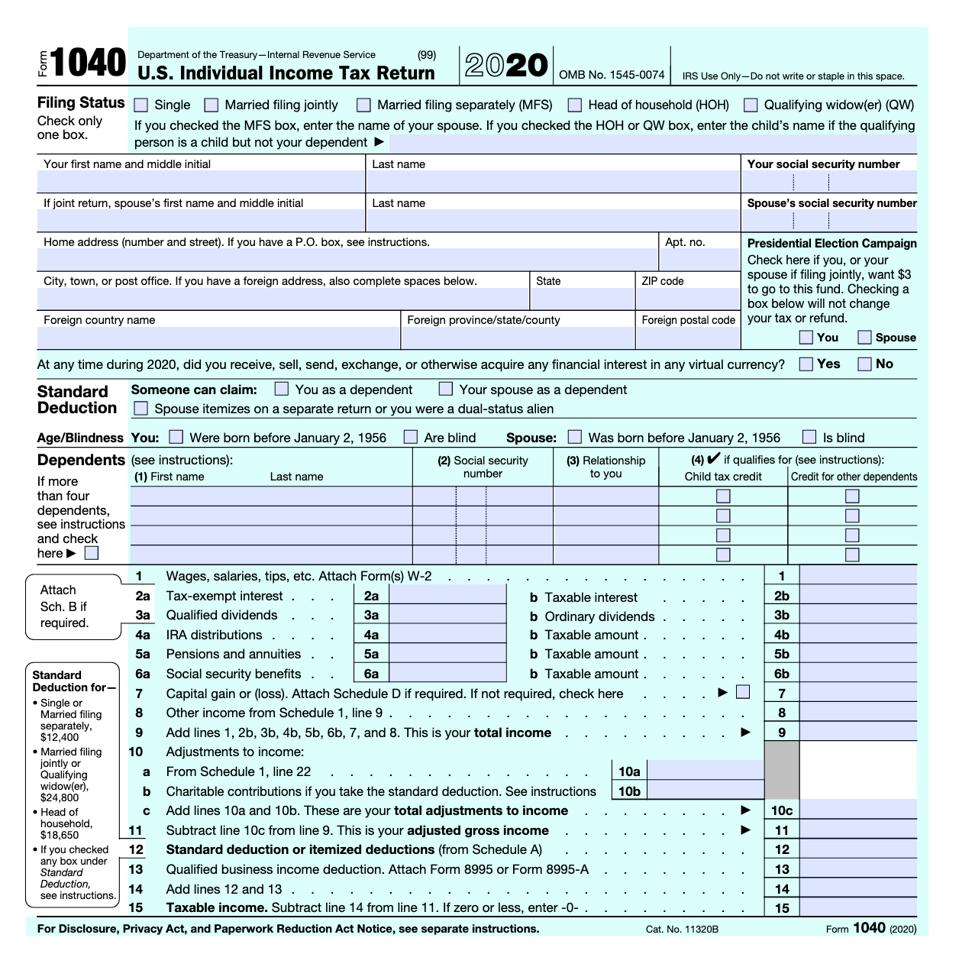

Page One

Form 1040 (2020)

IRS/KPE

Identifying information. There are no real changes to the identification portion of the Form 1040: this is where you list your name, address, Social Security Number (or ITIN) and note your filing status.

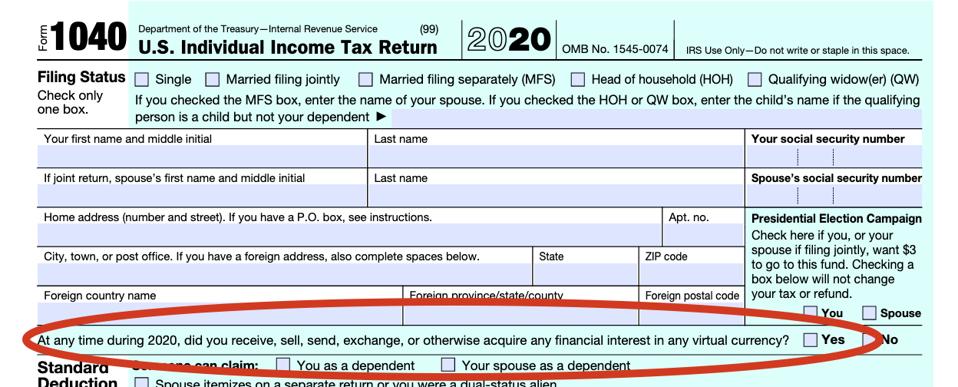

Virtual currency. As expected, a question about virtual currency remains on the front of the Form 1040. A new cryptocurrency compliance measure for taxpayers was introduced in 2019 in the form of a checkbox on the top of Schedule 1, Additional Income and Adjustments to Income. Schedule 1 is used to report income or adjustments to income that can’t be entered directly on the front page of form 1040.

Crypto question on Form 1040

KPE

I noted last year that the IRS has made no secret that it believes that taxpayers are not correctly reporting cryptocurrency transactions. An IRS dive into the data showed that for the 2013 through 2015 tax years, when IRS matched data collected from forms 8949, Sales and Other Dispositions of Capital Assets, which were filed electronically, they found that just 807 individuals reported a transaction using a property description likely related to bitcoin in 2013; in 2015, the number fell to 802. This, despite a clear uptick in cryptocurrency use and trading. The IRS has made cryptocurrency compliance one of its target issues for the 2021 year, so expect this box to get a lot of scrutiny.

MORE FOR YOU

Standard Deductions and Dependents. This routine information and the layout remain the same (only the numbers for the standard deduction have changed: you can find those here).

Charitable contributions. As a result of the CARES Act, charitable cash contributions of up to $300 are temporarily above-the-line deductions. That means that you do not have to itemize your deductions to deduct your charitable contribution. And yes, the $300 limit is per return, so a married couple can only deduct a total of $300.

Income items. Outside of the adjustments to income, there isn’t much difference in income reconciliation. We’ll just have to get used to yet another line number for taxable income (it’s now line 15).

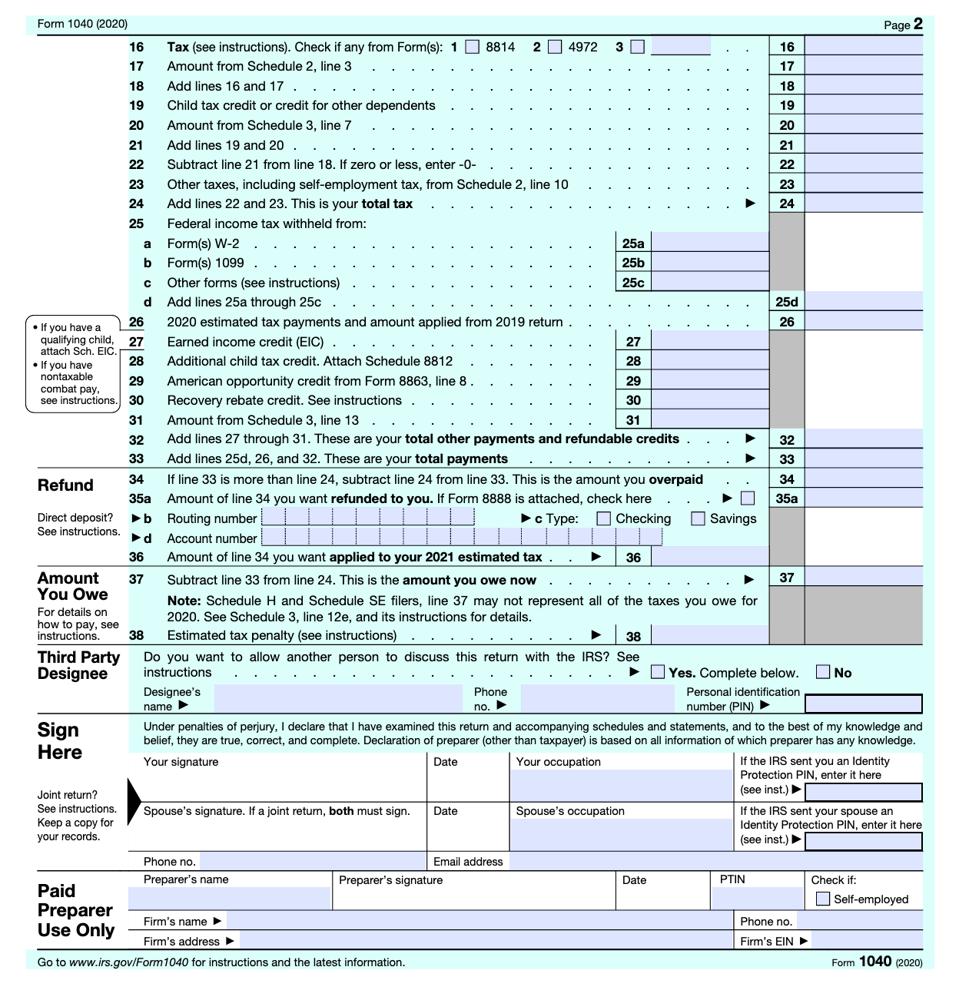

Page Two

Form 1040 for 2020, p2

IRS/KPE

Tax, Credits, and Deductions. One thing that jumps out immediately is that the “Federal income tax withheld from Forms W-2 and 1099” line has now been divided into separate lines (lines 25(a)-(c)) for withholding for Forms W-2, 1099, and “other forms.” This suggests an increased level of scrutiny for the self-employed and gig workers.

And keep in mind that there’s a new Form 1099 in town: Form 1099-NEC, Non-employee Compensation, will replace Form 1099-MISC for gig workers and independent contractors. You can find out more here.

You’ll also post any estimated tax payments and amounts carried forward from last year’s return (if any) on line 26. This is new and much more simple: previously, estimated tax payments were lumped in together on line 18 after you figured the amounts on Schedule 3.

Stimulus Checks. There is a separate reconciliation schedule for stimulus checks that will carry over to page two of your Form 1040. You’ll see it on line 30: Recovery rebate credit. If you didn’t receive the correct amount in your stimulus check in 2019 (for example, you made too much money in 2019 or you had a child in 2020), you’ll make those adjustments on line 30.

The instructions will include a worksheet that you can use to figure what you’re owed. The maximum credit is $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child. The instructions aren’t out just yet, but you can get a sense of what you’ll need to know by checking out the draft instructions.

Refunds. Outside of some renumbering, the refund sections have not changed.

Amount You Owe. Usually, figuring the amount you owe is pretty simple: it’s tax due less credits and payments. But there’s a new line for 2020 which notes: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for 2020. See Schedule 3, line 12e, and its instructions for details.

And yes, Schedule 3, line 12e, is new. It says: Deferral for certain Schedule H or SE filers (see instructions) That deferral? Under the CARES Act, employers may defer the deposit and payment of the employer’s portion of Social Security taxes. The deferral applies to deposits and payments of the employer’s share of Social Security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020, with half being due on December 31, 2021, and the remainder due on December 31, 2022. What does that have to do with Form 1040? The relief also applies to self-employed persons.

Other Information

IP PIN. The spot for an IP PIN isn’t new but more taxpayers may be paying attention this year since there’s an opportunity to opt-in.

Numbered and Lettered Schedules. Form 1040 still has lettered schedules (like Schedule A, Itemized deductions) and numbered schedules (like Schedule 1, Additional Income and Adjustments To Income).

New Schedule LEP. There is a new schedule: Schedule LEP, Request for Change in Language Preference. Schedule LEP allows taxpayers to state a preference to receive written communications from the IRS in a language other than English. The draft instructions suggest that you can choose from 20 languages, including French, Spanish, Japanese, and Farsi.

Form 1040-SR. For 2020, if you were born before January 2, 1956, you have the option to use Form 1040-SR, U.S. Tax Return for Seniors (downloads as PDF).

Expect more information as IRS continues to update forms for what promises to be an interesting tax season!