December 1 is Giving Tuesday 2020. Donating stock to charities can be more effective and … [+]

GETTY

As the stock market reaches new highs, the needs of charities and nonprofits are greater than ever. Making donations of stock instead of cash provides critical financial support to them and a potentially bigger tax deduction for you.

In fact, donating stock instead of cash can be a smart tax-planning move for many types of investors. This is true whether you have greatly appreciated shares acquired long ago in one of the most valuable stocks of 2020 (e.g. Amazon, Apple, Etsy, FedEx); stock from being an early-stage investor in an upcoming hot IPO company (Airbnb, DoorDash); or company shares acquired from the exercise of stock options, the vesting of restricted stock/RSUs, or an employee stock purchase plan.

1. Core Tax Rules For Stock Donations

After you have held stock for more than one year and its price has risen, at the time of the donation you get a tax deduction equal to the fair market value of the stock (i.e. not your lower purchase price, technically known as the cost basis). For stock not held for one year, the deduction is the cost basis or the current fair market value, whichever is lower.

If the sale of the appreciated shares would have triggered long-term capital gains, your deduction is up to 30% of your adjusted gross income (20% for family foundations), and you can carry forward higher amounts for five years. When the sale of the shares would have produced ordinary income or short-term capital gain, the deduction is limited to 50% of your adjusted gross income (30% for family foundations) with five-year carry-forwards. Shares gifted to donor-advised funds receive the same tax treatment.

2. How Stock Donations Are Valued For Tax Deductions

For public companies with an active market in their stock, the fair market value for the donation is the average between the high and the low stock selling prices on the delivery date. For the stock of pre-IPO companies, you need a valuation by appraisal or some other reasonable valuation method. You, with your tax and financial advisors, want to review various sources, including IRS Revenue Ruling 59-60. It lists valuation factors and explains that no general formula fits all private-company situations.

MORE FOR YOU

3. Donation With Stock Can Be Bigger Than With Cash

With a charitable gift of appreciated securities held long-term, the donation you make and the deduction you get are greater than they would be if you were to sell the shares and donate the cash proceeds instead. That is because when you donate shares, you avoid paying the capital gains tax.

Donation Example

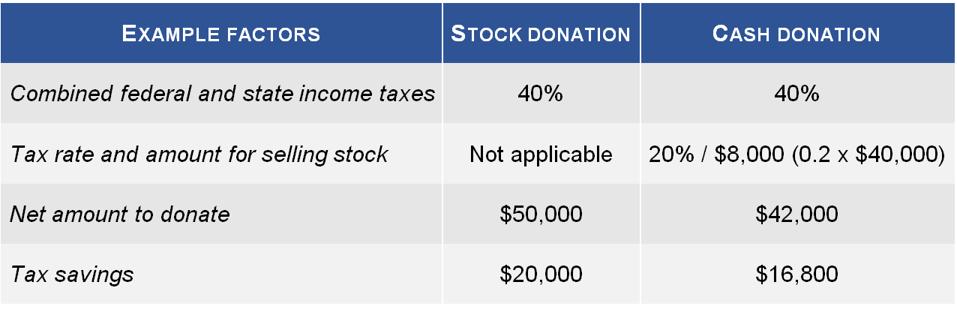

Suppose you can either (1) donate $50,000 in stock held more than one year or (2) sell the stock first and donate the proceeds. The stock has a cost basis of $10,000. You have a 40% combined federal and state tax rate on your income and a combined 20% tax rate on capital gains.

myStockOptions.com

4. Company Stock Can Help Bunch Donations

The advice from many experts is to bunch donations so that your itemized deductions go beyond the Tax Cuts & Jobs Act standard deduction amounts in 2020 of $12,400 for individuals and $24,800 for joint filers (adjusted annually for inflation). If you do not routinely exceed the standard deduction, you can get over it by bunching in a given year donations of stock to charities or a donor-advised fund.

Alert: The CARES Act, adopted in response to the Covid-19 pandemic and related economic crisis, does have provisions on charitable contributions, but they do not involve stock donations. Taxpayers who use the standard deductions instead of itemizing deductions can claim up to a $300 deduction for a cash donation to a charity directly off adjusted gross income (i.e. an “above the line” deduction on Line 10b of the IRS draft 2020 Form 1040). For the 2020 tax year, the legislation also increases the deduction percentage limitation for cash charitable contributions (not stock) from 60% to 100% of adjusted gross income.

5. Extra Time May Be Needed To Process Stock Donations

To obtain a deduction for the current tax year, the stock transfer must be completed by December 31. For electronic transfers from your brokerage account, the donation is recorded on the day it is received (not when you approve the transfer). Plan your year-end stock gifts as early as possible, know the process the charity or nonprofit requires, and have ongoing communications with your broker to ensure that the transfer takes place.

If you have valuable stock in a pre-IPO company, you will want to start the process especially early. Donations and transfers of stock in a private company can take longer than those for stock in public companies and can raise valuation issues.

Donating appreciated stock can be easier through tools like Cocatalyst. Developed with financial advisors, donors, and charities in mind, Cocatalyst has each donor fill out a secure webform and then automatically processes the stock donation with their brokerage firm. Charities of all sizes can use the Cocatalyst system to process their stock donations from donors and receive ACH or check transfers. The company explained to me that the tool is similar to a pass-through donor advised fund (DAF), but focused on directly donating stock, which offers more tax flexibility while retaining the benefits of a DAF.

Alex Chung is the founder of Cocatalyst and a current member of its board. “We wanted to enable every donor to be able to give in a tax effective way without the headache,” he told me. “Maximizing donations through stock donations and other tax strategies is important because it helps charities get every last dollar.”

Alex started Cocatalyst because he wanted to streamline his family office’s philanthropic giving, but he ultimately decided to make the tool available to all. According to Cocatalyst Research, there are over $21 billion in stock donations per year, and that figure is growing at 62% annually. He pointed out to me that philanthropists such as Jack Dorsey (Twitter) and Phil Knight (Nike) have made large contributions using stock in the past year.

6. Must File Special IRS Form

With your tax return, you need to report the stock donation on IRS Form 8283, used for your noncash charitable contribution. The instructions for the form and IRS Publication 561 explain the rules that apply when you must obtain and include a written appraisal. For example, with private-company stock valued at $10,000 or less, a qualified appraisal is not needed (it is for higher amounts), but the charity needs to explain how it determined the valuation. For a donation of publicly traded stock, you do not need an appraisal.

7. Special Issues With Stock Compensation

For a charitable donation of company stock acquired from equity compensation, the tax treatment and rules are the same as they are for donations of any stock to a qualified charity or donor-advised fund. If the donated shares were acquired from incentive stock options (ISOs) or an employee stock purchase plan (ESPP), be sure you donate the shares after you have met the related special holding periods for ISO and ESPP stock (more than two years from grant and one year from exercise/purchase). Executives and directors will also want to review the Section 16 and Rule 144 requirements before gifting or donating company stock.

More Ideas For Financial Planning With Stock

For other ideas on year-end financial and tax planning for company shares, see the year-end articles and FAQs at myStockOptions.com. The website’s section on gifts and donations has additional related content, such as on charitable remainder trusts, private foundations, and estate planning.