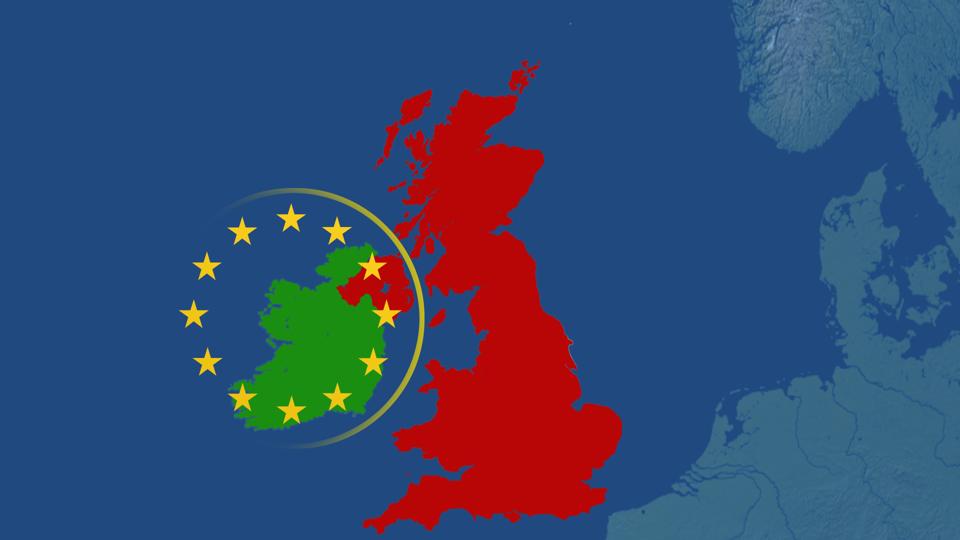

Map of the UK and Republic of Ireland

Getty Images

Current Position

As members of the United Kingdom (UK), goods can move freely between Great Britain (GB) and Northern Ireland (NI). However, the end of the Brexit withdrawal period on 31 December 2020 could result in changes to this and additional tax requirements for these movements.

What Is Changing?

HMRC has issued new guidance, clarifying the VAT rules regarding movements of goods between Great Britain, Northern Ireland and the European Union (EU) from 1 January 2021. Assuming there are no further changes due to the ongoing (at the time of writing) UK/EU trade negotiations or the Internal Markets Bill.

It is proposed that NI will be treated as remaining in the EU for trade with the EU, but within the UK for trade with the UK.

Consequently, intra-EU VAT rules and simplifications applicable to the movement of goods between EU Member States will no longer be available where the goods move to or from GB. In contrast, the EU VAT rules for goods will still apply to goods movements between the EU and NI.

For goods moved (but not sold) by VAT registered business from GB to NI, those transactions are reported as movements of own goods on the UK VAT return. For goods moving from NI to GB, there will only be a requirement to account for VAT when the goods are supplied to a customer (i.e., own goods movements do not create a deemed supply).

Actions – Seven Key Points from HMRC’s Revised Guidance

- VAT Registration of NI Businesses: HMRC confirms that there will be no requirement for new or separate VAT registration for sales of goods in NI, and both GB and NI sales should continue to be reported on a single UK VAT return.

- NI EORI Number: From 1 January 2021, to move goods to or from NI, businesses will need an EORI number that starts with XI. Companies that have an existing GB EORI number can apply for a NI one. Any trader that registered before 23 November 2020 with the government’s recently launched Trader Support Service will automatically be allocated one.

- VAT On Goods sold between GB and NI: HMRC confirmed that VAT-registered sellers should continue to charge UK VAT on goods sold between GB and NI and report this on the VAT return in the usual way. The exception to this includes goods that are 1) declared into a particular customs procedure when they enter NI or GB, 2) subject to a domestic reverse charge, or 3) subject to an onward supply procedure. For these exceptions, the importer is responsible for accounting for the VAT due.

- VAT On Goods Sold Between NI and GB: For goods moving from NI to GB, there will only be a requirement to account for VAT when the goods are supplied to a customer.

- Businesses Moving Their Own Goods From GB to NI: VAT is due on the movement of own goods from GB to NI. This VAT should be payable on the UK VAT return and recovered in line with the standard rules. Businesses will usually recover the full amount of VAT incurred.

- Businesses Moving Their Own Goods from NI to GB: There will be no requirement to account for VAT when a company moves its own goods from NI to GB (unless the goods are subject to a sale or supply to a customer).

- EU Customs Duties will be payable on goods entering NI which are destined for Ireland.

MORE FOR YOU

The UK government states that the Brexit transitional period will not be extended despite the impact of COVID-19 and the current economic environment. Businesses should prepare for the UK’s new trading arrangements, and those businesses trading with NI will need to take extra care to understand the changes in tax requirements.