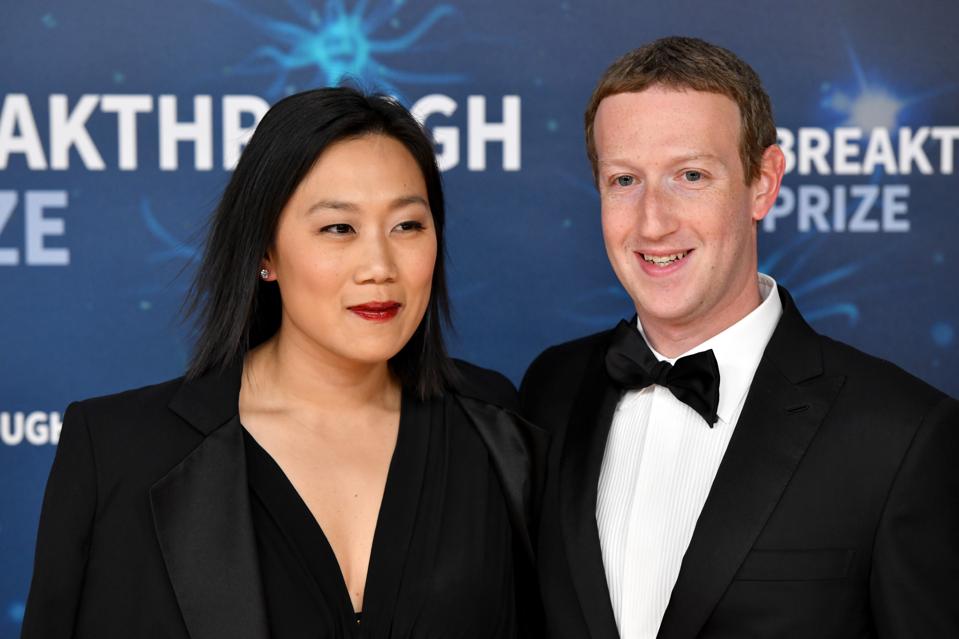

Priscilla Chan and her husband, Mark Zuckerberg, pictured in 2020.

Ian Tuttle/Getty Images for Breakthrough Prize

Proposition 15, a ballot initiative to raise taxes on commercial properties in California, has failed to secure a majority of votes in the state as of Friday, November 6, and appears unlikely to be written into law. As of 9:15 am Eastern Time, it is down 51.8% to 48.2%, with 76% of the results already tallied.

The bill would modify the state code by taxing properties worth more than $3 million at their current market value, as opposed to purchase price. It would raise $6.5 billion to $11.5 billion in funding for schools and local governments, but it has encountered opposition from many businesses, who have said it would increase overhead and, ultimately, the cost of goods for consumers.

The bill received significant support from Mark Zuckerberg, the CEO of Facebook, which is headquartered in Menlo Park and would have owed additional taxes as a result. Three entities he runs with his wife, Priscilla Chan— the Chan Zuckerberg Initiative, the Chan Zuckerberg Initiative LLC and the Chan Zuckerberg Institute—spent a combined $14.6 million to advance Prop 15.

The Chan Zuckerberg Initiative, their main philanthropic arm, is perhaps best known for a lofty $3 billion promise in 2016 to eradicate all diseases. The organization declined to comment for this article.

This year, Zuckerberg and Chan also gave roughly $2.3 million to oppose Prop 20 in California, which would have further restricted early parole for some felonies. That ballot initiative failed, with more than 60% of votes so far against the measure.

Read more about the winners and losers of the 2020 election cycle here.

California restricted tax hikes on both residential and commercial properties in 1978 through Proposition 13. The state now faces an enormous $54.3 billion budget deficit, caused largely by Covid-19. Prior to the pandemic, it had forecast a $5.6 billion surplus. Without Prop 15, local governments will need to find alternative revenue streams, or otherwise cut services, to close the gap.