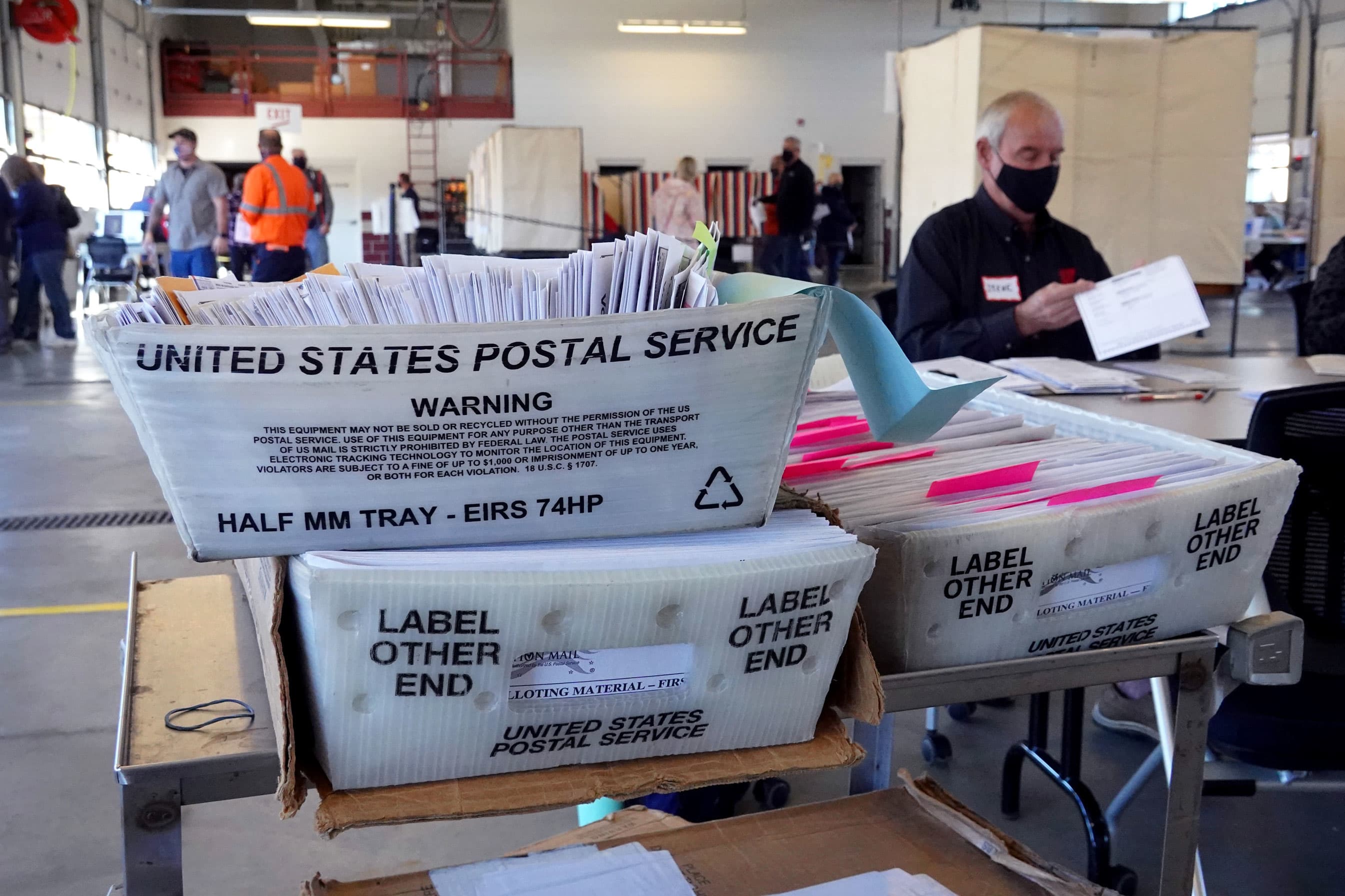

Election officials count absentee ballots at a polling place located in the Town of Beloit fire station on November 03, 2020 near Beloit, Wisconsin.

Scott Olson | Getty Images

Stock futures rose on Tuesday night following a sharp rally during regular trading while investors awaited the result of the presidential election.

Dow Jones Industrial Average futures traded 230 points higher, or 0.8%. S&P 500 futures gained 0.7% and Nasdaq 100 futures advanced 0.5%.

Georgia, Indiana and Kentucky are among the states where polls are scheduled to close at 7 p.m. ET. In Pennsylvania and Florida — two key battleground states — polls are expected to close at 8 p.m. ET.

Traders added risk in other markets as well overnight. U.S. oil futures gained 2%, while futures on the 10-year Treasury fell.

Earlier in the day, the Dow popped more than 500 points, or 2.1%. The S&P 500 gained 1.8% and the Nasdaq Composite advanced 1.9%. Those gains added to Monday’s strong performance.

This week’s market moves come as investors hoped a delayed, or contested, U.S. presidential election result would be avoided and a clear winner would emerge Tuesday night.

“This most recent uptick in prices seems to be a ‘clarity rally’ as investors look forward to finally having the election uncertainty overhang removed,” Adam Crisafulli, founder of Vital Knowledge, wrote in a note Tuesday.

Former Vice President Joe Biden held a 10-point lead nationally over President Donald Trump, according to an NBC News/Wall Street Journal poll released Sunday. Wall Street is also watching some key Senate races, which could lead to Democrats taking control of Congress.

Investors are betting that a so-called blue wave — a scenario in which Democrats win the White House, obtain a Senate majority and keep control of the House — could facilitate the passing of new fiscal stimulus as the economy continues its recovery from the coronavirus pandemic.

“I think that no matter who wins, you have a quick dip and you have to buy,” CNBC’s Jim Cramer said earlier on Tuesday.

The S&P 500 lost 0.4%, on average, the day after presidential elections, according to Baird.

Chao Ma of the Wells Fargo Investment Institute thinks investors with a longer time horizon should not worry too much about the election’s impact on the broader market.

“The history of the economy and the S&P 500 Index suggests that a president’s party affiliation has made little difference when it comes to long-term returns,” said the firm’s global portfolio and investment strategist. “The long-term drivers of the S&P 500 index have been the economy and business earnings, and we expect that to continue to be the case … beyond the 2020 elections.”

One year out from a presidential election, the S&P 500 averaged a return of more than 8%, according to the Baird data back to 1960.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.