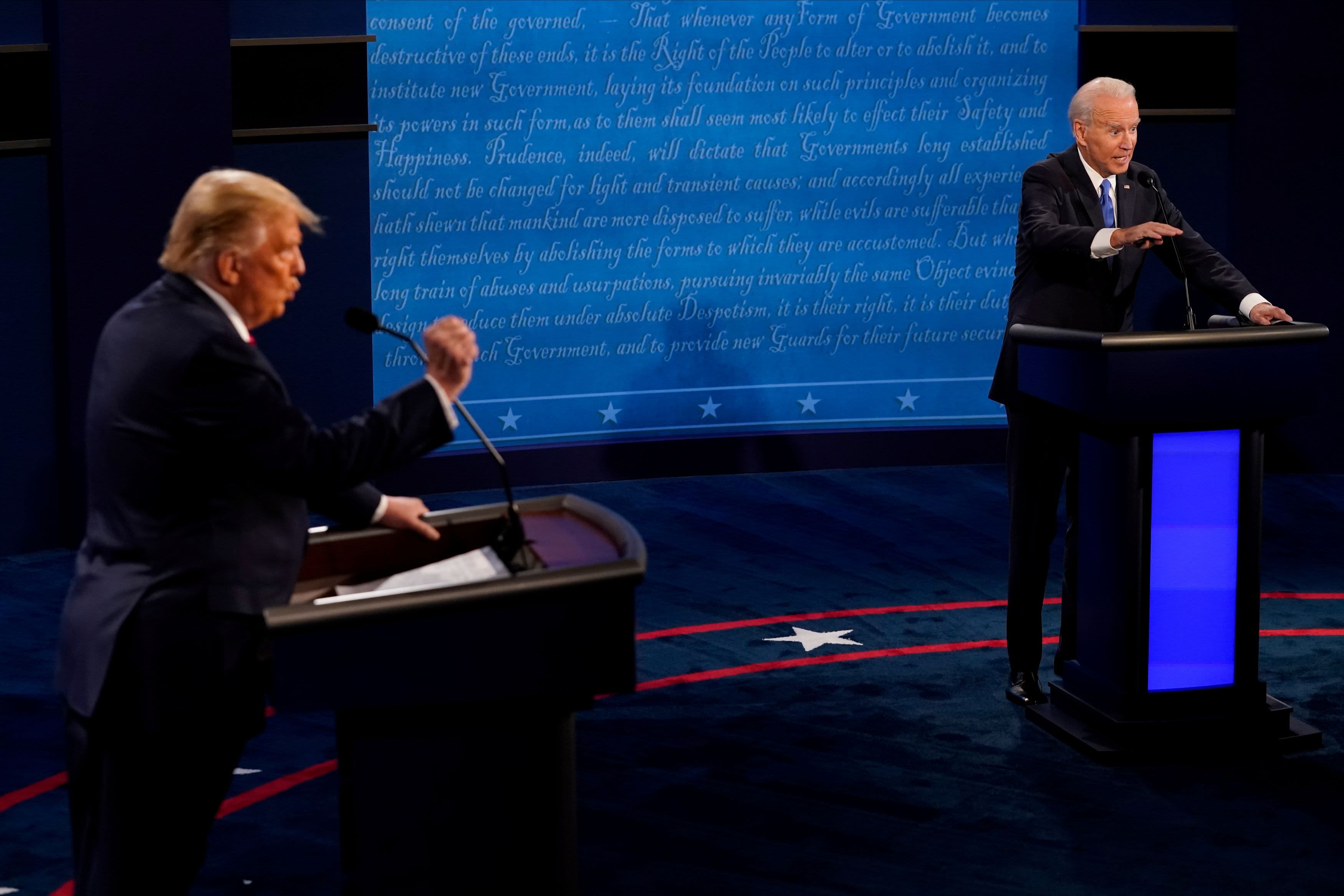

U.S. President Donald Trump and Democratic presidential candidate former Vice President Joe Biden answer a question during the second and final presidential debate at the Curb Event Center at Belmont University in Nashville, Tennessee, October 22, 2020.

Morry Gash | Pool | Reuters

During the pandemic, federal student loan borrowers have been given a break from their monthly bills until the end of the year. As a result, many Americans are focused on more pressing concerns, like being able to pay their rent or put enough food on the table.

But in two months, the bills will become due again and experts predict delinquency rates will jump, with high unemployment rates persisting and cases of the coronavirus continuing to surge across the U.S.

The trajectory of the student loan crisis could be largely determined by the results of Tuesday’s election.

Donald Trump and Joe Biden have proposed very different policies when it comes to the loans, which have long outpaced credit card and auto debt as a burden to Americans. Each year, 70% of college graduates start off their lives in the red, and the average balance is around $30,000, up from $10,000 in the early 1990s. The typical monthly payment is $400.

There’s a strong desire for reform: More than half of Americans say student debt is “a major problem” for the country, according to a Politico/Morning Consult poll.

Here’s what the different views of the candidates may mean for borrowers.

Student loan forgiveness

As president, Biden says he would forgive tuition-related undergraduate federal student loan debt picked up at public colleges and historically Black colleges and universities for those earning less than $125,000 a year.

He would also forgive $10,000 in student debt for all borrowers.

Trump has said nothing about sweeping student loan forgiveness.

Monthly bills

Trump has proposed monthly payments for student loan borrowers that would be 12.5% of their discretionary income. Undergraduate students would pay for 15 years, and graduate students for 30 years.

Meanwhile, Biden has called to set the monthly loan bills at 5% of borrowers’ discretionary income and they would be on the plan for 20 years.

Public service loan forgiveness

Biden would keep the program but make changes to it. Instead of canceling borrowers’ remaining debt after a decade, he would forgive $10,000 a year of their debt for up to five years.