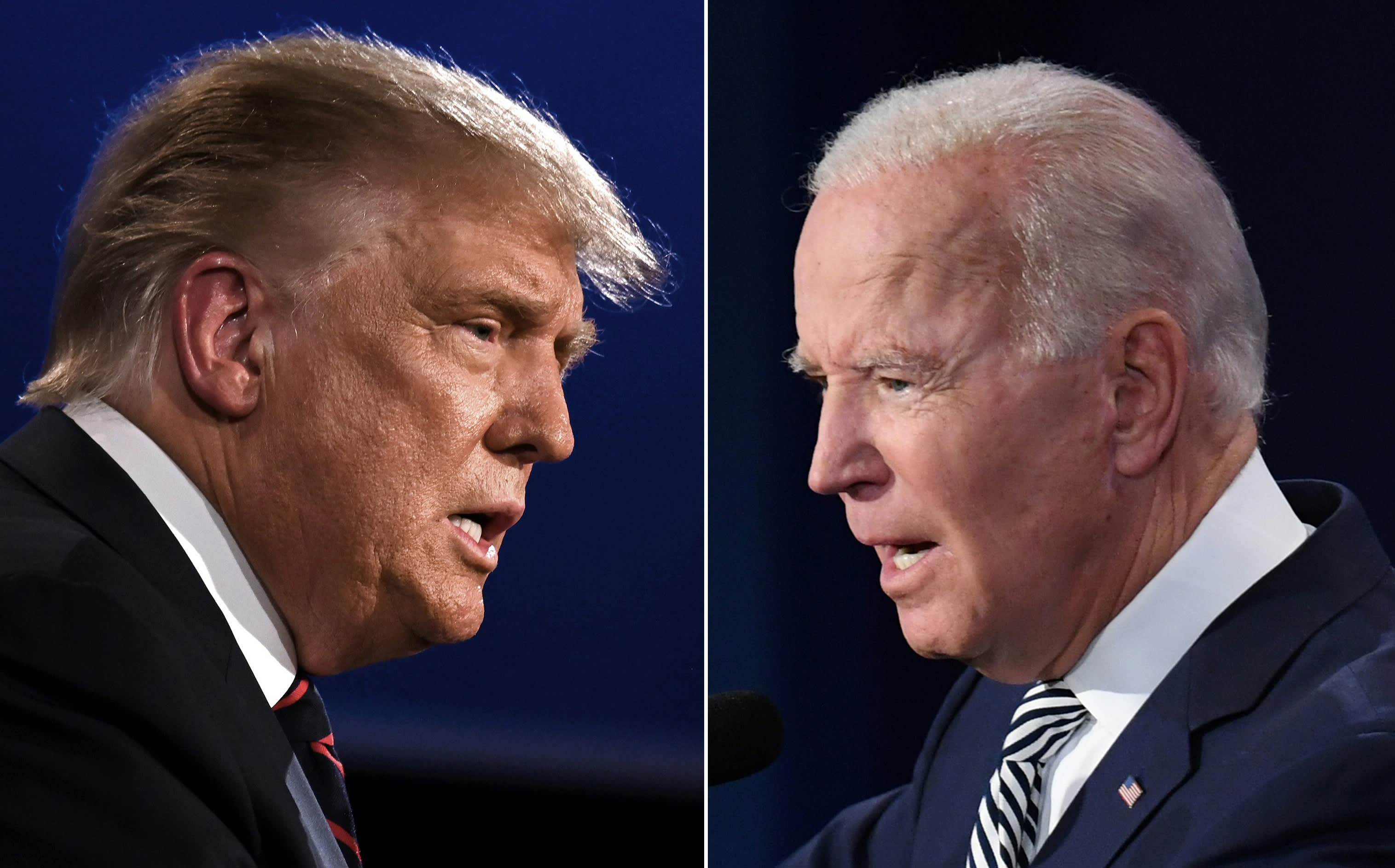

This combination of pictures created on September 29, 2020 shows US President Donald Trump (L) and Democratic Presidential candidate former Vice President Joe Biden squaring off during the first presidential debate at the Case Western Reserve University and Cleveland Clinic in Cleveland, Ohio on September 29, 2020.

Getty Images

For business tax expert Tony Nitti, the significance of this year’s presidential election for Main Street entrepreneurs can’t be understated.

“With zero hesitation, I can say this is the hardest voting decision small business owners have ever faced,” said the partner focused on federal tax at the accounting firm RubinBrown.

A coronavirus pandemic that has rocked many small businesses and caused a previously humming economy to fall into recession, civil unrest that led to downtown closures across the U.S., a cultural divide that is bigger than ever before — and that’s before taking into account the differences between President Trump and Joe Biden on the core business, tax and trade issues that historically have guided many business owner voting decisions.

“I do think there are more variables this election than in recent elections,” said Kevin Kuhlman, vice president of federal government relations at the National Federation of Independent Businesses. “The policy differences are stark, and we have the pandemic creating uncertainty and need for additional financial assistance. There are many short-term and long-term issues that would factor in, and would make a decision difficult.”

Entrepreneurs do vote in large numbers — 95% of small-business owners vote regularly in national contests, according to the National Small Business Association — and the demographic does skew conservative. Forty percent of small-business owners identify as Republican, versus 29% identifying as Democrats, and another 25% who say they are independent. An increasing portion of business owners indicate that they are voting on a more polarized basis. Straight party ticket votes have increased from 18% in 2014 to 27% today, according to a forthcoming survey from the trade group. In 2016, 40% said that neither party best represents their small business, but today, that number is down to 26%.

“More and more are picking sides,” said Molly Day, NSBA spokeswoman.

Here are a few of the biggest business and economic issues that owners are weighing as they cast votes in 2020.

Corporate tax

We know more about Biden’s tax platform than Trump’s for a second term, but that is because the Trump administration passed the biggest tax cuts in decades, so specifics about its future tax moves are less in focus, said Nitti. For Trump, making the tax cuts passed in 2017 permanent in a second term is likely the most significant issue for business owners, as some key provisions will expire in 2025 based on current law.

That includes the 199A deduction which has allowed taxpayers with income from pass-through businesses, such as sole proprietorships, corporations, and partnerships, to deduct up to 20% of their qualified business income from their individual taxes.

The 2017 tax law changes also lowered the corporate rate to 21% for C corporations and that led more businesses to restructure as C corporations to take advantage. Biden is campaigning on an increase to a 28% rate — which would still be lower than the corporate tax rate was in 2016 — but would change the math for businesses that recently reclassified. And if the Democrats take the Senate in addition to presidency, tax changes could happen quickly. “Lots of businesses that welcomed the C corp will have to give it a second look. For the last 31 years it was the entity of last choice,” Nitti said.

NFIB’s Kuhlman said because the majority of small businesses are “pass through” entities when sole proprietors are included.

“For those who are focused on tax issues and are happy with the current tax situation and the current rates and thresholds, they would likely support Trump’s tax and economic vision,” Kuhlman said, adding that it is made even more likely by the fact that the tax changes could expire in 2025 and Trump plans to make them permanent, if reelected.

Income, capital gains taxes, and $400,000

Trump also has talked about lowering the top capital gains tax rate to 15%, which for business owners looking to exit in the next few years, could be significant, according to Nitti.

The president also has talked about eliminating payroll taxes, though there has been little support for the concept, even among his own party. But Nitti said that as a small business owner, there is a lower current tax burden because of the 199A deduction, and it could be reduced even more with a low capital gains tax and low payroll taxes. While maybe not likely, the tax partner said that, in general, Trump’s approach to taxes can result in a clear-cut vote for business owners who see taxes as a huge issue.

“Everything we are hearing from Trump is a common theme of reducing the tax burden. The GOP won’t run on a platform of raising taxes for anyone, let alone small business,” Nitti said.

That is why when it comes to taxes, his clients are paying the most attention to what happens if Biden wins. “His platform makes no bones about increasing taxes,” the tax partner said.

The Biden tax platform does indicate that incomes under $400,000 a year will not experience any tax increases, including provisions like 199A deductions.

“Most are making less than $400,000 a year and should not have a tax increase coming,” Nitti said, but he added that there are obviously small businesses and owners that make over that level and they will experience a tax increase under a Biden presidency. Additional income and capital gains taxes, and payroll and Social Security taxes on taxpayers over $400,000, are an issue for entrepreneurs to consider.

Biden has promised that for taxpayers at the higher levels of income above $400,000, the top individual tax will revert to 39.6%, up from 37% currently. Long-term capital gains will also be taxes at 39.6% on income above $1 million.

That can be important for small business owners holding valuable assets that they may be potentially selling in the future and Nitti said it is a conversation he is having with clients all the time, with many entrepreneurs worried about how fast that tax change could become law and whether they should be selling their business sooner rather than later.

“They are definitely taking this seriously right now,” he said. A business may have never had a very significant windfall in any given year, but “selling a life’s work” is a seminal moment, he said, and when an owner does exit the business they do not want to pay a much higher tax rate on the sale and any real estate that could be included as part of it as well.

Estate tax

As older owners plan their exit strategies, they do want to know that they have the option to pass on the wealth they have created to heirs on favorable tax terms in the event of death. Biden is planning to make changes to estate taxes which will affect the wealthiest Americans, and some small business owners among them.

Among the most important is Biden’s planned elimination of the step-up basis for passing on assets to heirs, something to which small business owners pay close attention.

Nitti said there will be ways for business owners to adjust their estates and limit the potential hit, but it does mean they need to sit down with estate planning experts and put in place a new plan to protect their assets. Doing nothing could ultimately mean taking a much bigger estate tax hit.

NFIB’s Kuhlman said the individual tax rates and pass-through rates are the highest priority, followed by the corporate rate, and then estate taxes. The percentage of small businesses that need to do planning around estate taxes is significant, Kuhlman said, and while there are options to minimize tax consequences, it takes time and resources.

Covid-19

Small business tax experts said that in this election, even with all of the potential tax implications, it can be hard for entrepreneurs to focus on the longer-term view when they are worried about making it to next year.

Kuhlman said recent surveys conducted by the NFIB do showing improving confidence among business owners, but more stimulus is needed for small businesses and without another round of financial support from the federal government many businesses will not be around in the future to worry about their tax rates.

That is not an issue which Main Street blames on any one figure. “Business owners are angry at everyone,” Kuhlman said. “I think the discussion of tax policy and labor policy and even health-care are back of mind, and front of mind, top of mind is the very acute and urgent threat,” he said.

According to the NFIB, about half of business owners anticipate needing additional financial help in the next 12 months. What is more frustrating for Main Street is that “it’s never been the small business elements holding back a deal,” he said. “We’re recovering from near record lows in small business confidence over the summer and that’s good, but the uncertainty elements of that also continue to be high.”

“They blame everyone,” said Nitti. “”But Trump is the man in charge and the buck stops there, and we should not still be in this situation. The argument can be made that the economy can never recover until the pandemic is under control.”

Tax policy is always important to small business and that will check the box for Trump. … But we have this weird dichotomy. They trust a Trump presidency allow them to open the doors, but don’t feel confident a Trump presidency will take care of the pandemic in a way that keeps friends and family and customers safe.

Tony Nitti

federal tax partner at RubinBrown

The pandemic leaves small business owners with some almost-impossible choices. A vote for Trump could mean a vote for more liberal reopening policies and more business protection from liability related to Covid cases among employees and customers.

“The pandemic is not partisan. Just because Trump gets reelected doesn’t mean businesses can reopen, or Biden that the pandemic goes away.”

But Nitti said for some business owners who voted for Trump in 2016 largely based on hopes for a tax cut, the last four years culminating in Covid-19 have led them to conclude that it wasn’t worth it. “They will go in a different direction, and the pandemic changed that,” he said.

“Tax policy is always important to small business and that will check the box for Trump. … But we have this weird dichotomy. They trust a Trump presidency allow them to open the doors, but don’t feel confident a Trump presidency will take care of the pandemic in way that keeps friends and family and customers safe.”

NFIB has pushed back against the type of emergency standards that Biden supports OSHA putting in place, and of which labor unions have been strong proponents.

Kuhlman described the debate over business liability as another example of “stark” policy differences and he noted that over half of its small business survey audience indicate in surveys they are very concerned about lawsuits, a data point that has ranged from 55% to 70% in recent work, and yet there seems to be a lack of middle ground in D.C. It is an issue he noted that House Speaker Nancy Pelosi has indicated is a sticking point, and Senate Majority Leader Mitch McConnell has referred to as a “red line.”

Small business owners in their own words

Not all small business owners are being driven by core tax and regulatory factors. Some small business owners are still more impacted by Trump’s trade war with China than any other factor, and entrepreneurs are individuals — some are swayed more by personal political philosophies and fears.

Adam Miller, 28-year-old owner of Revel Bikes, a high-end bike manufacturer in Carbondale, Colorado, says the pandemic has led to a boom in his business as more Americans flock to outdoor activities and away from overseas vacations, and stimulus in response to Covid triggered more consumer spending. “I feel like I couldn’t be luckier. We can barely keep up with demand,” he said.

But Miller — who as an outdoor enthusiast has problems with Trump’s environmental record and as an owner recently began offering health insurance to all of his 18 employees even though it was costly because he believes health care is a right — is voting for Biden.

“I am on the liberal side of things, which is tough when you own a small business. I am quite in the middle when it comes to taxes because I can see the GOP side of things,’ Miller said, explaining that higher taxes means less money for entrepreneurs to reinvest and that can mean less hiring.

But whether the tax rate is higher or lower, he said the uncertainties that come with a Trump presidency weigh more heavily on his vote. Though it has moved some manufacturing to other parts of Asia in recent years, Revel relies to a large degree on manufacturing in China. Miller, who funded his business “with my house and bank loans” said the combination of tariffs and the constantly changing administration position on trade is a larger concern than paying more in taxes. “Biden will make it so I pay 7% more in taxes, but if I don’t have unknown and radical changes making it hard to do supply chain planning, I’m confident I’ll make more profits,” Miller said. “I spent the last four years of my life flying to China once every few months. Any business owner who manufactures overseas should steer far away from a Trump presidency.”

The pandemic has added to that vote against Trump based on uncertainty. “If I look at the short term, we won’t have as many mandates under Trump as Biden for opening and closing, but long-term, if this virus is not under control, we will keep having the same problems,” Miller said. “If the pandemic is not under control it will hurt all of us long term.”

Miller see Biden as a vote for stability. “As a business owner, if you are putting out fires every day, how can you run a business under that regime?”

Other business owners are viewing stability in terms more closely aligned with individual political preferences. Ben Thomas, owner of 5 Pound Apparel in Springfield, Missouri who identifies as independent, voted for Trump in the last election, and said he is leaning that way again now, sees the pandemic as a global problem over which it is unfair to blame Trump.

I wish Trump would act more presidential sometimes, and I hear many people say they can’t take it and that’s why they won’t vote for him. In my circle, everyone just talks about how they wish there were better options on the table.

Ben Thomas

owner of the 5 Pound Apparel retail shop in Springfield, Missouri

He is not happy with Trump’s messaging on masks, but his retail shop has held up well during the pandemic, and being shut down for roughly seven weeks forced Thomas to launch an online shop and monthly subscription service — ideas he was thinking about pre-Covid but did not enact until the pandemic triggered quick action. Now sales are similar to the level from before coronavirus.

Thomas is not motivated to vote from Trump based on the pandemic, or taxes. “Taxes are one of those things necessary to operate in a country where we pave roads, and everyone is part of the system … it doesn’t play into how I view the election. I would say I vote more as an individual,” he said.

Ultimately, he is being swayed by fear, but not the same fears that Miller has of aTrump second term and uncertainty waying on business decisions. In fact, for Thomas, even amid the pandemic, the current president is the better bet for stability.

“I am a little bit scared of what Biden would do … policies like the Green New Deal. … Change for the sake of change isn’t good,” Thomas said. “I definitely prefer a candidate other than Trump or Biden. I think Biden is a relatively moderate Democrat but I don’t know if he can fight off the far left progressives in party. … I wish Trump would act more presidential sometimes, and I hear many people say they can’t take it and that’s why they won’t vote for him. In my circle, everyone just talks about how they wish there were better options on the table. But fundamental structural changes scare me more, and are coming from the Democratic side.”