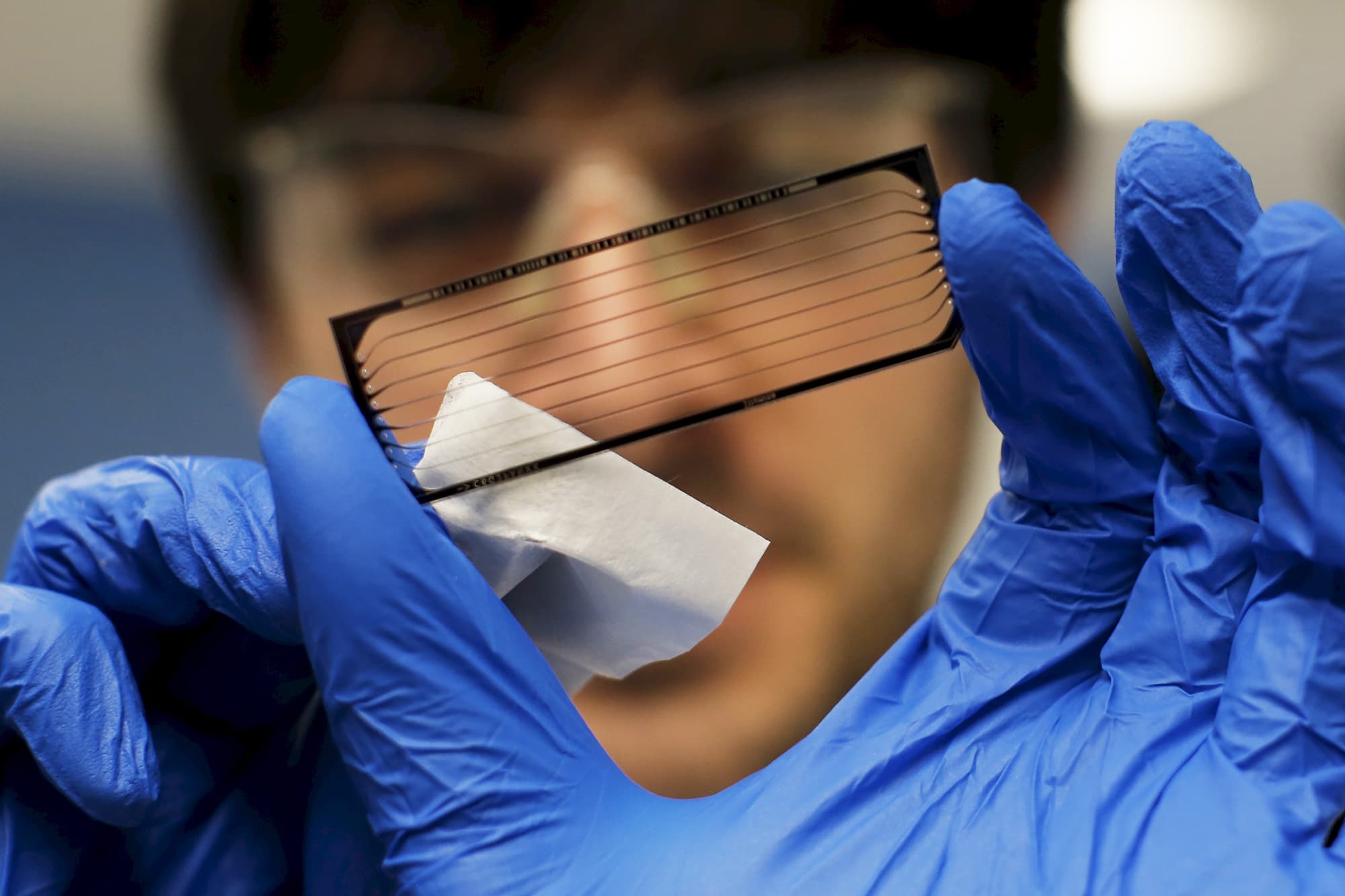

A technician prepares a flow cell slide for loading onto a genetic sequencing machine at a Regeneron Pharmaceuticals laboratory at the biotechnology company’s headquarters in Tarrytown, New York

Mike Segar | Reuters

Check out the companies making headlines in midday trading.

Regeneron — Shares of the biotech company rose 5.9% after President Donald Trump used Regeneron’s experimental antibody cocktail as part of his treatment for Covid-19. Cantor Fitzgerald upgraded the stock to overweight from neutral, citing potential growth from the antibody treatment and a dermatitis treatment.

CrowdStrike — Shares of CrowdStrike rallied more than 4% after Goldman Sachs upgraded the cyber security company to buy from neutral. The Wall Street firm said CrowdStrike was a “technology leader” and had “best-in-class” economics, with room for its stock to run.

AMC Entertainment — The movie theater stock sank more than 10% after rival Cineworld announced that it would close its theaters in the U.S. and UK. The decision comes after several major releases, including a new James Bond film, were pushed back until 2021. Last week, S&P Global Ratings lowered its issuer credit rating on AMC from CCC+ to CCC-.

DraftKings – Shares of DraftKings fell more than 6% after the sports betting company announced a public offering of 32 million class A shares. The offering consists of 16 million shares from DraftKings and 16 million shares from certain selling stockholders. The company will not receive any proceeds from the sale offered by the stockholders. DraftKings will use the proceeds that it receives for general corporate purposes.

Stryker —The stock rose 2.5% after Evercore ISI added the medical technology company to it its tactical outperform list and said it sees “better-than-expected” recovery trends ahead of Stryker’s third-quarter earnings.

MyoKardia – Shares of the biotech name jumped more than 58% after the company said it is being bought by Bristol-Myers for $13.1 billion, which represents a 61% premium to Friday’s closing price. “The acquisition of MyoKardia further strengthens our portfolio, pipeline and scientific capabilities, and is expected to add a meaningful medium- and long-term growth driver,” Bristol-Myers said in a statement.

McDonald’s – Shares of McDonald’s rose more than 1% after Bank of America raised its 12-month price target on the fast food chain to a Wall Street high of $250, which represents a 10% gain for the stock. BofA said that McDonald’s has benefited from consumers turning to drive-thru dining options amid the pandemic. CNBC’s Jim Cramer also Monday called McDonald’s a “very high quality company.”

Eidos Therapeutics – The biotech company gained more than 42% after it said it will merge with BridgeBio Pharma. Eidos shareholders have the option to receive either $73.26 in cash per share, with the cash payout limited to $175 million, or 1.85 shares of BridgeBio Pharma.

Starbucks — Shares of the world’s largest coffee chain ticked 1.6% higher after Oppenheimer named Starbucks an “actionable buy idea” and said it sees “attractive earnings power” for the coffee company.

— with reporting from CNBC’s Jesse Pound, Yun LI and Pippa Stevens.