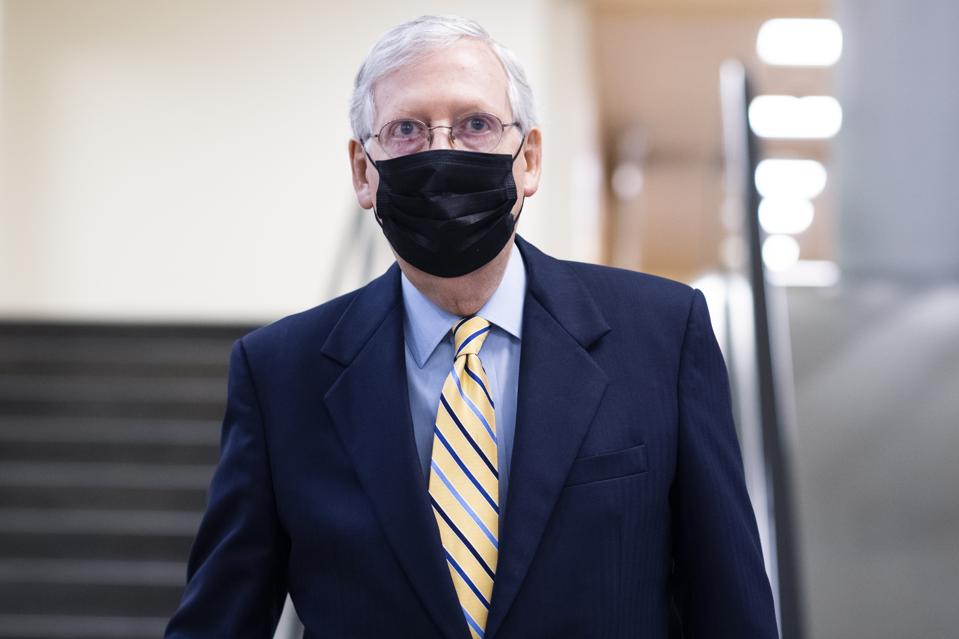

UNITED STATES – SEPTEMBER 10: Senate Majority Leader Mitch McConnell, R-Ky., is seen in the basement … [+]

CQ-Roll Call, Inc via Getty Images

If you invest lifespan in the 285 pages of what is known as the Senate skinny bill, which has nothing to do with skinny dipping, you will never get that time back, so I did it for you. The title is Delivering Immediate Relief to America’s Families, Schools and Small Businesses Act. Here is a link that will give you a pdf download. Ignore the top paragraph about condemning gross human rights violations of ethnic Turkic Muslims, the bill starts half-way down the page.

Apparently the consensus is that this bill is going nowhere even if it passes the Senate, but it might be valuable in giving insight into Republican priorities. I will share what struck me.

The Curious Incident

What many people are interested in is another stimulus check. Here we have another example of the wisdom of Sherlock Holmes. This one is from the Silver Blaze.

Gregory (Scotland Yard detective): Is there any other point to which you would wish to draw my attention?

Holmes: To the curious incident of the dog in the night-time.

Gregory: The dog did nothing in the night-time.

Holmes: That was the curious incident.

Nothing on another stimulus check in the skinny bill. Curious. Let’s move on to what Republicans find important.

Liability “Relief”

After moving some money around, we get to ‘‘Safeguarding America’s Frontline Employees To Offer Work Opportunities Required to Kickstart the Economy Act’’ or the “SAFE TO WORK Act” (I’ll go with STWA).

STWA starts with some editorializing beginning with:

The SARS–CoV–2 virus that originated in China and causes the disease COVID–19 has caused untold misery and devastation throughout the world, including in the United States.

And going on to Page 10, where the Constitutional lesson begins. They have to explain why they are getting ready to ride roughshod over state’s rights.

Congress can deploy its power over interstate commerce to promote a prudent reopening of businesses and 18 other organizations that serve as the foundation and backbone of the national economy and of commerce among the States.

We get down to brass tacks on Page 11.

Congress must also safeguard its investment of taxpayer dollars under the CARES Act and other coronavirus legislation … CARES Act funds cannot be diverted from these important purposes to line the pockets of the trial bar. (Emphasis added)

There is an explanation of how one of the biggest things slowing down the opening of the economy is the fear of being sued. And there are all those medical decisions affected by fear of litigation. That is followed by another swipe at the trial lawyers on Page 13 in case you missed the first one.

These lawsuits also risk diverting taxpayer 2 money provided under the CARES Act and other coronavirus legislation from its intended purposes to the pockets of opportunistic trial lawyers.

The definitions start on Page 17. What STWA actually does commences on Page 31 and continues to page 70. A some what educated layman’s perspective is that it makes it harder to sue if the suit is related to Covid-19. It is easier to pull the case into Federal District Court. I have tried reaching out to tort attorneys but not have heard back.

One observation I have picked up over the years is that when you manage to make a federal case out of it, the lawyering is harder to do which will discourage the less bookish among those opportunistic trial lawyers.

Two of my good friends were trial lawyers. One told me of his business plan of doing wills and divorces for short money, because then he was their lawyer and anybody can get hit by a car. When my mother literally got hit by a car, she called me to let me know that she was OK and that a nice man from the insurance company had been out to see her. I told her to call my friend Benny right away. I think he got her about five grand for getting knocked on her you know.

Anyway, I like trial lawyers even the opportunistic one. The only ones I don’t like are the ones who sue CPAs for malpractice. And there is really nothing special when it comes to liability about Covid-19. It is just a matter of people who are in favor of tort reform seeing an opportunity to get their nose under the tent.

Assistance For American Families

The Continued Financial Relief to Americans Act of 2020 starts on page 71. I suppose this is where the second stimulus check would have been, had there been one. So it goes.

Federal Pandemic Unemployment Compensation would be continued under the act until December 31, but at a rate of $300 rather than $600. I am sure that Democrats will call this a cut, but that is really unfair, since without some action it is at zero.

Small Business

The Continuing Paycheck Protection Program Act starts on Page 73. The curious incident there is that there is no mention of the IRS position that made the income exclusion of PPP pointless. That is probably the biggest concern of accountants, besides getting stiffed by the banks, which also goes unmentioned.

There are a few sorts of expenses that are added to the list of what you can spend PPP money on. Lenders are allowed to rely on statements by borrowers.

Something that will make accountants cheer is on page 83. SBA will have to give out a one-page form for borrowers under $150,000 to apply for forgiveness.

There is a lot more as it goes up to page 136, but nothing that stood out to me. Remember this is probably not going to pass so studying the details might just confuse you when you go to apply whatever ultimately does pass.

Instead Of Paying Taxes Give Money To Private Schools

I’m skipping the Post Office and moving to Education Freedom Grants on page 138. This one is Republican ideology in spades.

It defines an Eligible Scholarship-Granting Organization. An ESGO provides scholarships for students to attend private elementary and secondary schools. Federal money will be appropriated for them and states will allocate their share.

More significantly a new credit is added to the Internal Revenue Code. Under Section 25E, there would be a 100% credit for donations to an ESGO. The credit allowed is limited to 10% of AGI with a five year carryforward. For corporations the limit is 5%.

This straight up taking federal tax collections and turning them over to private schools. There is an overall limit on the credit of $5 billion which will be allocated among the states in proportion to school age population.

The devilish details of the program bring us up to page 163.

There we have something on allowing 529 money to be used for primary and secondary schools and used for home schooling expenses.

Charitable Giving

This would raise the above the line charitable deduction to $600 – $1,200 for a joint return. The expected scamming that this will lead to is addressed by raising the accuracy penalty to 50% from 20% in the case of overstating above the line charity.

It is on pages 185-208.

Other provisions

On child care there is a grant program that runs from Page 166 to 189. Then comes the Pandemic Preparation And Strategic Stock-Pile from 189-195.

Critical minerals are covered from pages 209-243. I didn’t find the balance all that interesting.

Already Failed

As I write this the New York Times reports that the bill has already failed to pass the Senate. I still think it is worthwhile to take a look at the provisions as a window into the Republican mind.

no individual or entity engaged in businesses, services, ac6 tivities, or accommodations shall be liable in any 7 coronavirus exposure action unless the plaintiff can prove 8 by clear and convincing evidence that—

in engaging in the businesses, services, ac10 tivities, or accommodations, the individual or entity 11 was not making reasonable efforts in light of all the 12 circumstances to comply with the applicable govern13 ment standards and guidance in effect at the time 14 of the actual, alleged, feared, or potential for expo15 sure to coronavirus;

the individual or entity engaged in gross 17 negligence or willful misconduct that caused an ac18 tual exposure to coronavirus; and 19 (3) the actual exposure to coronavirus caused 20 the personal injury of the plaintiff.

f an individual or enti15 ty engaged in businesses, services, activities, or 16 accommodations maintained a written or pub17 lished policy on the mitigation of transmission 18 of coronavirus at the time of the actual, alleged

Emergency Education 4 Freedom Grants; Tax Credits for 5 Contributions to Eligible Schol6 arship-granting Organizations

PROGRAM AUTHORIZED.—From the funds 13 appropriated to carry out this section, the Secretary 14 shall carry out subsection (c) and award emergency 15 education freedom grants to States with approved 16 applications, in order to enable the States to award 17 subgrants to eligible scholarship-granting organiza18 tions under subsection (d).

(1) IN GENERAL.—Section 6662(b) of the In4 ternal Revenue Code of 1986 is amended by insert5 ing after paragraph (8) the following: 6 ‘‘(9) Any overstatement of qualified charitable 7 contributions (as defined in section 62(f)).’’. 8 (2) INCREASED PENALTY.—Section 6662 of 9 such Code is amended by adding at the end the fol10 lowing new subsection: 11 ‘‘(l) INCREASE IN PENALTY IN CASE OF OVERSTATE12 MENT OF QUALIFIED CHARITABLE CONTRIBUTIONS.—In 13 the case of any portion of an underpayment which is at14 tributable to one or more overstatements of a qualified 15 charitable contribution (as defined in section 62(f)), sub16 section (a) shall be applied with respect to such portion 17 by substituting ‘50 percent’ for ‘20 percent’.’’.