When you think of real estate investment trusts (REITs), you might think of office parks… outlet malls… or residential leases. In more recent years, you might even think of rooms filled with giant data processors.

I’m guessing you probably don’t think of buildings lined wall to wall with boxes of paper documents…

Yet, that’s exactly what makes Iron Mountain Incorporated (IRM) such a unique REIT.

If you’re not familiar with Iron Mountain, the company is a world leader in storing critical information.

Wills and other legal documents… Tax returns… Valuable artwork… Hand-written love notes between your grandparents…

Iron Mountain doesn’t ask what’s in the box (insert Brad Pitt joke here) — It just keeps the contents safe.

If you look inside some of its physical storage locations, you’d likely see something like this…

Iron Mountain’s racking system, which was designed to “withstand the 8.8 magnitude earthquake in … [+]

www.mecalux.com

Iron Mountain’s racking system, which was designed to “withstand the 8.8 magnitude earthquake in 2010 that devastated the Chilean regions of Maule and Bio Bio.”

Yikes… not exactly exciting, right?

Wrong.

In fact, Iron Mountain’s locations provide a home to some of the most important documents in modern history.

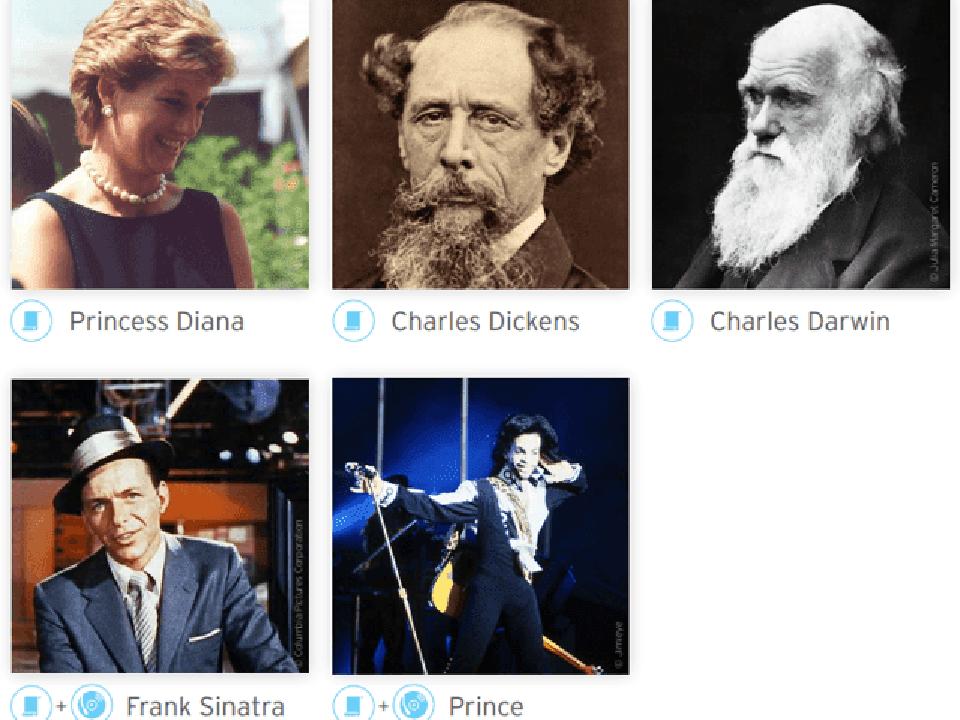

Recognize any of these people?

Iron Mountain stores the wills of figures like Princess Diana, Charles Dickens, and Charles Darwin… … [+]

Iron Mountain website

They’re all clients of Iron Mountain (in a sense)…

That’s right — the company stores the wills of figures like Princess Diana, Charles Dickens, and Charles Darwin… as well as the original recordings of pop culture icons like Frank Sinatra and Prince.

Achieving the Coveted REIT Status

The reason Iron Mountain was able to achieve the REIT designation was thanks to its steel shelving systems.

Specifically, just over four years ago, Iron Mountain obtained a private letter ruling (PLR) from the IRS, characterizing its racking structures (seen in the top photo) as real estate.

This was an important milestone — it allowed IRM to follow the steps of Equinix

EQIX

By converting to a REIT, Iron Mountain was also able to pay out a larger dividend. (Currently, the payout represents about an 8 percent yield, according to CEO William Meaney, whom I had on my podcast recently to interview about the company.)

While, since the PLR, IRM shares have underperformed the broader REIT market… Iron Mountain has an incredible reach that few other companies in the space offer — specifically, relationships with 950 of the Fortune 1000 companies.

Plus, maybe more importantly… the company is undertaking an enormous transition into faster-growing business segments — one that, so far, has been proving successful…

Bigger than Boxes

You might see cardboard file boxes and think this company is stuck in a time warp…

But that’s not at all the case — for a few reasons.

To start, Iron Mountain has an incredible knack for converting its physical customers to the cloud — a market that is expanding at a rapid pace. The company writes in its white paper: “According to IDC, 49 percent of data will be stored in public cloud environments by 2025. And nearly 30 percent will be consumed in real time.”

In fact, according to the paper, the company has already invested over $2 billion in “cutting-edge global data center infrastructure.”

Currently, Iron Mountain owns 14 data storage centers across the U.S., Europe, and Asia, and it continues to bring in new business. For instance, the company recently signed a huge lease with a Fortune Global 200 company out of Singapore.

The company is aiming for these data center locations to account for 10% of adjusted earnings before EBITDA by the end of 2020.

But truthfully, it’s already delivering impressive results: According to Meaney, the company guided at 15–20 megawatts for all of 2020. By the end of the first half, it’s already hit over 38 megawatts, and counting.

“So clearly, we’re having a lot of success in our data center, even beyond what our expectations were — and there’s an opportunity to deploy even more capital,” said Meaney.

Secondly… it turns out, the physical data storage business is actually quite profitable — yes, even in 2020.

(Maybe that shouldn’t come as a surprise after learning about the wills of Princess Diana and Prince.)

The company has an impressive global footprint with its legacy business, spanning over 50 counties, including Singapore, Amsterdam, and — of course — the U.S.

Think about it this way: Every single storage box acts as a revenue driver. What’s more, the company holds onto over 50 percent of its clients’ boxes for 15 years or longer.

“I know that people may not think it’s sexy storing paper, but I’ll tell you it’s a hell of a good business,” said Meaney. “It probably infuriates people that we keep printing 4% organic EBITDA growth, because they say, ‘How can you do that storing physical stuff?’ But it’s a very, very good business.”

Thirdly, although the steel racking structures were instrumental in the company achieving REIT status… that’s not its only valuable property: The company still has around $2.5 billion of “owned” real estate at its disposal.

But maybe most importantly, this business model is somewhat recession-proof — and seemingly even pandemic-proof. Trusted assets (legal documents, collectibles, personal mementos, what have you) will never disappear — we wouldn’t want them to.

The fact that we care so much about items like these — that we require safety and security in storing them for years, or even decades, at a time — is why a company like Iron Mountain can survive even the most trying times.

A Closer Look at the Fundamentals

Some analysts call Iron Mountain a “blue chip.” I’m not sure about that designation, considering the S&P 500 rates the company as BB- — one downgrade away from a B+.

A B rating means a company is capable of meeting its current obligations… but an adverse economic development could spell future problems for the company.

Still, Iron Mountain operates a unique business model that derives revenue from multiple sources — primarily storage, both physical and digital.

As for leverage, it does run higher with a target of 4.5–5.5x. But it’s driving that down, in part by simplifying its business model by consolidating external reporting segments and streamlining the management structure. Prior to COVID-19, the company reduced its VP count by approximately 45 percent so far. And it plans to cut around 700 positions in all this year and next.

These actions could add as much as $375 million in EBITDA through 2021. As of the first quarter (Q1) of 2020, it had a cash balance of $150 million and $1 billion left in the chamber. And there are no significant debt maturities on its horizon.

Sure, that’s all well and good… But the real question you’re likely asking…

The Real Question: Can the Dividend Be Trusted?

As you probably know, REITs are required to pay out at least 90 percent of their taxable income in the form of dividends.

You probably also know some of the tell-tale signs of a dividend in danger.

While it took a COVID-related hit to profits in the first half of the year (Meaney called them “impactful” but “not major”), the business has the resources to weather the storm.

So what’s the outlook for Iron Mountain’s payout?

The company raised its dividend slightly coming into the year… but announced the payout would remain flat through the remainder of 2020 — and likely, for a while.

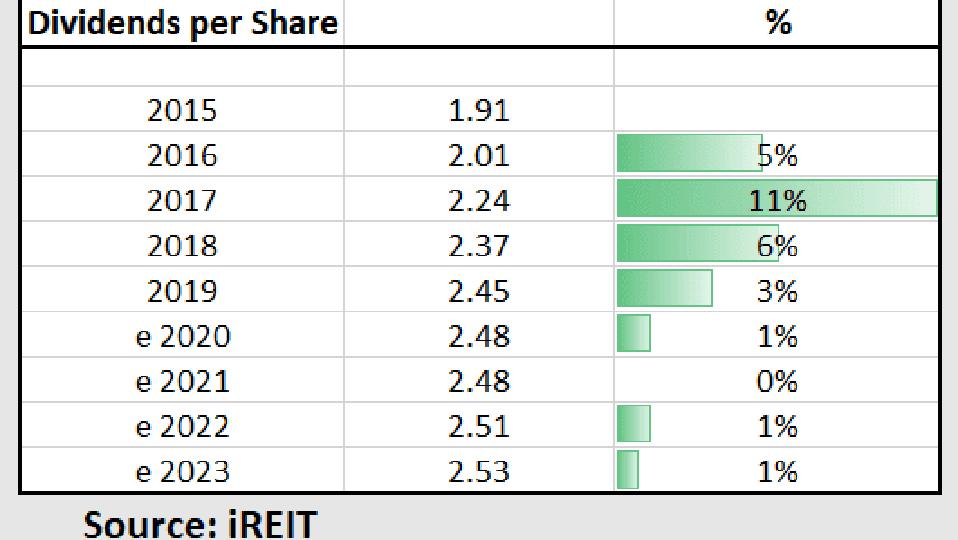

Also, let’s examine Iron Mountain’s historical dividend-per-share rate:

Iron Mountain Dividends per Share.

iREIT

Clearly, Iron Mountain’s dividend growth engine has slowed. And, in terms of the payout ratio, its dividend safety score isn’t as good as it was before.

However, assuming analysts are right about Iron Mountain delivering 15 percent growth in 2021, its payout ratio could improve to 75 percent.

Everything else aside, Meaney told me that the company is philosophically committed to its dividend.

“When you’re an income-oriented stock, that’s an important trust bond that you have with your investors. And it’s one that, luckily, with our business model, we’re able to honor.”

Brad Thomas owns shares in IRM.