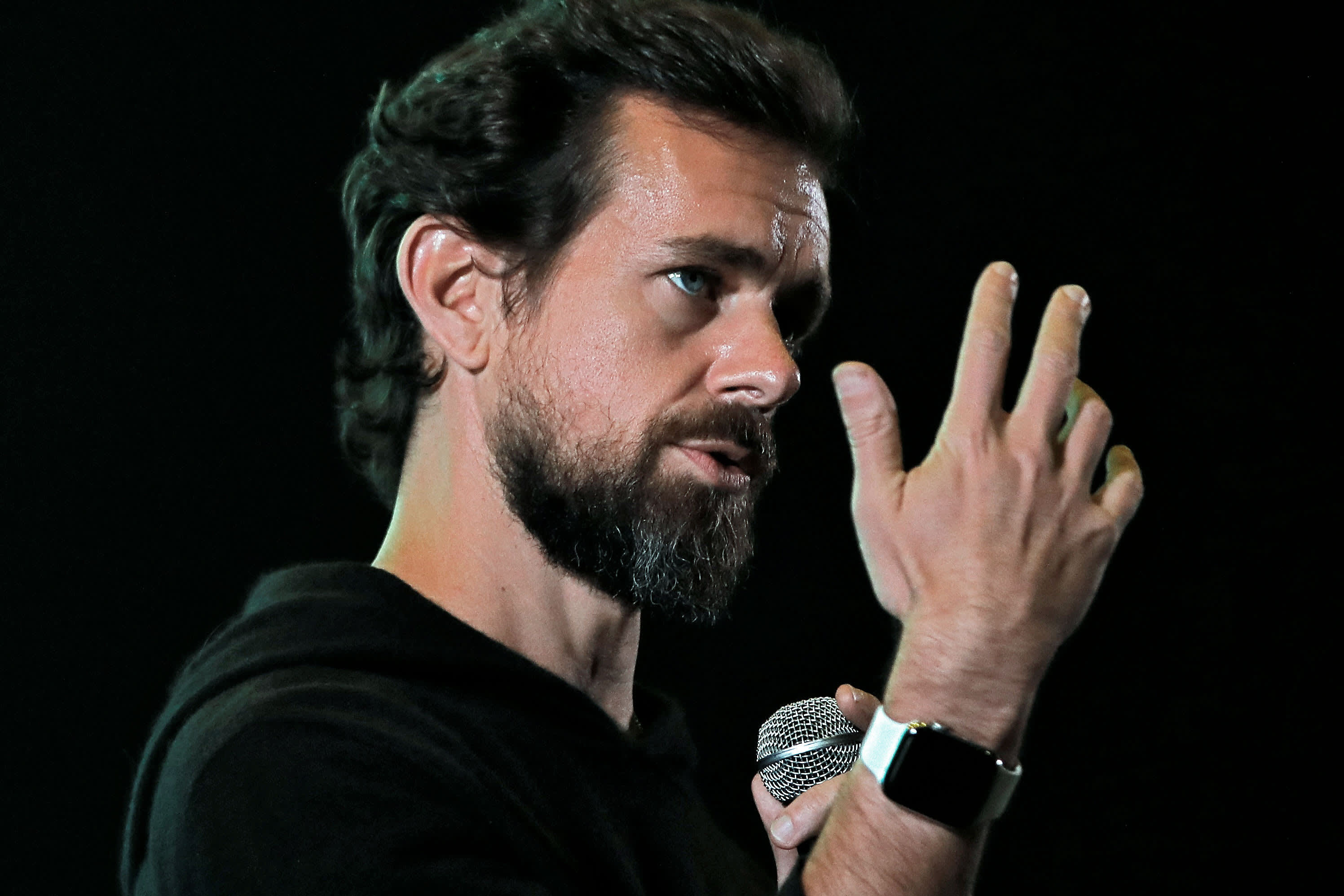

Twitter CEO Jack Dorsey addresses students during a town hall at the Indian Institute of Technology (IIT) in New Delhi, India, November 12, 2018.

Anushree Fadnavis | Reuters

Shares of Square soared on Tuesday evening after posting better-than-expected quarterly results and strong growth in its consumer payments app.

The San Francisco-based company reported $1.92 billion in net revenue for the second quarter — a 64% jump year over year. Adjusted earnings per share came in at 18 cents, far better than the 5 cent loss analysts polled by Refinitiv had expected. Net loss was $11 million on a GAAP basis.

Square stock jumped as much as 11% in after-hours trading, and has more than doubled this year as consumers flock to digital payments during the pandemic.

Its peer-to-peer Cash App, a competitor to PayPal’s Venmo, helped drive Square’s performance in the second quarter. Gross gross profit for the app rose 167% year over year to $281 million. Stored funds, or the amount of money customers keep on the app, jumped 86% from the prior quarter. Monthly active users jumped to 30 million, from 26 million in December, according to the company.

Cash App saw “meaningful uplift” from users getting government stimulus checks, CFO Amrita Ahuja said on a call with reporters Tuesday evening. Unemployment checks and tax refunds were also “tailwinds” that drove momentmum in the Cash App. But there is “uncertainty” around continued government stimulus, these trends could “normalize” as a result, Ahuja said.

Still, the company is heavily indexed to small businesses, such as coffee shops and restaurants, through its in-person payment terminals. Many of those brick-and-mortar businesses were forced to shut their doors amid the pandemic. Gross profit for Square’s core seller business fell 9% year over year to $316 million.

The payment trends improved each month in the quarter, driven by sellers picking operations back up as Covid-19–related shutdowns eased, and sellers adapted to contactless commerce, Square said.

A bulk of its sellers also moved online. Square’s gross payment volume from online channels was up 50% year over year, the company said. Online made up more than a quarter of seller payment volume, up from 14% a year ago.

The company was due to report earnings after the bell Wednesday, but issued its numbers a day early after Bloomberg News reported the numbers ahead of time.