An alternative to gold

Getty

There are other ways to capitalize on future market mischief

I think of gold this way: in times of market stress, own it…if you really have to. Gold has a reputation as a substitute for hard currencies. But there are many ways to invest to try to solve the problems gold addresses.

Gold ETFs or mutual funds, or a fund that invests in gold company stocks, are one way (though not foolproof) to invest in investor “fear.” You can even buy physical gold.

However, if you are trying to protect yourself from a stock market decline, you can look away from gold, and use inverse ETFs. Or you can pad your cash position, or even learn how to use protective put options.

Inverse ETFs

Inverse ETFs are structured to go up when a specific stock index goes down. There are inverses that cover many major indexes. There is also an interesting new breed of “bear market” ETFs that is not simply geared to deliver the opposite of the S&P 500, Dow, Nasdaq

NDAQ

I have been steadily increasing my research and use of these, as more ETF providers launch them. As with anything else, some are for real and others are either not very differentiated, too expensive or are sales gimmicks. I will probably devote a separate article to “structured notes” and “buffer ETFs,” so I can pinpoint the myriad reasons I don’t wish to use them in my portfolios.

If your concern is a systemic problem with world governments, or perhaps the eventual weakness of the US Dollar, gold can be viewed as a potential alternative. But again, there are ETFs and option strategies that can attack that issue more directly.

Protective Put Options

Sometimes, you just want to take the hedging directly into your own hands. In the couple of occasions in my career when I was the lead manager of a mutual fund, I used protective put options that essentially did the hedging directly.

You see, while a put option has a limited life (it expires on a certain future date), it allows you to define your maximum dollar loss. That can be comforting, sort of like a budget for your portfolio’s defense department.

Long-Short (e.g. “Hedged” Investing)

This is a big, wide-reaching topic. Suffice it to say that by looking for market segments that will outperform other market segments (”arbitrage”), you can try to out-earn cash and bonds with a fraction of the risk you would take to try to pick your spots buying and selling in a volatile market. I have written about this a couple of times in this space, and expect to again.

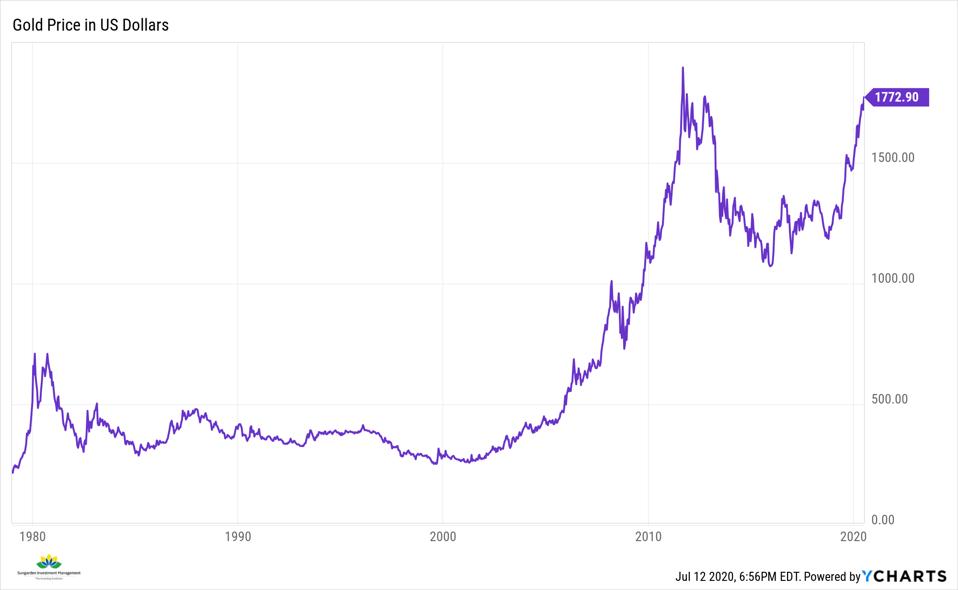

IGPUSD_chart

Ycharts.com

So, do you really need gold?

There is no right answer to this, and I am not providing individual advice with this article. A big part of the gold conundrum is that, as with all other investment decisions, it is about HOW you will use it and WHY you will. It is less about “should I own gold in my portfolio.”

The thing I always worry about when using gold (and I do at times) is that you get the underlying cause correct (world in disarray, etc. comes to pass) but that gold does not deliver as that “safe haven” investment. Gold was a relative outperformer earlier this year when the S&P 500 fell hard. But it did not appreciate in value during that awful 5-week period.

This has happened more often in the past few years than it did years ago. So, while a modest position in gold can be a consideration at any time, count me in the camp of “yeah, own gold, if you really have to.”

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors.