Without additional unemployment insurance and other government aid, the labor market and job creation are too weak for economic recovery. But Congress has not reauthorized the $600 weekly addition to benefits.

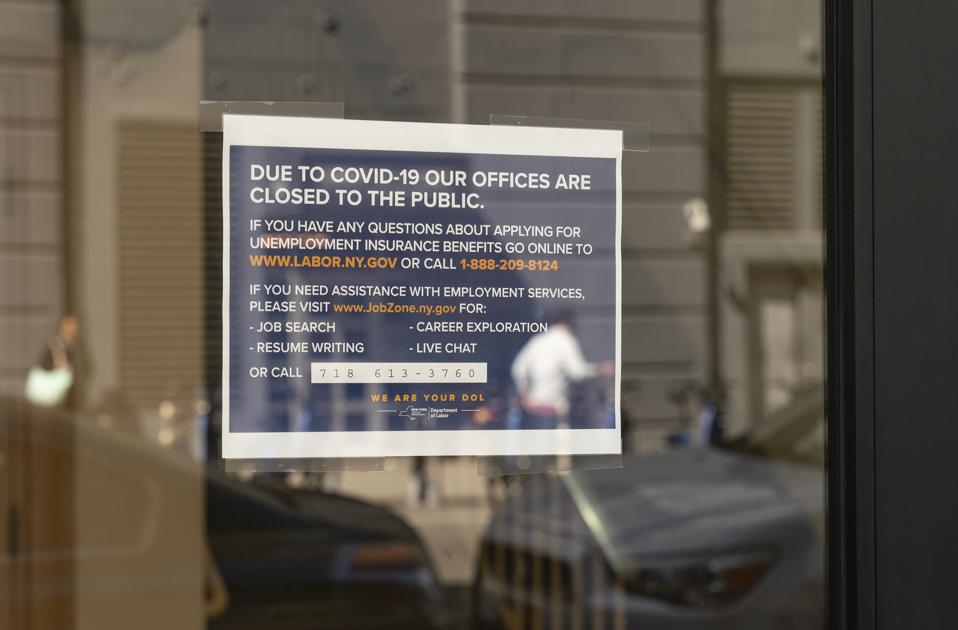

NEW YORK, UNITED STATES – 2020/03/26: View of Brooklyn office of NYS Department of Labor as … [+]

Pacific Press/LightRocket via Getty Images

Predictions for a quick economic recovery got a sobering dose of reality on Thursday. The Department of Labor reported 1.48 million new weekly unemployment claims, extending the historic bad employment news we have been suffering. Things are not getting better. And if Congress doesn’t renew the $600 additional weekly unemployment benefit, now expiring in late July, our deep recession will only get worse.

Although some, like National Economic Council director Larry Kudlow say the economy has “hit a turning point,” Heidi Shierholz of the Economic Policy Institute correctly says the claims data “highlight the deep recession we are now in.” Shierholz notes this is “the 14th week in a row where initial unemployment claims are more than twice the worst week of the Great Recession.” And if you include the new unemployment insurance (UI) offered to gig workers, self-employed people, and freelance workers, over 33 million people either are receiving benefits or have applied for them.

One of the few things keeping the economy afloat has been massive government spending—not only more generous and extended unemployment insurance, but small business support, direct payments to households, and aid to states and cities (although not nearly enough of the latter.)

Without that government spending, the economy would much worse. A team led by Harvard economist Raj Chetty finds consumer spending has fallen dramatically, especially by the wealthy. That collapse in demand rippled through the economy, leading to massive layoffs and loss of labor income for many workers, further depressing demand. The fall in demand has pulled the economy into this deep recession.

The economists find that small business aid and rebate checks to households “have not led to a rebound in spending at the businesses that lost the most revenue,” which in turn means those businesses are not doing extensive hiring. And they argue that policy “providing and extending targeted assistance to low-income workers impacted by the economic downturn (such as through unemployment benefits) is critical for reducing hardship.”

What about those who think the economy is recovering? Most states have been relaxing their shelter-in-place orders, and a lower-than-expected unemployment rate in May led some to think the economy can recover on its own. Others have pointed to an uptick in car sales or a faster-than-expected rise in airline traffic as hopeful signs.

But those data must be viewed in a context considering how deep this spring’s economic collapse was. We are still in a deep recession and many forecasters expect it to continue. On Thursday, the International Monetary Fund (IMF) forecast a 4.9% decline in global GDP for 2020, revising their April forecast downward by an additional 1.9%. And the IMF sees the US economy as declining by an overall 8 percent in 2020.

Given the recession’s current depth and likely continuation, and the importance of unemployment benefits, you might assume the federal government would rush to keep the UI system strong. But instead, states are being forced to borrow money to keep their systems solvent, and many Republicans haven’t endorsed extending higher UI benefits.

Unemployment benefits have been bolstered by an additional $600 per week, helping keep overall spending up. But that weekly $600 expires in late July, and U.S. Labor Secretary Eugene Scalia (yes, the son of the late Supreme Court Justice Antonin Scalia) rejected extending the higher benefits, saying “our economy has turned the corner against the coronavirus.”

Some claim the higher benefit is keeping workers from taking jobs. It is true that for some people, the UI “replacement rate”—the ratio of benefits to previous wages—may exceed 100%, and that leads to arguments that eliminating the benefit would encourage more work.

But there’s little evidence that high benefits are keeping people out of work; instead, it’s the weak economy. For May, economist Ernie Tedeschi found that “states with higher UI wage replacement rates didn’t see statistically-significantly worse labor market outcomes than those with lower wage replacement rates.” And May’s unemployment rate of 13.3% is the second highest ever since the Great Depression, and measured unemployment would be even higher except for data classification problems.

We remain in a deep and potentially long-lasting recession, especially if Covid-19 continues rising around the country, which in turn will lead to further economic contraction. Unemployment insurance, and the extra $600 per month, are essential to limit the damage. The economy’s problem isn’t generous unemployment benefits. It’s the lack of demand, income, and jobs. Reducing unemployment benefits won’t help solve that problem, but instead will make it worse.