1. Don’t underestimate the role of chance in life.

It’s easy to assume that wealth and poverty are caused by the choices we make, but it’s even easier to underestimate the role of chance in life.

The families, values, countries and generations we’re born into, as well as the people we happen to meet along the way, all play a bigger role in our outcomes that most people want to admit.

While you should believe in the values and rewards of hard work, it’s also important to understand that not all success is a result of hard work, and that not all poverty is due to laziness. Keep this in mind when forming opinions about others, including yourself.

2. The highest dividend money pays is the ability to control time.

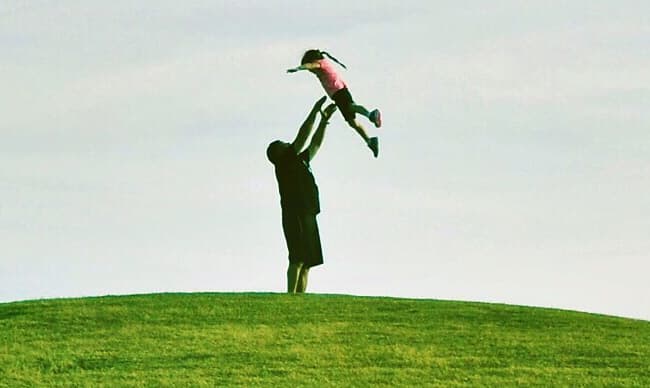

Being able to do what you want, when you want, where you want, with who you want and for as long as you want provides a lasting level of happiness that no amount of “fancy stuff” can ever offer.

The thrill of having fancy stuff wears off quickly. But a job with flexible hours and a short commute will never get old. Having enough savings to give you time and options during an emergency will never get old. Being able to retire when you want to will never get old.

Achieving independence is our ultimate goal in life. But independence isn’t an “all-or-nothing” — every dollar you save is like owning a slice of your future that might otherwise be managed by someone else, based on their priorities.

3. Don’t count on getting spoiled.

No one can grasp the value of a dollar without experiencing its scarcity, so while your mother and I will always do our best to support you, we’re not going to spoil you.

Learning that you can’t have everything you want is the only way to understand needs versus desires. This in turn will teach you about budgeting, saving, and valuing what you already have.

Knowing how to be frugal — without it hurting you — is an essential life skill that will come in handy during life’s inevitable ups and downs.

4. Success doesn’t always come from big actions.

Napoleon’s definition of a genius is the person “who can do the average thing when everyone else around him is losing his mind.”

Managing money is the same. You don’t have to do amazing things to end up in a good place over time, you just have to consistently not screw up for long periods of time.

Avoiding catastrophic mistakes (the biggest of which is burying yourself in debt) is more powerful than any fancy financial tip.

5. Live below your means.

The ability to live with less is one of the most powerful financial levers, because you’ll have more control over it than things like your income or investment returns.

The person who makes $50,000 per year, but only needs $40,000 to be happy, is richer than the person who makes $150,000, but needs $151,000 to be happy. The investor who earns a 5% return, but has low expenses, may be better off than the investor who earns 7% a year, but needs every penny of it.

How much you make doesn’t determine how much you have, and how much you have doesn’t determine how much you need.

6. It’s okay to change your mind.

Almost no one has their life figured out by age 18, so it’s not the end of the world if you pick a major that you end up not enjoying. Or get a degree in a field that you’re not 100% passionate about. Or work in a career and later decide you want to do something else.

It’s okay to admit that your values and goals have evolved. Forgiving yourself for changing your mind is a superpower, especially when you’re young.

7. Everything has a price.

The price of a busy career is time away from friends and family. The price of long-term market returns is uncertainty and volatility. The price of spoiling kids is them living a sheltered life.

Everything worthwhile comes with a price, and most of those prices are hidden. They’re sometimes worth paying for, but you should never ignore their true costs.

Once you accept this, you’ll start to view things like time, relationships, autonomy and creativity as currencies that are just as valuable as cash.

8. Money is not the greatest measure of success.

Warren Buffett once said: True success in life is “when the number of people you want to have love you actually do love you.”

And that love comes overwhelmingly from how you treat people, rather than your level of net worth. Money won’t provide the thing that you (and almost everyone else) want most. No amount of money can compensate for a lack of character, honesty and genuine empathy towards others.

This is the most important financial advice I can give you.

9. Don’t blindly accept any advice you’re given.

All the lessons here, including this last one, are things that most people learn too late in life. But feel free to reject them.

Your world will be different from mine, just as mine is different from my parents. No one is exactly is the same, and no one has all the right answers. Never take anyone’s advice without contextualizing it with your own values, goals and circumstances.

Your parents love you. We are so happy you’re here. Please let us sleep.

Morgan Housel is a partner at The Collaborative Fund, behavioral finance expert and former columnist at The Wall Street Journal and The Motley Fool. He is also a winner of The New York Times Sidney Award and a two-time finalist for the Gerald Loeb Award for Distinguished Business and Financial Journalism.

Don’t miss: