Housing is making a comeback post-COVID, thanks to surging demand and rising home prices.

Getty

If two months of rising mortgage applications weren’t indication enough, a new report is: the housing market is well on its way to recovering from the recent slump caused by the COVID-19 pandemic.

According to the Market Recovery Index from Realtor.com, both housing demand and home prices are above January’s pre-COVID levels, and housing supply and overall sales “are now following a recovery trajectory,” according to the report.

Nationally, demand for housing is above baseline levels, and recent data from the Mortgage Bankers Association proves as much. Last week, applications for purchase loans were up 13% over the year and 15% over the week. It was the eighth straight week that applications jumped.

As Realtor.com’s Javier Vivas explains, “Homebuyer interest recovered quickly post COVID-19 and remains high despite the weaker economic environment, as low mortgage rates, virtual tools and lockdown lifts have enabled many buyers to continue the home search process, albeit often with adaptations. Housing remains an essential good, and this activity demonstrates that real estate can remain fairly active even during recessionary periods.”

Prices and inventory

Though home prices had slowed down in recent months (they never outright declined), it appears that trend has ended. Realtor.com shows prices up 4.3% in the last week, up from a 3.7% growth rate in January.

According to Danielle Hale, chief economist at Realtor.com, prices could go even higher if more supply doesn’t hit the market soon. It’s one area that’s recovering—just not at as fast a clip as other indicators. New listings are down 21% over the year and 12.7% below January’s numbers.

“The general sentiment from consumer surveys is that now is not a good time to sell a home because of COVID, economic uncertainty and social unrest, but the data is saying the opposite,” Hale says. “Home prices are back to their pre-COVID pace and we’re seeing listings spend slightly less time on the market than last week. But the housing market still needs more sellers in order to meet the surge in demand. Looking forward, if we don’t get the inventory we need, we’ll see prices rise even more and homes sell faster later this summer.”

Recovery by market

The numbers certainly point toward recovery for the housing market, but real estate is local, and some metros are showing much stronger signs of recovery than others.

According to Realtor.com’s data, Las Vegas and Denver have bounced back the most thus far, followed by Boston, San Francisco and San Diego. Here’s a quick look at the most-recovered markets so far.

The housing markets in these cities have recovered most, according to data/

Data courtesy of Realtor.com

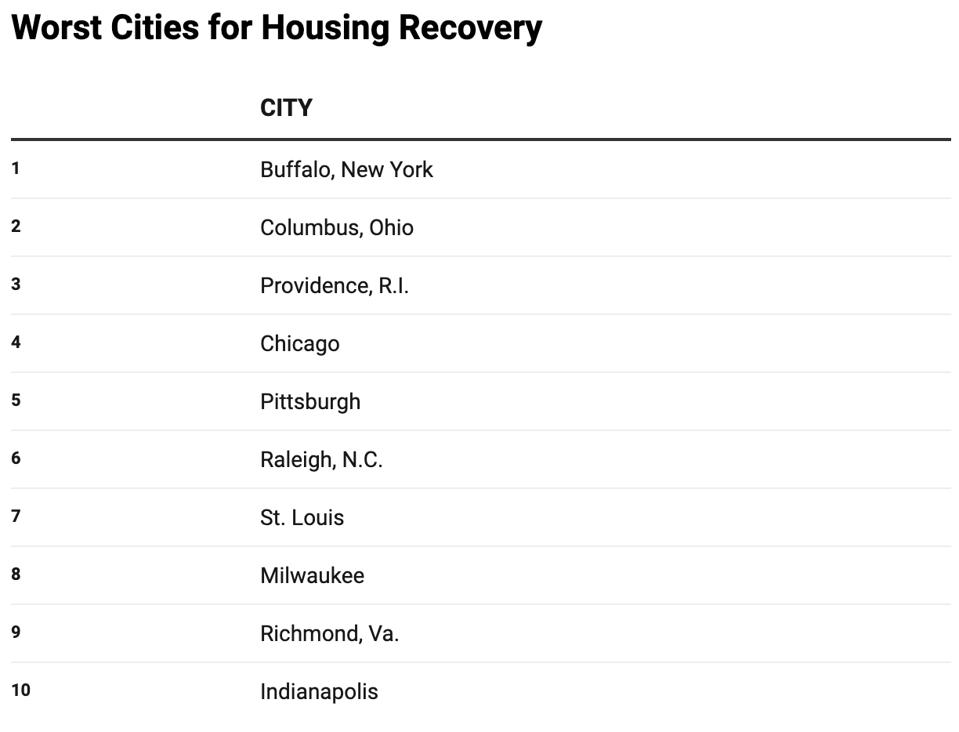

On the other end of the spectrum is Buffalo, New York, which came in with a recovery index of 61 (100 is the baseline) and Columbus, Ohio (recovery index of almost 81). Other cities at the bottom of the list were Providence, R.I., and Chicago.

These are the worst-off housing markets since COVID-19. According to Realtor.com data, they’ve … [+]

Data courtesy of Realtor.com

Price-wise, Pittsburgh has recovered the most, followed by Minneapolis-St. Paul. Louisville, Cincinnati, and Austin, Texas, also have above-national-average price growth compared to January.