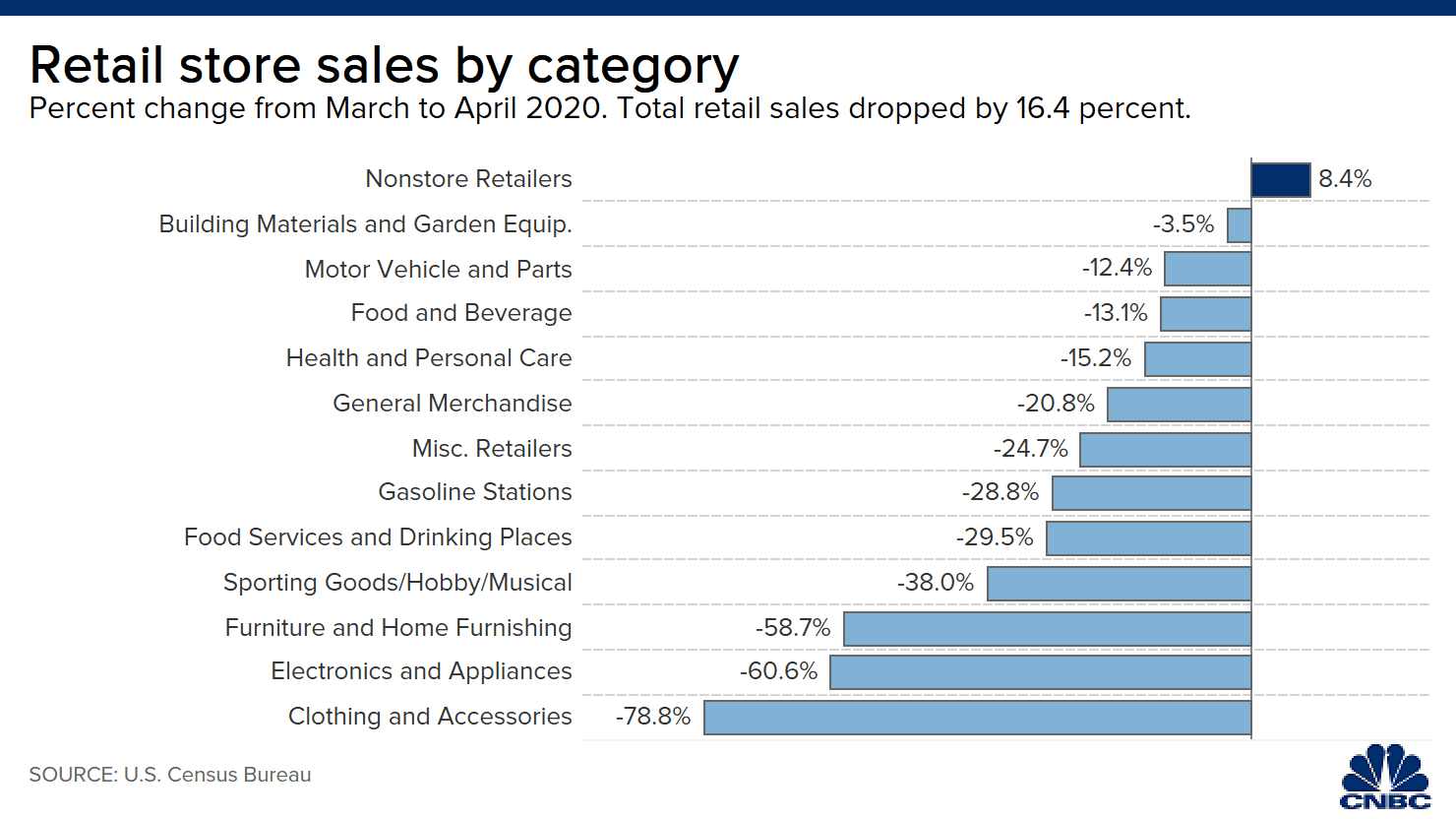

Consumer spending plunged by a record 16.4% in April, but one category saw a bounce: nonstore retailers. Included in this category, which saw an 8.4% month-over-month increase, is online shopping. With much of the country under shelter-in-place orders during April, consumers increasingly turned towards e-commerce giants like Amazon for their shopping needs.

As the pandemic took hold in the U.S. in March, shares of the Seattle-based company initially moved lower, but since then the stock has recovered — and then some. Amazon hit an all-time intraday high of $2,475 on April 30, and shares have gained nearly 30% this year, compared with the S&P 500’s 11.7% decline.

In the first quarter, Amazon said that net sales jumped 26% year over year to $75.5 billion as people flocked to its site. The volume was so high that the company temporarily halted delivery for non-essential items, while hiring 175,000 additional workers to keep up with the heightened demand.

“We believe that the long term steepening of Amazon’s growth curve driven by the acceleration of consumer adoption of ecommerce and enterprise adoption in cloud computing, enabled by the company’s investments in fulfillment and infrastructure, and the associated high returns are likely to drive significant share price outperformance well beyond the current crisis,” Goldman Sachs analyst Heath Terry said following the company’s first quarter results.

The 8.4% jump in sales for nonstore retailers was the second largest in history, going back to 1992 when the data first began being tracked.

For April the 16.4% drop in retail sales was larger than the 12.3% economists surveyed by Dow Jones had been expecting. Clothing sales was the hardest hit, dropping 78.8%, while restaurant spending fell nearly 30%.

Shares of Amazon were slightly lower on Friday.

– CNBC’s John Schoen and Michael Bloom contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.