Take a look at some of the biggest movers in the premarket:

Qualcomm (QCOM), Cisco (CSCO), Apple (AAPL), Boeing (BA) – Reports out of China suggest that retaliation against these and other U.S. companies could come if the U.S. goes ahead with plans announced this morning to block chip shipments to China’s Huawei.

JD.com (JD) – The China-based e-commerce retailer beat estimates by a wide margin on both the top and bottom lines for its latest quarter, with annual active customer accounts up 24.8% from a year ago and mobile active daily users up 46%.

DraftKings (DKNG) – The sports betting company posted a larger-than-expected quarterly loss, although revenue grew 30% from a year ago despite the Covid-19 pandemic shutting down sports events. The company does not expect a virus-related impact on its longer-term projections.

VF Corp. (VF) – The maker of North Face apparel and Vans shoes earned an adjusted 10 cents per share for its latest quarter, 4 cents a share below estimates. Revenue also missed analysts’ forecasts and VF said it sees current-quarter revenue falling a little more than 50% this quarter, but it does intend to continue paying its dividend.

Walt Disney (DIS) – Disney reached a deal with union workers at Walt Disney World on employee safeguards. The deal removes a significant obstacle to Disney’s reopening plans for its theme parks.

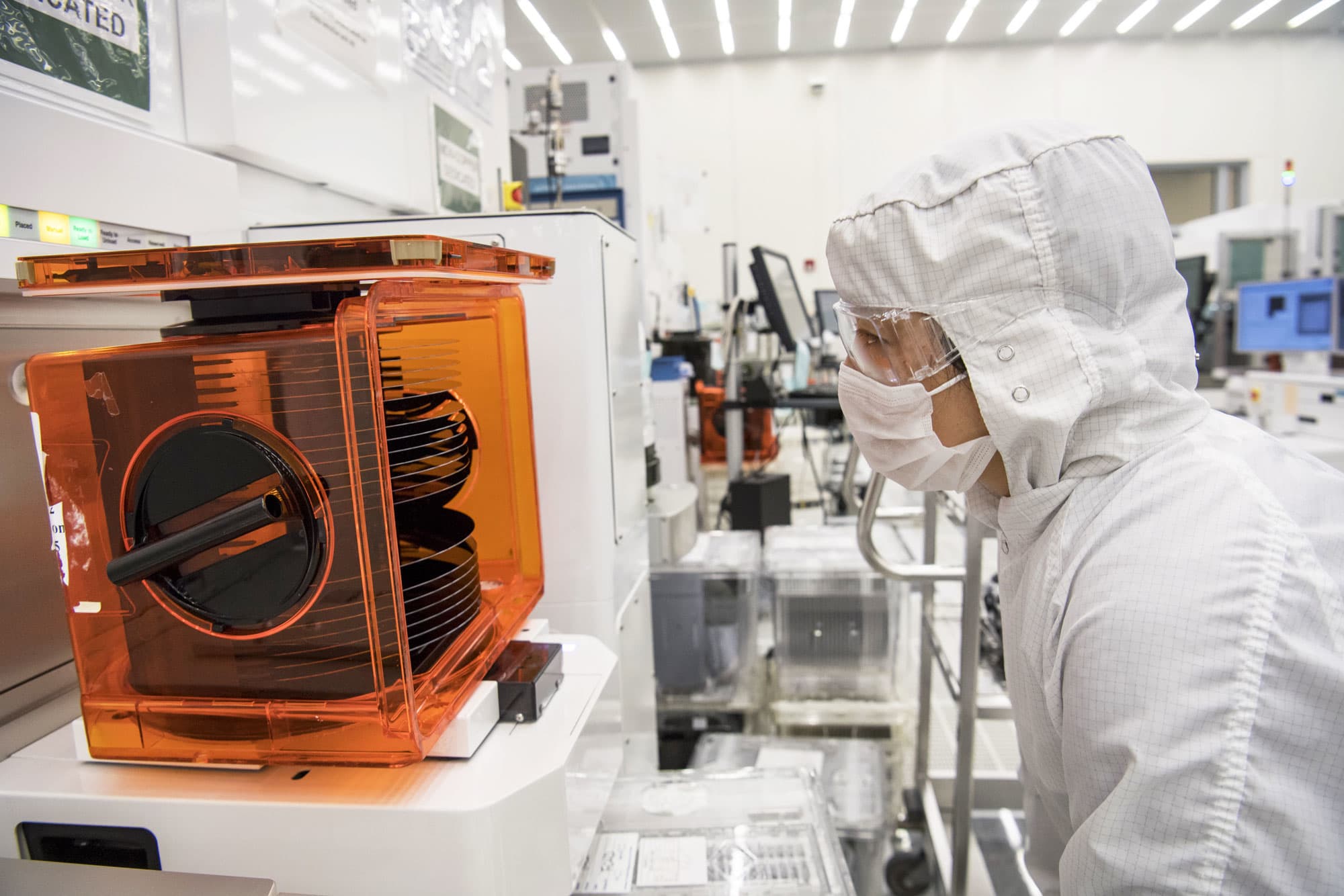

Taiwan Semiconductor (TSM) – Taiwan Semiconductor will spend $12 billion to build a chip factory in Arizona. Construction will begin next year, with a goal of beginning chip production in 2024.

Abbott Laboratories (ABT) – The Food and Drug Administration will review Abbott’s fast coronavirus test amid concerns about its accuracy – particularly about failing to detect patients who have Covid-19. Abbott will conduct multiple new studies of the test in various health-care settings.

Applied Materials (AMAT) – Applied Materials fell 5 cents a share shy of estimates, with quarterly earnings of 89 cents per share. The maker of semiconductor manufacturing equipment’s revenue also came in short of forecasts. The company said it expected to recoup any pandemic-related lost sales during the second half of the year.

Office Depot (ODP) – Office Depot plans to cut more than 13,000 jobs and close an undetermined number of stores by the end of 2023. The office supplies retailer said the restructuring could save it as much as $860 million.

Nike (NKE) – Nike warned that pandemic-related store closures during the current quarter will hurt its retail and wholesale results. The athletic footwear and apparel maker did say that 100% of its Greater China stores have reopened and that online sales are helping offset lost sales from store closures.

Aurora Cannabis (ACB) – Aurora Cannabis posted a smaller loss for its latest quarter, with sales of cannabis jumping 39% from a year ago as customers in the U.S. and Canada stockpiled products ahead of virus-related lockdowns.

Norton LifeLock (NLOK) – Norton LifeLock came in 7 cents a share ahead of estimates, with quarterly profit of 26 cents per share. The cybersecurity company’s revenue also beat Street forecasts, however it gave weaker-than-expected current-quarter revenue guidance.

Denny’s (DENN) – Denny’s reported better-than-expected quarterly earnings, even as the restaurant chain’s revenue tumbled 36% from a year earlier. Denny’s streamlined its menu as the pandemic spread, and emphasized curbside delivery and shareable family meal packs.

Dillard’s (DDS) – Dillard’s reported a smaller-than-expected loss for its latest quarter, and the retailer announced plans to reopen 116 stores and five clearance centers next week.