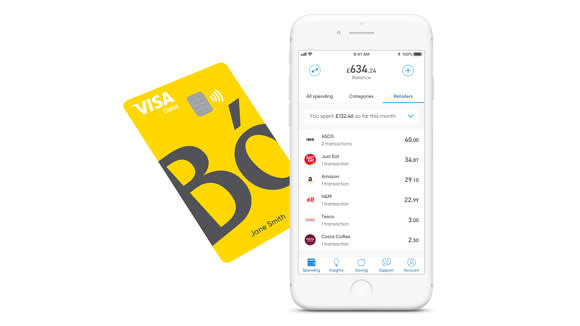

RBS’ standalone digital bank Bo.

RBS

British state-backed bank RBS has dropped its standalone digital bank Bo following a tumultuous launch and a global pandemic that has forced the lender to refocus its investment strategy.

RBS launched Bo, an app-based account accompanied by a yellow payment card, back in November on Google and Apple’s app stores. The move was aimed at competing with rising start-ups in the financial technology world such as Monzo, Revolut and Starling, which have rapidly acquired millions of customers between them.

But one expert told CNBC that Bo failed to achieve that aim in a crowded domestic market with plenty of apps from both fintech challengers and well-established lenders. On Friday, RBS CEO Alison Rose said the bank would close Bo and fold it into its other standalone digital brand, Mettle, which is targeted at small and medium-sized enterprises.

“We have decided to merge our personal digital account, Bo, with our digital bank for SMEs, Mettle,” Rose said in a call with reporters following the bank’s first-quarter results. “As a result, we will be winding down Bo as a customer-facing brand. Technology used in Bo will be integrated as we develop Mettle further.”

The bank’s CEO said “circumstances have changed” given the economic toll of the coronavirus outbreak and lockdown measures taken by the U.K. to contain the disease. RBS’ profits halved in the first quarter, and the bank has set aside set aside £802 million ($1 billion) in credit loss provisions due to the crisis.

Rose insisted that Bo didn’t “fail,” stressing the bank “never undertook a consumer launch” with Bo. But skeptics aren’t convinced.

“Bo was always going to have a tough time attracting customers given the crowded nature and maturity of the digital banking market in the U.K.,” Sarah Kocianski, lead researcher at 11:FS, told CNBC. “It needed to find a way to stand out and establish a USP (unique selling point) to differentiate itself from the digital-only banks.”

“It clearly failed to do so, hence the shuttering of the brand.”

Rose said the bank managed to attract just 11,000 customers — including “friends and family” of the bank — in the almost six months since it launched. That’s a far cry from Revolut’s more than 10 million users and Monzo’s 3.5 million signups.

To be sure, RBS has racked up millions of users across its main apps, which have much better ratings than Bo. The standalone brand has been hit with mixed reviews on Google Play and the App Store. Rose said the bank would take its learnings from Bo and applying them to its other products.

Bo’s launch was marred by the recent exit of its CEO, Mark Bailie, as well as having to reissue thousands of cards which weren’t up to scratch with the latest EU regulatory requirements on authentication. A month after Bailie’s departure, the bank also moved Bo under the same leadership as its Mettle unit.

“We’re very sorry to see Bo go,” a spokesperson for Starling told CNBC. “We’re glad to see that RBS has said the lessons from Bo will be valuable for its other products. This suggests that digital banking tools are having a disruptive effect on the wider market.”

For some in the fintech space, it’s a lesson in how not to launch a standalone digital banking brand. Bo’s closure is reminiscent of the fall of JPMorgan’s online bank Finn, which was shuttered just a year after its release.

Goldman Sachs on the other hand has found success with its digital retail bank Marcus, which has attracted millions of users in the U.S. and Britain. Santander meanwhile has lured in over 1 million customers to its online banking brand Openbank in Europe, and is now taking on money transfer start-up TransferWise in the U.K. with a new service called PagoFX.

Still, the coronavirus crisis is likely to be a problem for all banking players going forward — both big and small.

“Like incumbents, digital-only banks are going to face challenges during the coming months of recession/economic downturn,” Kocianski said. “It remains to be seen if their financial positions and short term strategies for dealing with the fallout are robust enough to weather the storm.”