This an extraordinary Budget in an extraordinary time, and there are many questions left unanswered … [+]

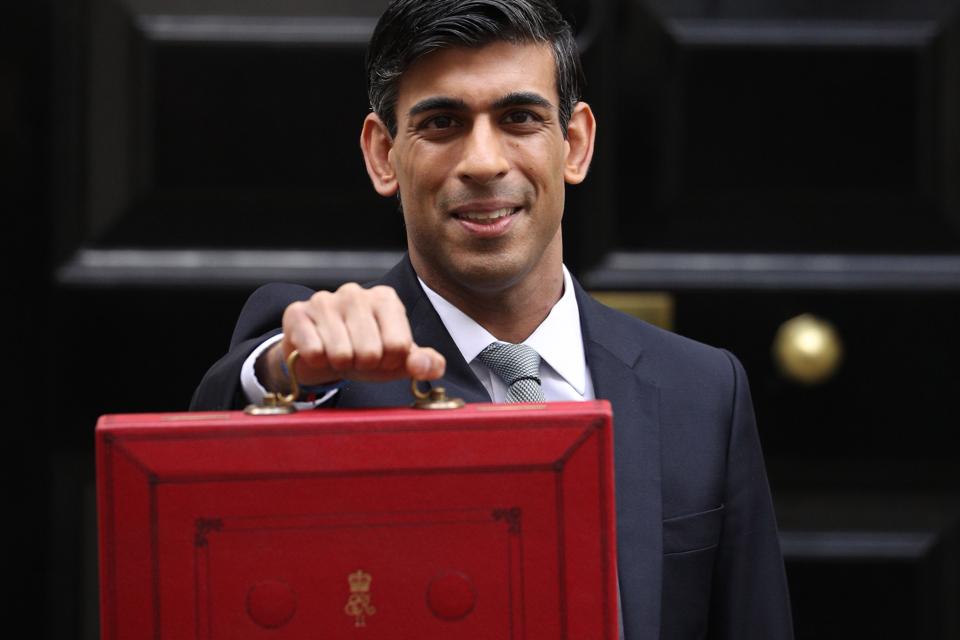

Getty Images

The new Chancellor of the Exchequer, Rishi Sunak, on Wednesday, March 11 set out the Conservative government’s Budget 2020 against the unprecedented backdrop of a coronavirus (COVID-19) outbreak which was officially classified by the World Health Organisation as a pandemic on the same day.

Unofficially called a ‘coronavirus budget’ because of the last-minute fiscal changes implemented to address the impact of COVID-19 on the economy and to support business and personal finance, there are fewer direct budgetary inclusions for housing than I had expected. Nevertheless, the overall package does include several notable adjustments for the property industry, and there are a few interesting touchpoints.

Interest rates cut 50 basis points from 0.75% to 0.25%

In a widely anticipated move just prior to the launch of the Budget, the Bank of England announced a reduction to interest rates of 50 basis points from 0.75% to 0.25%. This brings borrowing costs to their lowest point in history. The new interest rate is likely intended to support the extra £30 billion in spending set out in the Budget.

The immediate benefit of this rate cut will be a reduction in homeowner mortgage repayments for track and variable rate mortgages; but fixed rate mortgages will remain the same. An additional relief vehicle that came through just prior to the Budget was the announcement of loan repayment holidays from several U.K. mortgage lenders – the Royal Bank of Scotland, for example, said that they would defer mortgage payments for up to three months for those affected.

Stephen Jones, chief executive of UK Finance, says: “All providers are ready and able to offer support to their customers who are impacted directly or indirectly by COVID-19, which could include offering or increasing an overdraft or allowing repayment relief for loan or mortgage repayments: asking for help early is key.”

Unfortunately, the rate cut doesn’t offer similar benefits for savers, who now stand to see little in the way of interest on their savings. Disappointing news for those aiming to save towards a deposit or cash purchase, but it will alleviate the pressure for some first-time buyers.

Stamp Duty surcharge on overseas buyers

Whilst not the change to Stamp Duty Land Tax (SDLT) that many were hoping for, the Budget introduced a 2% increase in SDLT on U.K. investment properties for non-resident overseas buyers, to come into effect from April 1, 2021. The surcharge is intended to manage house price inflation and hopefully should support U.K. residents to get on the ladder.

Monies raised through the surcharge will go towards addressing rough sleeping, with £643 million earmarked to help rough sleepers into permanent accommodation. The government intends to buy up to 6,000 new homes to ease the homelessness issue. This pledge is personally pleasing as my company and I support Centrepoint charity for youths sleeping rough.

House building

Additional housing was at the heart of the Conservative manifest during the last election, and the government recommitted to building at least 1 million new homes before the end of this current parliament, at an average of 300,000 homes a year by the mid-2020s, with a £10.9-billion increase in housing investment.

The Budget introduced an additional £9.5 billion that will be added to the Affordable Homes Programme, bringing a total of £12.2 billion of grant funding from 2021-22 to the U.K. which will help first-time buyers get on the ladder and support efforts to prevent homelessness.

In addition, the Budget confirmed an allocation of £1.1 billion from the Housing Infrastructure Fund for nine different areas including Manchester, South Sunderland and South Lancaster that will help to unlock up to 69,620 homes as part of the government’s ‘levelling up’ plan for the North of England.

The government also announced a £400-million budget for the Mayoral Combined Authorities and local areas to build housing on brownfield sites across the country. If it works as intended, then this investment could help to catalyse home building across the country at a faster pace.

Unsafe cladding removal

A £1-billion Building Safety Fund will be established for the removal and replacement of all unsafe non-ACM cladding to help residents of high-rises apartments feel safe in their homes. The new fund will be available for all private and social sector buildings above 18 metres in height, which may leave some people in smaller buildings with unsafe cladding feeling short-changed.

ACM cladding was the material used on Grenfell Tower, which led to the tragic disaster in 2017 that resulted in 72 deaths. The government estimates that there are at least 300 ACM-cladded high-rise buildings above 18 metres in the U.K., with many more using other forms of unsafe cladding. Since the disaster, government introduced a fund, £600 million over 2018 and 2019 for public and private flats, aimed specifically at ACM cladding, but the costs for removal have often been pushed onto leaseholders by building owners.

This precarious situation has led to many leasehold flat owners being unable to sell or re-mortgage their properties, as living in ‘unsafe’ structures renders them ‘worthless’ to buyers. Hopefully now residents in these flats can see value return to their homes.

House price growth

The Office for Budget Responsibility (OBR) has significantly revised their house price forecast in their latest Economic and Fiscal Outlook released with the Budget. As a result of the Treasury and the Bank of England’s fiscal easing, the OBR – which is an independent organ of the Treasury – forecasts that the end of austerity will boost real household incomes and house price inflation in the near term.

The OBR overall estimates that house prices will rise 23% between the fourth quarter of 2019 and the first quarter of 2024, with annual house price inflation anticipated to reach 4.3% by the end of 2020. House price inflation is expected to peak at 7.5% in the third quarter of 2021 before declining to the lower rate of 4.1% by the forecast horizon.

Final thoughts

It’s disappointing that stamp duty did not receive more attention in this Budget. Calls from both the property industry and buyers have been growing increasingly louder to remove the levy which has become a break on affordability and transactions.

I would also like to have seen a refocus on the government’s Help to Buy scheme, perhaps with a focus on the resell market. And it’s a shame that there was no relief for landlords, who in particular have suffered under the incremental removal of capital gains and mortgage relief.

That said, this an extraordinary Budget in an extraordinary time, and not only is there considerable uncertainty over the future of the economy, but there are also many questions left unanswered over how the government will pay for their considerable borrowing spend.

I suspect that many of the originally planned fiscal adjustments were left off because of the coronavirus outbreak. So, when the next Budget takes place later in the year at the Autumn Statement, I anticipate a considerable correction.