Getty

More than 7,000 media workers lost their jobs in 2019, pushing many of the laid-off reporters and editors into the unstable world of freelance journalism.

Building a freelance career comes with some freedom, but with a lot of complexity. Although you may not always think of freelancing in these terms, becoming a freelancer means you’ve put yourself in charge of running your own small business.

In the month of January, I’m taking questions from freelancers about retirement planning, including members of Study Hall, an organization of freelance writers, podcasters, editors and media workers. Last week, we heard from Julia, a 27-year-old writer trying to get back into the habit of saving for retirement after leaving a staff job 18 months ago.

Today, we’ll hear from Anna, who has maxed out her Roth IRA and is wondering where to put her savings next.

I’m really curious about self employed retirement plans—I think they’re called SEP IRAs and I’ve always wondered: how do they work? What’s the best way of doing it? Are they worth it, or should you just save otherwise? If I’ve already made my yearly maximum contribution to a Roth IRA, does it make sense to put any additional money into a SEP IRA after that? – Anna, 34, Freelance Journalist

Since you’re under 50, you’re allowed to contribute $6,000 to either a Roth IRA or traditional IRA (the contribution limit is combined across these two types of accounts). But many workers will need to save more than $6,000 for retirement: after all, to retire without a major pullback in your quality of life, you’ll typically need to be saving 15% of your income for retirement. That means if you’re a freelancer making more than $40,000 a year, it’s important to start thinking about retirement planning beyond a Roth IRA.

You mention a SEP IRA as a next step — that’s a great choice, but there’s also another similar type of account, the solo 401(k), that’s also worth considering. I’ll talk about the pros and cons of both — for many freelancers, the differences between a SEP IRA and solo 401(k) are small enough that either type of account would meet their needs. Contributing to either a SEP IRA or a solo 401(k) can lower your current tax burden, giving you the chance to save more for retirement. You also mentioned the idea of doing the rest of your retirement savings outside of a tax-advantaged account — that comes with a significant “opportunity” cost when it comes to saving on taxes, but gives you more flexibility if you end up needing to tap into your savings before retirement age.

You can open up a SEP IRA at nearly any brokerage: Vanguard, Fidelity, Charles Schwab, T. Rowe Price, Betterment and Wealthfront all offer SEP IRAs, and many credit unions do as well. The process for opening up a SEP IRA won’t be that different from what you’re familiar with from when you opened up your Roth IRA. You can normally open up a SEP IRA online from your brokerage’s website: when I opened up my own SEP IRA with a popular online brokerage, it took me less than 10 minutes.

A SEP IRA lets you contribute up to 25% of your business’ profits (even if you’ve already maxed out your Roth IRA contribution), but the way you calculate your maximum contribution can be somewhat tricky, since you need to subtract any of your business expenses you plan to deduct on your taxes, along with half of the amount you’re paying in self-employment tax. If you’re working with an accountant or bookkeeper, they should be able to help you with this; otherwise, most brokerages offer SEP IRA contribution calculators. If you’ve incorporated as an S-Corp and pay yourself a salary from the S-Corp, the rules are a bit different still.

If you think you’d like to max out or come close to maxing out your SEP IRA contributions (e.g, if you want to contribute 25% of your income), you’ll probably need to either calculate your business profits throughout the course of the year, or wait until you file your tax return so you know your Schedule C income.

Assuming you’re self-employed and have no employees working for you, SEP IRAs and solo 401(k)s are fairly similar, although in most cases, the solo 401(k) lets you make bigger contributions. While a SEP IRA only lets you contribute 25 percent of your earnings after business expenses, the contribution limits for solo 401(k)s are often significantly higher depending on your circumstances. Another benefit of the solo 401(k) is that some brokerages let you make post-tax “Roth” contributions to a solo 401(k), which you can’t do with a SEP IRA. If you make “Roth” contributions to a solo 401(k) instead of “traditional” contributions, you won’t get a tax benefit today, but you’ll avoid taxes when it comes time to retire. Roth contributions are normally a better deal if you tax rate is higher in retirement than it is today, while traditional contributions are normally a better deal if your current tax rate is higher than what it will be in retirement: for people in their 30s who are on the fence about whether to choose a Roth or a traditional contribution, I would normally suggest a Roth contribution.

The biggest downside with a solo 401(k) is you have less freedom to withdraw your money early. With a SEP IRA, you can withdraw the money for any reason, although you’ll be hit with a big tax penalty if you do so. By contrast, to make an early withdrawal from a solo 401(k), you either need to meet the criteria for a “hardship” distribution, or repay the amount you took out from the solo 401(k) as a loan with interest within 5 years (and not all providers offer this solo 401(k) loan option).

The last thing to thing about is the paperwork burden: some personal finance writers suggest it’s easier to open up a SEP IRA, but after talking to representatives from Vanguard and Charles Schwab about their account opening processes, I’ve concluded you’ll spend a similar (and relatively) amount of time opening up either type of account. A solo 401(k) will have a little bit more paperwork you need to complete annually once the account reaches $250,000 in plan assets. While neither SEP IRAs nor solo 401(k)s are hard to open, a few brokerages, like Betterment and Wealthfront offer SEP IRAs but not solo 401(k)s. And some brokerages, including Merrill, charge administrative fees for solo 401(k)s but not for SEP IRAs.

This would be my overall advice: if you know you want to make Roth contributions rather than traditional contributions, use a solo 401(k) instead of a SEP IRA, and make sure the brokerage you’re choosing has a Roth option for their solo 401(k). If you want to make traditional contributions, or if you’re undecided between traditional and Roth contributions, honestly, both a solo 401(k) and a SEP IRA are great options. Move forward with either confidently, knowing you are doing great work to secure your financial future!

Now back to your question — is having a SEP IRA “worth it?” The conventional answer for a personal finance writer to give you would be to say “yes!” If you’re making less than $100,000 per year, I lean more towards “probably,” and I’ll explain why.

Here’s the reason it normally makes sense: In the great scheme of things, it takes very little time to set up a SEP IRA or a solo 401(k): normally well under an hour. Using a tax-advantaged SEP IRA or solo 401(k) account only becomes complicated if you’re planning to max out the contribution (which requires the accurate calculation of business profits), at which point, the tax benefits are generally going to be pretty big as well.

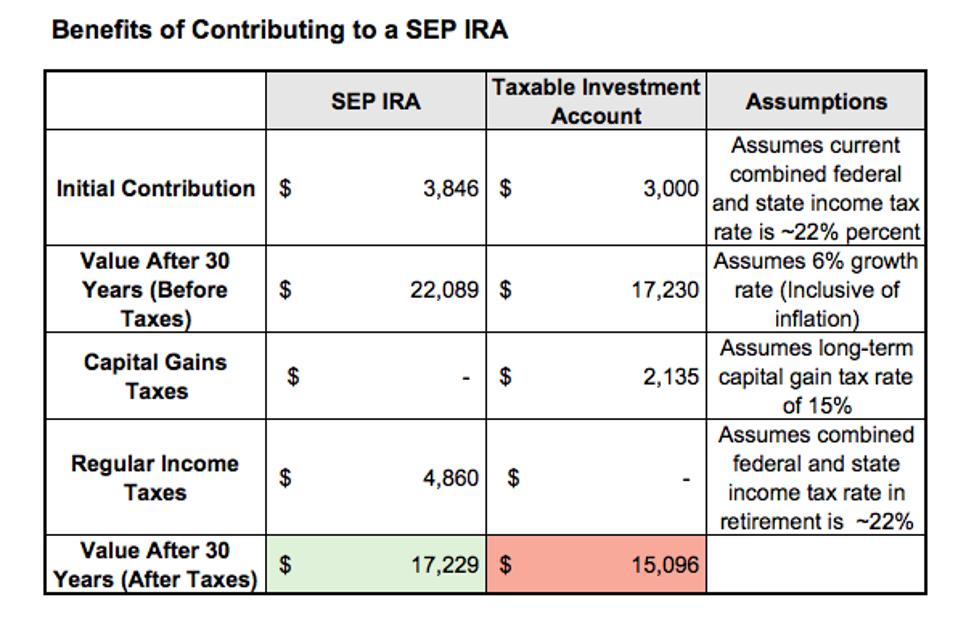

Let me use an example to show you how big the savings can be — for the sake of simplicity, I’m illustrating things using current tax laws, which of course, could definitely change in the next 30 years!

Suppose you’re making $60,000 a year, and want to save $9,000 per year for retirement: the recommended 15% of your income. $6,000 of those savings can be put in your Roth IRA, so $3,000 worth of savings needs to find a home. If you put that $3,000 into a SEP IRA, you’ll get a tax deduction, so instead of contributing $3,000, you should be able to afford to contribute $3,846. If that $3,846 grows at 6% per year, after 30 years, it will be worth $22,089: when it comes time to take distributions from the SEP IRA when you retire, you’ll pay income tax but not any capital gains tax, so your $22,089 would be worth around $17,229 after taxes (see the table below). Let’s compare that with the alternate scenario, where you still save for retirement but in an ordinary taxable investment account. Instead of contributing $3,846, we assume you contribute $3,000, since you’re not getting a tax deduction today. After 30 years, the $3,000 would be worth $17,230 if it grew at a 6% rate. Then, under current law, you’d have to pay capital gains tax on your investment growth. For filers earning between $40,000 and $440,000, the long term capital gains tax rate is 15 percent: that would mean after taxes, your $17,230 retirement savings would be worth around $15,096. In this example, making the choice to put your retirement savings into the SEP IRA instead of a normal taxable account would have been worth about $2,000 ($17,229 versus $15,096), for something that shouldn’t have taken more than an hour or two of your time — and keep in mind, this was just for a single year’s contribution of $3,000, not for the retirement savings over your whole career.

For many self-employed workers, contributing to a SEP IRA will offer considerable tax savings.

The higher your current income, the more it makes sense to use a SEP IRA: at lower incomes, your tax rate is lower, so the value of the tax deferral is smaller. And under current tax law, if your income in retirement was less than $40,000, you wouldn’t have to pay long-term capital gains tax even if your retirement savings were in an ordinary taxable account. Depending on what assumptions you make about the tax bracket you’ll be in during retirement and your current tax bracket, the extra value from contributing to a SEP IRA instead of a normal taxable account starts to get relatively small. The biggest benefit of having the money outside of a SEP IRA, in a normal investment account, is that you won’t face penalties if you need to use it before retirement age: of course, that flexibility can become a temptation to spend money that you’re better off keeping tucked away. That’s why, assuming you have an emergency fund, I’d put all the money you should assume you’ll need for retirement — at least 15% of your income — into a dedicated retirement account, where you’ll be less tempted to touch it.

Congratulations on maxing out your Roth IRA, and happy saving!

I’m wondering about pros and cons of the SEP IRA and the Solo 401k (and whether they can be combined). – Katia, 34, Freelance Journalist

To recap what we talked about with Anna: the SEP IRA gives you more flexibility to make early withdrawals if needed (although making an early withdrawal will come with a steep penalty). The solo 401(k) in most cases lets you make bigger contributions. Perhaps most importantly, the solo 401(k) allows for both post-tax Roth contributions and pre-tax traditional contributions, while a SEP IRA only allows for pre-tax traditional contributions, but a disadvantage of the solo 401(k) is that fewer brokerages offer solo 401(k)s, and there is a small additional amount of paperwork over time if you have $250,000 or more saved.

Now: can you combine them, assuming you only have a single business? Under some circumstances you’re permitted to have both types of accounts for a single business, and in other circumstances it’s forbidden: it depends on the exact type of SEP IRA you created. But even if you’re allowed to, I wouldn’t say it’s a good idea under most circumstances: it generally doesn’t increase the amount you’re allowed to contribute compared to having just a solo 401(k). If you opened up one type of account and realize you’d prefer to have the other type of account, I would work with your brokerage to make sure you stay compliant with the law: under some circumstances, this may mean rolling over your SEP IRA or solo 401(k) into a traditional or Roth IRA so your business will only have one qualified retirement plan.

The information provided above is for educational purposes only. It may not directly apply to your situation, and should not be construed as financial advice. For financial, investment or tax advice, please consult a professional. You can submit a question about freelance retirement here for consideration.