©Nitr – stock.adobe.com

How To Get The Same Return With 1/3 Less Risk…Sometimes

The original commercials for Miller Lite Beer started in the 1970s. Sports stars like Mickey Mantle, entertainers like Rodney Dangerfield and others took part. One of the key lines in many of those commercials went something like this: “…and it has 1/3 less calories than their regular beer.” Those commercials helped launch a now-iconic brand. After all, who wouldn’t want the same great taste in a less filling beer (other than wine drinkers, of course).

What used to work

In my last article, I shared some research my firm is doing. It deals with essentially “mapping” some very simple portfolios to what investors have traditionally sunk their money into.

The goal of these simple portfolios is NOT to make them auto-pilot investment vehicles. I am not a big believer in buy-and-hold investing, nor do I favor “re-balancing” a portfolio based purely on neat time intervals.

Such simplified portfolio techniques are good for the firms that want to scale their businesses at the investor’s defense. And they do work at times. However, they breed complacency, and often leave the investor flat-footed when conditions get less friendly.

Great taste, less filling? What the research shows.

The idea of this set of 11 portfolios is even simpler than that: it is to present a set of modern reference points to measure how much risk your portfolio is taking. These are risk-management portfolios, not another in a long time of performance contests that Wall Street tries to present to influence you.

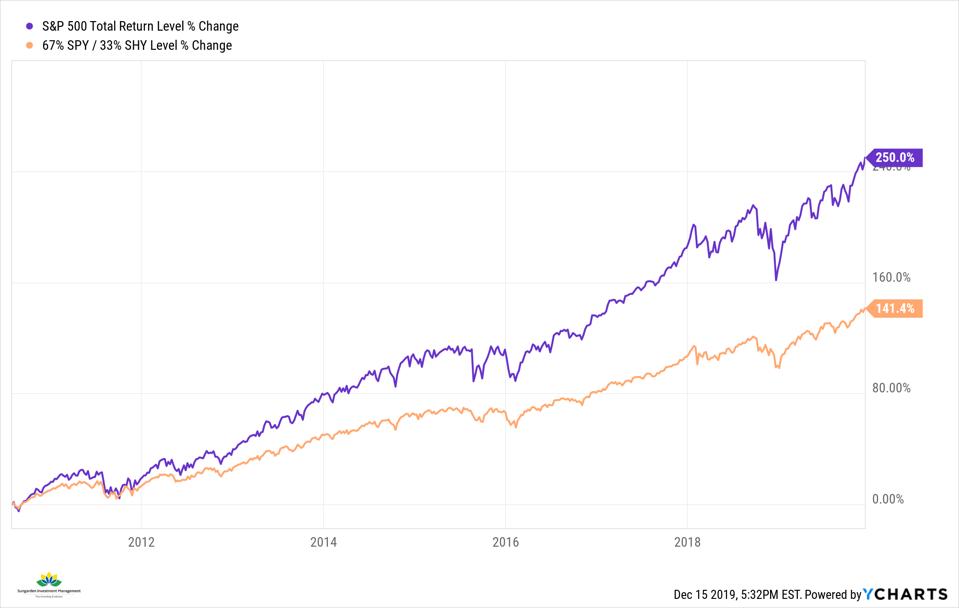

Here is one example of a risk-management reference point. The chart below simply compared an all-S&P 500 portfolio (100% invested in symbol SPY) with a portfolio that invests 67% in SPY, but shaves off 33% to invest in short-term U.S. Treasury Bonds (1-3 years to maturity, represented by symbol SHY).

^SPXTR_P286834_P336980_chart (2)

For about the past 8 years, the more you had in the S&P 500 Index, the better you did versus nearly any investment. That has made the S&P 500 Index deceptively popular. The next chart shows why.

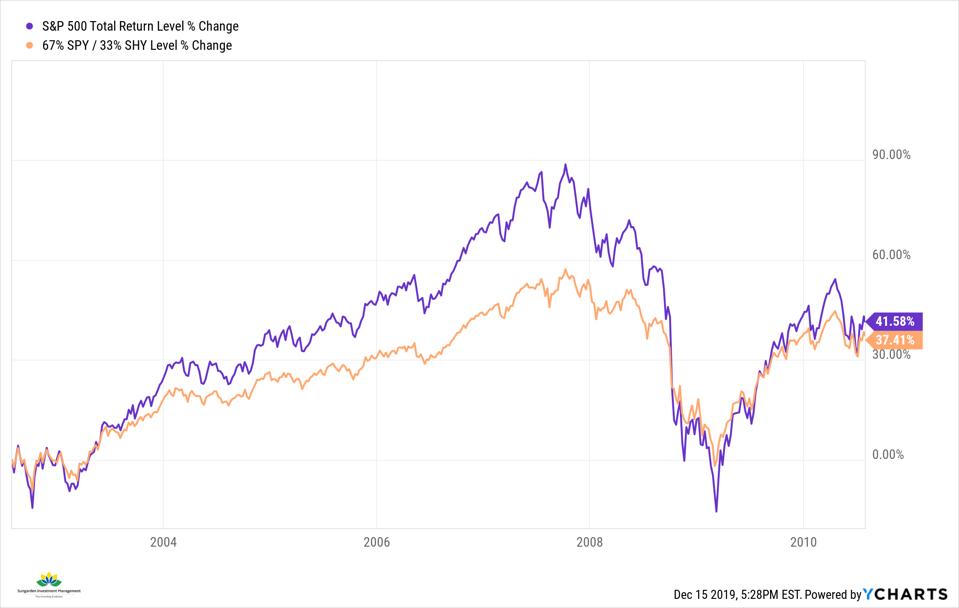

^SPXTR_P286834_P336980_chart (1)

In the roughly 8 years prior to that last 8-year period, the all-S&P 500 portfolio ran just about neck-and-neck with the portfolio that took only 2/3 of the stock market risk. Just like the Lite Beer commercials said, same great taste (i.e. return), less filling (less volatility and risk of major loss, since 1-3 year Treasuries are nowhere near the risk of the stock market).

Imagine if you were retiring on or around 2002. You did not know what was coming next (bull market, then financial crisis/bear market). However, if you were close enough to your retirement wealth level in 2002 to downshift, you might have saved yourself some drama and emotion.

Getting rewarded for the risk you take

Again, I am not suggesting you run out and sell 1/3 of your stock portfolio, and buy short-term bonds with it. My point is that you should be aware of how much risk you are taking. Furthermore, you should know full well how that portfolio is likely to do in an investment environment that is anything other than the 10 years of bliss that has accompanied S&P 500 stock index investing since the Financial Crisis ended.

Ask yourself if you really need all of the equity market risk you are taking. Or, to put it another way, if you find a light beer you like as much as a regular beer, switching to the light might just make you healthier in the long-run.

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors