Construction workers are seen outside a new house being built in Monterey Park, California on March … [+]

2020 will be a challenging year for the housing market.

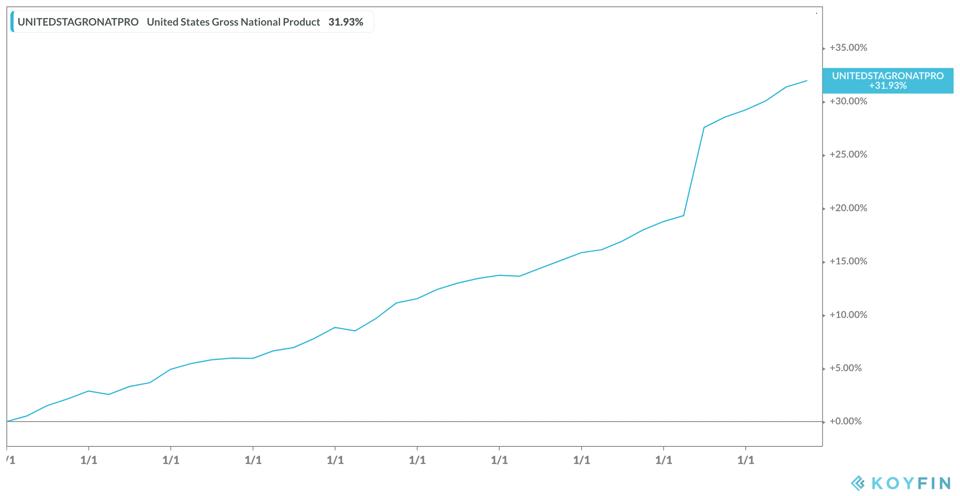

On the one side, there’s a strong US economy that has driven the unemployment rate to record low levels, boosting disposable income, which makes a bullish case.

Then, there are low mortgage rates and housing shortages, which add to the bullish sentiment.

“We think the housing market will remain strong for the most part in 2020, as low-interest rates will keep demand high for new mortgages,” says Josh Stech, CEO, and Co-Founder of Sundae, a site that helps sellers get a fair price for their house. “We also think there will continue to be shortages of new housing in many markets, which will contribute to overall price growth.”

koyfin_20191205_122355161

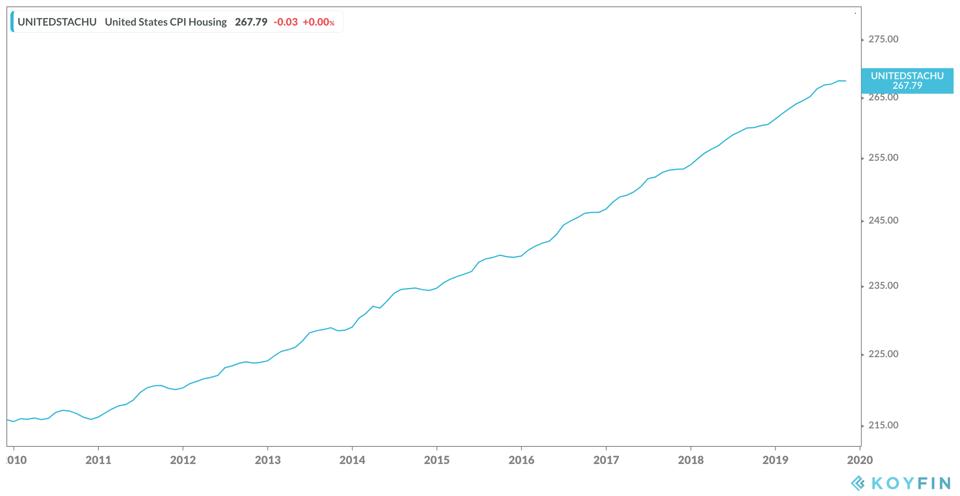

On the other side, there’s the problem of affordability, which will put the brakes on the housing market. The Case Shiller Home Price Index in the US reached an all-time high of 218.27 Index Points in September of 2019, making it difficult for first-time home-buyers to afford a home.

“While sellers may be able to ask more for their homes, they’re likely to get fewer offers in total due to more buyers being priced out of the market,” says Stech. “This could lead to longer listing times and increased stress on sellers who go the traditional route of marketing their homes on the MLS.”

That’s how bull housing markets usually end.

koyfin_20191205_094635948

And there’s “pent-down” demand, which has been “stealing” sales from the future since the era of “free money” began. A period of very low interest rates, that is.

To understand how “pent down demand” (a concept I coined) affects sales for high ticket items, a good place to begin is with the more familiar concept of “pent up demand,” the lack of current demand for high-ticket items households buy — like appliances, autos, and homes.

Pent up demand usually arises ahead of periods of consumer euphoria. It’s caused by such factors as lower price expectations, depressed consumer confidence, or a credit crunch.

And it disappears together with these conditions when that future day comes, and consumers rush to buy the items they put off in the past.

In contrast, pent down demand arises after a period of consumer euphoria. It’s caused by the low cost of financing — which blurs the distinction between present and future. Why wait to buy a new car or a new home next year when you can have it this year, with a “zero percent” financing plan?

Simply put, pent down demand “steals” sales for high discretionary items from the future. It eventually depresses spending on these items when the future arrives.

That’s what happened in the middle of the last decade when the housing market went from a boom in 2005 to a bust in 2007.

Does it mean that the US housing market is where it was back in 2005? Dan North, chief economist at Euler Hermes North America, doesn’t think so. He sees several differences between then and now.

“Houses, in general, are probably overvalued but not to a great degree, and certainly not as much as before the housing bubble peaked in 2005,” North says. “The housing bubble which had been inflating for over a decade before it collapsed had been driven by significant risks such as speculation, house-flipping, and highly questionable mortgages such as no-documentation loans, and adjustable-rate loans which turned disastrous for many borrowers.”

That’s why he assigns low probability of a housing crash in 2020. “At the current time we see little of these excessive risks, and combined with only modest overvaluation, the probability of damaging housing crash is limited.”

Queen, New York-based independent real estate agent Basili Makris agrees. “I expect real estate prices to stabilize in 2020,” he says. Though, some local markets may have a little bit more room to rise.

Still, there’s “mean-inversion,” which can raise the probability of a market correction after years of a big run.